Eagle Ford Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Devon Boosts Onshore Production Guidance by 3%, While LOE Declines by 21%

Devon Energy Corp. has raised its full-year production guidance by 3% after exceeding midpoint expectations for North American natural gas, liquids and oil output, led by outperformance in Oklahoma’s stacked reservoirs.

Lease operating expenses (LOE) fell sharply year/year by 21%, well ahead of guidance, and given the strong year-to-date performance, Devon raised the midpoint of its 2016 production guidance by 15,000 boe/d, or 3%. Incremental production is expected to be delivered without additional capital spending.

The full-year LOE outlook was reduced by $50 million to a range of $1.75 billion to $1.85 billion. Field-level costs, which include LOE and production taxes, are forecast to decline by up to $400 million.

“In spite of the challenging industry conditions, Devon achieved another high-quality operating performance in the first quarter as we continued to take the appropriate steps to deliver significant cost reductions and accelerate efficiency gains across our portfolio,” CEO Dave Hager said Wednesday.

“Looking ahead, our top priority is to maintain a strong balance sheet. We are balancing capital requirements with cash flow and enhancing our financial strength by utilizing asset sale proceeds to reduce debt. This disciplined financial strategy positions us to take advantage of our world-class resource plays when prices incentivize higher activity levels.”

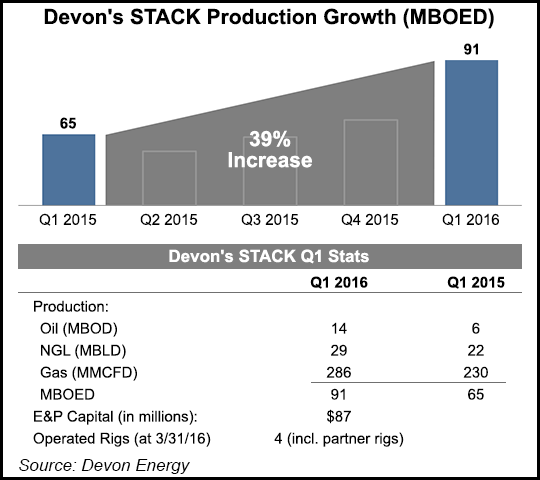

The Oklahoma STACK, the Sooner Trend of the Anadarko Basin (mostly) in Canadian and Kingfisher counties, is the No. 1 priority, with net production in the first quarter averaging record 91,000 boe/d — a 39% increase year/year.

The growing asset is achieving “one of the lowest LOE costs of any property” at $4.28/boe, which is down 21% from a year ago. Hager has said the STACK combines the best attributes of Devon’s positions in the Eagle Ford Shale and in the Permian’s Delaware sub-basin. Like the Delaware, the Oklahoma reservoirs offer stack pay opportunities, found in the STACK’s Meramec, Osage and Woodford formations.

For perspective, Devon’s natural gas production in the STACK improved year/year to 287 MMcf/d from 230 MMcf/d, while oil output more than doubled to 14,000 b/d from 6,000 b/d and liquids increased to 29,000 b/d from 22,000 b/d.

By comparison, Devon’s total onshore gas production fell from a year ago to 1,295 MMcf/d from 1,304 MMcf/d, while U.S. oil production rose slightly to 129,000 b/d from 127,000 b/d and liquids output increased to 108,000 b/d from 105,000 b/d.

Devon is running four rigs in the STACK — and it’s only running six rigs across its onshore portfolio — with the other two in the Eagle Ford Shale. About 5,300 risked undrilled locations have been identified across the STACK position, with one-third in the Meramec, which has five producible intervals, according to the company.

The Upper Meramec thickens to the southeast, while the Lower Meramec thickens to the northwest. Given the geology, three of the five Meramec intervals are expected to be prospective for development in any given section. Overall, Devon’s undrilled location count in the Meramec is “conservatively risked” at only four wells per section.

To test the upside, Devon is testing up to eight wells per section in the primary interval and is jointly developing primary and secondary targets through staggered well pilots.

In addition to the Meramec, liquids development continues in the Woodford Shale, which sits directly below and is the source rock for the Meramec. During the first quarter, Devon achieved peak rates for all 57 wells from the seven-section Gordon Row in the Woodford, which is in northeastern Canadian County. Initial 30-day rates from 28 wells averaged 1,600 boe/d, of which 54% was liquids-weighted. Gross monthly production was almost 300 MMcfe/d, exceeding Devon’s forecast by 30%.

The Delaware is not playing second fiddle, either, achieving 21% production growth year/year, with net output averaging 63l,000 boe/d in 1Q2016. LOE declined $62 million, or 36%, from peak rates in early 2015 to average $10.76/boe.

Delaware gas production increased to 84 MMcf/d from 66 MMcf/d, with oil output rising to 38,000 b/d from 33,000 b/d, and liquids at 12,000 b/d from 8,000 b/d.

Driving the decline in LOE in the Delaware were improved water-handling infrastructure and lower power costs. Water handling infrastructure now services 70% of the produced water in the Delaware, while most of the wells were converted to electrical power, which reduced the use of rental generators by 80%.

In the Eagle Ford Shale, production averaged 107,000 boe/d in 1Q2016, with 24 wells drilled. Gas-weighted production in the Barnett Shale totaled 168,000 boe/d in the period with no new wells. Canada production, all heavy oil, totaled 129,000 boe/d, and nine wells were drilled.

Devon reported a net quarterly loss of $3.1 billion (minus $6.44/share), versus a year-ago loss of $3.6 billion (minus $8.88). Adjusted for one-time charges, Devon lost 53 cents/share, beating Wall Street forecasts of a loss of 60 cents. Revenue was $2.13 billion, down 34% from a year ago.

The priority to maintain a strong balance sheet has cut into personnel. Devon’s general and administrative costs during 1Q2016 fell 23% from a year ago after 20% of the entire workforce was laid off. Since the start of 2015, Devon has fired about 25% of its staff, top to bottom.

Accrued exploration and production capital spending, which accounts for activity that was incurred during the reporting period, amounted to $363 million in 1Q2016, 9% below the midpoint of guidance. Upstream capital activity compares with $749 million reported for consolidated cash flows. The difference primarily resulted because of spending for the midstream partnership EnLink Midstream.

EnLink, in which Devon holds a majority stake, generated $202 million of operating profit in the first quarter. Devon’s ownership is valued at about $3 billion and is expected to generate cash distributions of $270 million in 2016.

Devon exited the first quarter with $4.6 billion of liquidity, consisting of $1.6 billion of cash on hand and $3.0 billion of capacity on its senior credit facility. Liquidity was bolstered by a secondary stock offering. Net debt, excluding EnLink obligations, totaled $7.7 billion. To further enhance its financial strength, Devon plans to sell $2-3 billion of assets this year; it already has announced the sale of its Mississippian Lime assets in northern Oklahoma for $200 million, a deal set to close by the end of June.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |