NGI Archives | NGI All News Access

NatGas Cash Picks Up Small Shoulder Season Gains; Tetco Pipe Blast Fallout Unknown

Natural gas traded April 25-28 for gas flow Tuesday through Saturday was mostly a game of small gains during shoulder season trading, however, trading could heat up in the new week following news Friday of a massive explosion and fire on a portion of Spectra Energy Corp.’s Texas Eastern (Tetco) pipeline in Westmoreland County, PA, about 30 miles east of Pittsburgh.

First things first, NGI‘s National Spot Gas Average for the trading week ending Thursday April 28 tacked on 4 cents from the previous week to average $1.82, and a vast majority of points across the country added from between a couple of pennies to a nickel. Of the outliers, the largest weekly gains were turned in by northeastern points such as Tennessee Zone 6 200 Line, which gained 40 cents to average $2.64, while Algonquin Citygate picked up 32 cents to $2.67. The Midcontinent also saw a few large increases as Northern Natural Ventura and Northern Border Ventura each picked up 17 cents to average $1.88 apiece.

The largest individual declines were turned in by East Texas points, where Houston Ship Channel and Katy each dropped 4 cents to average $1.88 and $1.87, respectively.

Regionally, East Texas was the only loser, dropping a penny to average $1.85, while the largest gainers were the Midcontinent and the Northeast, which added 7 cents and 6 cents, respectively, to average $1.82 and $1.71.

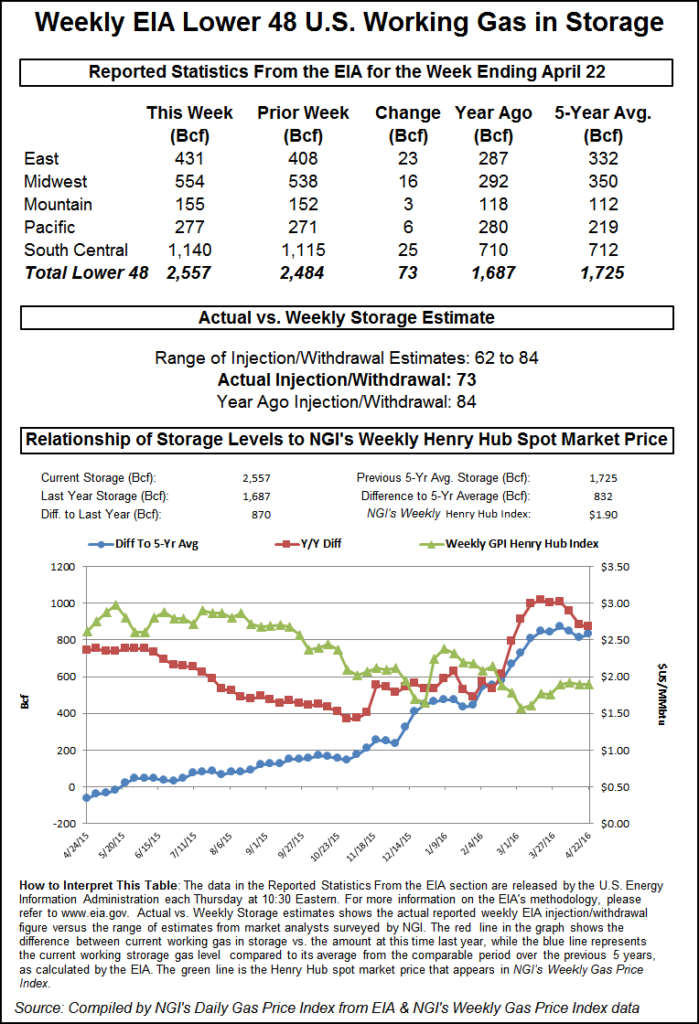

Over in the futures arena, it was a week of ups and downs. After putting together more than a week of $2-plus daily settles, May expired at $1.995 on Wednesday, down 3.7 cents from Tuesday’s finish. Traders also digested a somewhat bearish storage report during the week. The Energy Information Administration (EIA) reported Thursday that 73 Bcf was injected into underground stores for the week ending April 22, which was a few more molecules than industry consensus expectations. Prior to the 10:30 a.m. EDT report, June futures were already at a discount to the contract’s $2.153 Wednesday close. In the minutes before the report, the contract was hovering at $2.095, and immediately after the release, June sunk to a session low of $2.075. After some back-and-forth, the prompt-month contract closed out the regular session at $2.078, down 7.5 cents from the regular session close on Wednesday.

Before the report, many were expecting an inventory build to fall between last year’s 84 Bcf addition for the week and the five-year average of a 52 Bcf injection. Citi Futures Perspective analyst Tim Evans was on the record with an 81 Bcf injection expectation, while a Reuters survey of 22 industry experts produced a 62 to 84 Bcf build range with a consensus estimate of a 70 Bcf injection.

The weak winter, which left robust storage inventories, has some analysts concerned that the U.S. storage capacity limit could be tested this refill season. However, others are not so sure. Some market-watchers took Thursday’s deficit to last year’s build for the week as a sign that the storage situation could be undergoing some corrective action.

“We believe the storage report will be viewed as neutral,” said Randy Ollenberger, an analyst with BMO Nesbitt Burns Inc. “Storage remains at record levels but the level of injections is well below last year and points to a rebalancing over the course of the summer. We believe that U.S. working gas in storage could exit the summer season at five-year lows, assuming normal weather.”

While the 73 Bcf build was smaller than last year’s 84 Bcf build, the margin was significantly slimmer than the prior week, where 7 Bcf was injected for the week ending April 15, compared to 82 Bcf in the previous year’s week.

NGI Market Analyst Nathan Harrison said it’s far too early to tell how the 2016 injection season will play out but noted that Thursday’s build report fell well within historical norms. “Early on in the summer, historical injection rates should be a decent indicator of what to expect. If we start to close in on the a full-storage situation later this summer, an asymptotic decline in injection rates will likely result simply due to pressure.”

As of April 22, working gas in storage stood at 2,557 Bcf, according to EIA estimates. Stocks are now 870 Bcf higher than last year at this time and 832 Bcf above the five-year average of 1,725 Bcf. For the week, The South Central Region injected 25 Bcf and the East Region injected 23 Bcf, while the Midwest deposited 16 Bcf. The Pacific and Mountain regions each chipped in 6 Bcf and 3 Bcf, respectively.

Turning attention to the screen, Tom Saal, vice president at FCStone Latin America in Miami, said he thinks Thursday’s futures price action had a lot to do with May’s expiration a day prior. “There is a little bit of a roll-gap. We settled May at $1.995, and June started its run nearly 16 cents higher, creating a gap on the chart,” he told NGI. “It looks like we’re trying to connect the dots here. The storage number came out a little bit on the bearish side and futures ended up a little bit lower. I really don’t think we’ll head much lower. We might get down to the May settlement, but that’s about it.”

Looking ahead, Saal said a small uptick could be in store. “From what we’ve seen on the CFTC Commitment of Traders Report, the speculators are liquidating some of their short positions, so at least for now, they are not looking to be too aggressive on the short side,” Saal added. “We may be running out of natural sellers, unless they crush the market.”

With no real weather to speak of, natural gas cash market values on Friday for gas to be delivered the first two days of May on Sunday and Monday slid. That was excluding many Northeast prices, which rebounded from a couple of consecutive down days, perhaps on news that part of a Tetco mainline in Pennsylvania exploded Friday morning. Over in the futures arena, the June natural gas contract looked to be still finding it’s prompt-month footing, trading a wide $2.042-2.195 range during the regular session before closing out at a three-month prompt-month high of $2.178, up a dime from Thursday but 8.9 cents below the contract’s previous Friday’s close.

The bump in Northeast pricing, and perhaps in futures as well, could be attributed to the force majeure on Tetco on Friday, which Spectra Energy Corp. issued following a massive explosion and fire on its Penn Jersey Line near the Delmont Compressor Station in Westmoreland County, PA, about 30 miles east of Pittsburgh (seerelated story). With 9,096 miles of pipeline, Tetco is a vital piece of infrastructure that connects the Gulf Coast with high-demand markets in the Northeast. The pipeline can transport up to 10.46 Bcf/d.

Pennsylvania Department of Environmental Protection (DEP) spokesman John Poister said the system’s 36-inch mainline ruptured, exploded and caught fire at 8:30 a.m. EDT on Friday. The fire had been extinguished by early afternoon, but first responders, utility workers, state regulators, area residents and others were left to deal with the aftermath. One person was injured. Spectra Energy Corp. personnel on Friday afternoon were conducting a controlled release of some of the natural gas that’s still built up in the system. DEP said it is a looped line with four pipelines running parallel to one another in the right-of-way, adding that it’s unclear which of the pipelines caused the incident and how badly damaged each one is. Tetco declared a force majeure and an operational flow order at about 11 a.m. on Friday. It also issued a number of operational flow restrictions and imbalance warnings, noting that excess takes beyond limited amounts could lower line pack, further hindering deliveries.

Texas Eastern M3 Delivery was the single largest index gainer on Friday, adding 13 cents to average $1.40. How much capacity is shut-in and for how long remains to be seen. The fact that they don’t yet know which or how many of the looped lines exploded argues for an extended downtime. The site has to cool down and be gas free before any work can commence.

Looking in on natural gas futures, the June contract on Friday posted the highest settle for a front-month contract since Jan. 29, 2016. Some market-watchers believe this could be part of a meaningful, albeit moderate rebound. “We remain in a relatively shallow and thus sustainable rate of advance in price, which has been going on since the end of February,” David Thompson, vice president at Powerhouse LLC, a Washington DC-based trading and risk management firm, told NGI. “Sometimes when you have near vertical price moves, either up or down, they don’t last.”

Thompson also pointed to the recent pushback and delays of pipeline projects in the East as reason for some of the recent price rebound. “If some of these pipeline issues delay or restrict Marcellus gas getting down to the Gulf Coast and the pricing points, that may be slightly bullish. In addition, with the possibility of increased exports via LNG out of the Gulf Coast, that also will help prices.”

The broker said it is important to remember that the natural gas market has been in bear mode a lot longer than the oil market has been, so a lot of that economic rationalization has had the time to work its way through. He added that markets often create symmetry.

“Back in April of 2012 we hit a significant low on the weekly chart around the $1.90ish range. Then we had a solid 97-week rally up north of $6 in March 2014, which sparked another sell-off. It looks like a very symmetrical mountain with roughly 97 weeks on either side,” he said. “I would suggest we’ve been in this basing phase since the end of 2015 and that the market has rationalized demand and supply given the new shale economics. I think we’re moving up in a moderately bullish pattern due to the impacts of supply from constrained Marcellus Shale supplies, as well as the normal seasonal push higher as we come into summer.”

Looking at Thursday’s natural gas storage report one day later, analysts at Tudor, Pickering, Holt & Co. (TPH) called the 73 Bcf build for the week ending April 22 a “bearish tilt” and “well high of historic norms.”

The significant build also brought into question whether the fundamentals are currently in place to erase the current storage surplus. A combo of very mild weather and a miss versus expectations indicates a market no better than balanced on a weather-adjusted basis,” TPH analysts said Friday morning. “Not good enough when we need to see both normal weather and a 3 Bcf/d undersupply to erase excess storage levels.” They added that weather for the week was warmer than normal with just 48 heating degree days (HDD) versus the 79 HDD five-year average.

“Declining production and decent weather-adjusted demand has the market increasingly confident that a much higher gas price will be needed this coming winter to balance the market,” they said. “However, in the meantime the market needs to be tighter than it has been recently to work down excess storage, so in the near-term price needs to adjust accordingly.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |