Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

SoCal Edison Sees Risks from Idled Aliso Canyon, Volatile NatGas Prices

Southern California Edison Co. (SCE) is keeping a close eye on summer power requirements in the aftermath of the Aliso Canyon underground natural gas storage field closure and the prospects, albeit small, of gas prices spiking.

That was the takeaway from Ted Craver Tuesday, who is CEO of SCE parent Edison International. During a quarterly conference with analysts he outlined a strategy that would wean the utility from relying on gas to a robust electrification strategy, bolstered by environmental and climate change policies in California and across the nation.

Craver said Southern California Gas Co.’s (SoCalGas) storage field, which is closed for extensive testing following the four-month storage well leak, poses increased risks to electric system reliability this summer. Longer term, renewable power generation sources are looking better than gas-fired options, he said.

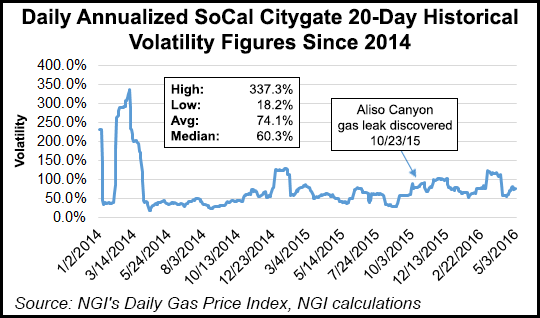

The growing percentage of renewables in SCE’s power mix “is creating an excellent hedge against potential future spikes in natural gas prices,” Craver said. Although he doesn’t expect much pressure on near- and intermediate-term on gas prices, “I can’t imagine there is much room for prices to go much lower.”

SCE’s generation mix, he noted, is slated to move from its current level of 25% renewables to California’s mandated 50% level by 2040, and the “cost of renewables is increasingly becoming equal to, or better than, new natural gas [power plants]. Also since renewables have no fuel costs, [electric] customers are increasingly less exposed to future natural gas price spikes.”

He also outlined Southern California’s prospects for power grid reliability this summer in the wake of the Aliso shutdown, noting that SCE is working with state regulators and Sempra Energy’s SoCalGas. Aliso, the state’s largest gas storage field, provides pipeline pressure balancing to the region year-round and additional supplies in the winter when demand exceeds the region’s interstate pipeline capabilities.

“SCE is one of SoCalGas’ largest customers, and [we are] very focused on this issue,” Craver said. “Because of the shutdown, the risk to electric reliability has increased, which presents its own public safety implications.”

From the electric sector’s perspective, he said, the best solution to maintain reliability is to quickly complete the remaining integrity tests on the critical storage wells at Aliso Canyon to determine if they can be safely returned to service in time for summer peak power use (see Daily GPI, April 15).

SCE also is working on contingency plans to “reduce demand and maximize generation flexibility,” Craver said. It is also at the state regulators’ behest working to track any added electric utility costs tied to Aliso. “These costs are not expected to be sizable,” he added. The storage field problems do not present any financial risks for SCE, but are “reliability risks for our customers.”

For 1Q2016, Edison International reported net income of $271 million (83 cents/share), compared with $299 million (92 cents) for the same period in 2015.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |