Steady Oil Price Uptick, OPEC Freeze A Plus, Says Marathon Petroleum CEO

A gradual, steady upward trend in global oil prices helped by an OPEC production freeze next month could eventually send crude prices into the $60/bbl range by year-end, according to Gary Heminger, CEO of refiner Marathon Petroleum Corp. (MPC).

Responding to analysts’ questions on a quarterly earnings conference call Thursday, Heminger emphasized that it is important that prices not spike, and that from his experience he is confident the global oil producing nations in the Middle East will meet again next month to put a production halt in place, something he thinks will be good for the industry globally.

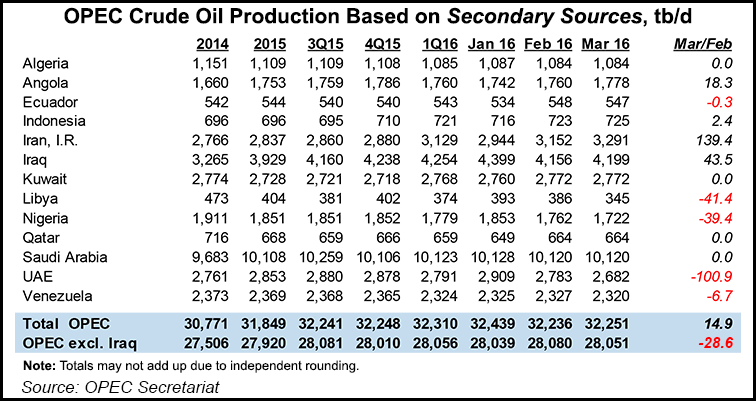

While a “freeze” on production is a possibility, some OPEC members are against it and a number of industry analysts have said they do not expect it to happen (see Shale Daily, April 19).

Heminger said as the global Brent oil price indicator nears $48/bbl, it is already building slowly some of the momentum that will be critical to move ahead throughout the rest of 2016.

“I still believe prices will continue on this trend, and it is so important that they inch up slowly,” said Heminger in announcing a substantial year-over-year 1Q2016 earnings decline largely due to what he called weak crack spreads in the refining sector. “We do not want a [price] spike on a very short-term basis.

“A peak and coming off a peak [again] would have longer-lasting negative effects on the marketplace, so we want a very slow gradual move. And that is what we see happening.”

Heminger said MPC is standing by its conclusion from earlier this year that “crude prices are going to continue to move.” His contention is this will be good across the entire energy sector, “boosting demand, getting more people working in the oilfields, and it’s a lift for the entire worldwide energy sector.”

An important indicator, Heminger noted, is the widening price spreads on medium-sour crude supplies, which are key to the asphalt sector in the United States. As the largest U.S. asphalt producer, MPC stands to benefit significantly if this trend continues. “Over the last month or so, we have started to see that medium sour crude spread widen out, and that’s very supportive to the industry, particularly refiners with the ability to run that product.

“I see crude continuing to move up for the balance of the year, and that will be very good for medium- and heavy-sour refiners, and at the same time we’ll see what happens with OPEC, which I would expect to call another meeting in May,” said Heminger, who was in Saudi Arabia in the past two weeks and noted a lot of disappointment among nations after their inaction at the April 17 meeting (see Shale Daily, April 19).

“If that meeting happens, I would expect to see the freezes [on production] put in place, and that will continue to put some pressure on some price spreads.”

For 1Q2016, MPC report earnings of $1 million (less than one cent/share), compared with profits of $891 million ($1.62/share) for the same period last year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |