E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Encana Sees Head-to-Head Match Up, Eventually For Montney, Marcellus NatGas

Encana Corp., one of the largest North American natural gas producers, doesn’t have any skin in the Marcellus Shale, but it’s fine with that, as its extensive Montney formation in Alberta should be able to compete well against the Appalachian behemoth, executives said Tuesday.

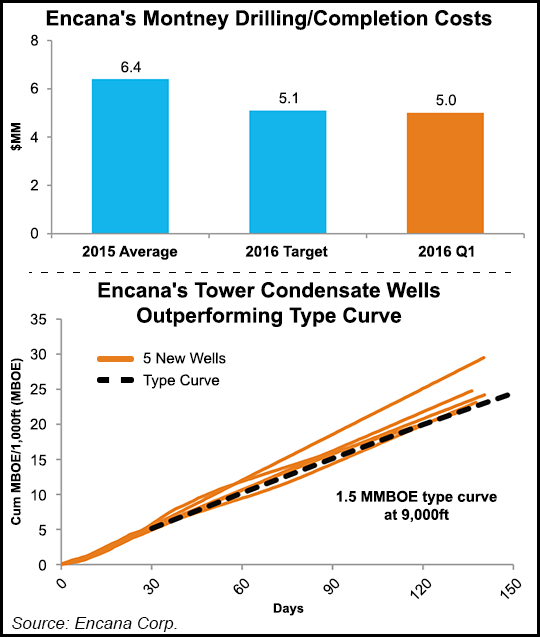

Encana has around 1,500 condensate-rich locations in the Montney, and likes what it is seeing from the formation, including the Tower wells, whose average initial production (IP) rates over 90 days are 5.5 MMcf/d (1,320 boe/d) and 370 b/d of condensate. Four new Dawson South wells recently brought onstream were averaging 8.4 MMcf/d (1,900 boe/d) with 500 b/d of condensate.

The Montney made Encana’s core four short list when it culled its 30-plus play inventory two years ago.

During a conference call Tuesday to discuss first quarter performance, CFO Sherri Brillon said the Montney may be competitive with the best gas play in the Lower 48, the Marcellus Shale, thanks in part to Alberta’s decision to reduce its royalties regime beginning in 2017 (see Daily GPI, Feb. 2). As of 2017, the revised regime would limit royalties for new wells to a nominal 5% until drilling costs are recovered and royalty rates for wells drilled before next year would remain frozen for a decade.

“The combination of cost and well performance, condensate yields and royalties, sets the Montney up to compete head-to-head with the Marcellus,” Brillon said. “The collaborative approach of both producers and infrastructure owners has historically aligned market access with the pace of development in the Montney, and in our view, this dynamic will continue.”

Operations chief Mike McAllister said Montney well costs today are averaging less than $5 million each, 22% lower than the full-year 2015 average, and “one of the largest quarterly well cost reductions we have seen in the Montney in over five years. A pace-setting well cost of $4.6 million positions Encana as one of the top performers in the play.”

Montney production is on track to grow by more than 50,000 boe/d by the end of 2018, McAllister said.

Brillon acknowledged that the pricing dynamics for Montney gas have been a focus for the market because AECO Hub pricing “reflects the impact of one of the warmest North American winters on record. Storage inventories across North America are high for this time of year. In Canada, we’ve seen a net storage injection throughout the first quarter.

“With the potential for future storage restrictions and the requirement to use TCPL Mainline to clear the basin, AECO basis has widened considerably. It is important to note that unlike Appalachia, Western Canada is not physically short of transportation capacity,” she said. The forward markets “have set expectations for a directional return to a more normalized AECO price relationship. This reflects the record low development activity in Western Canada, as well as the trend increasing demand.”

Encana isn’t only looking to the Montney to boost its long-term outlook, CEO Doug Suttles told analysts during the conference call. The Calgary-based company is on track to “meet or beat” its 2016 cost savings target of $550 million from all of its core four onshore plays, which also include the Duvernay formation in British Columbia, the Permian Basin and the Eagle Ford Shale. Year/year field costs alone are expected to decline by $460 million.

“Reducing cost and capturing efficiencies remains a priority for the entire organization,” Suttles said. “The operating cost reduction task force that was assembled in December has initiated over 1,000 initiatives across the company to lower our operating expenses…While the strengthening of the Canadian dollar will put pressure on some costs, we still expect to be within 2016 guidance ranges,” and “all of these savings are largely permanent and will have even larger impact in 2017 as we benefit from their impact over a full year.”

In the Permian, average drilling/completion (D&C) costs in the first quarter were $5.4 million/well, helping to reduce capital required for this year’s vertical drilling program by about $15 million. At a 14-well pad in Midland County, the company used four drilling rigs and completed 485 fracture stages with four spreads simultaneously.

“This approach has also accelerated the pace of learning,” McAllister said. “From the first well on the pad to the last well, our drilling costs have dropped by 16%. The 14-well pad will come on production in 2Q2016 and as a result, we expect Permian production to grow over the quarter.”

Eagle Ford output, which grew to more than 17,000 boe/d during 2015, set a new quarterly D&C cost average of $3.5 million/well in the first three months of this year, 44% below last year’s average. Completions “intensity” is expected to increase through this year, adding about $400,000/well, McAllister said.

Duvernay D&C costs averaged $8 million/well in 1Q2016, 35% lower than full-year 2015. Encana also brought onstream the 10-29 plant at the end of March, which brings gross field processing capacity to 30,000 b/d of condensate and 155 MMcf/d of gas.

“Today, Encana produces over of half the Duvernay’s total production from 30% of the play’s wells,” McAllister said. “Looking at all wells brought onstream since 2014, Encana has averaged IPs of greater than 1,000 boe/d…”

Encana expects to spend about 65% of its total capital budget in the first half of the year, Suttles said.

“Our higher-margin production from our core four assets continues to make up a greater proportion of the total production. In 1Q2016, the core four assets contributed 70% of total production. This is up from 60% in 2015…Our 1Q2016 combined oil and condensate mix was 77%, in line with the guidance range of 75% to 80%.”

Historically, said Suttles, Encana has entered each year with about half of its production hedged. As of April 26, Encana had hedged 75% of expected May to December 2016 oil and condensate and 85% of natural gas production.

“It’s a tough environment out there for absolutely everybody, and everyone, if you will, is doing their part to make sure that North America is competitive on a global stage,” Suttles told analysts.

Encana reported a higher-than-expected quarterly loss of $379 million (minus 45 cents/share), compared with a year-ago loss of $1.71 billion (minus $2.25). Excluding one-time items, including price impairments, losses were 15 cents/share from a loss of 3 cents a year earlier. Wall Street had expected average losses of 12 cents/share. Cash flow fell year/year to $13 million from $495 million, while revenue declined 40% to $753 million. Realized gas prices fell 54%, while oil/liquids prices were off almost 13%.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |