Bakken Shale | E&P | NGI All News Access

Hess CEO: Bakken Rig Count to Drop Further, $60/Bbl Threshold For Uptick

Hess Corp. senior executives said Wednesday onshore rig counts will drop, production will slide and an upturn won’t come until oil prices get back to the $60/bbl level.

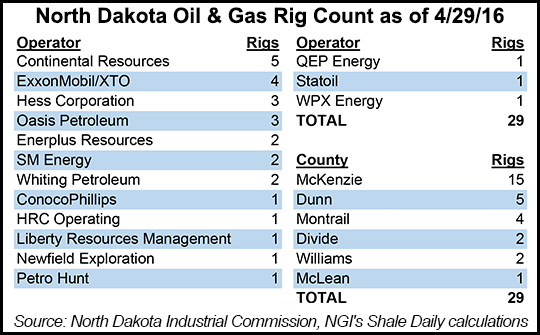

In this still sullen environment that is expected to continue into the third quarter, the strategy is to “preserve the balance sheet, operating capabilities and growth options,” said CEO John Hess. In the Bakken in North Dakota, this means being able to jump from a low of two rigs expected in 3Q2016 to putting six rigs back in operation over a nine- to 12-month period after reaching sustained WTI prices in the $60/bbl range, Hess said.

Noting that the Bakken is slated to be the play in which Hess will eventually reverse continued declines in its capital expenditures once there is a price uptick, Hess reported a net loss of $509 million (minus $1.72/share) for 1Q2016, compared to a net loss of $389 million (minus $1.37) for the same period last year. Nevertheless, on a conference call Hess and the other senior executives stressed that the company’s oil-leveraged portfolio has attractive growth opportunities, focused onshore on the Bakken and Utica shale plays, once prices rebound.

In the Bakken, Hess now expects to maintain production of 100,000-110,000 boe/d while operating only two rigs after the third quarter this year. This is possible due to longer-stage, more efficient hydraulic fracturing operations that will push initial new well production averages to 1,000 boe/d by the end of the year, according to COO Greg Hill.

“Our focus is on value, not volume, and we do not believe that accelerating production in the current low-cost commodity environment makes sense,” Hess said. “Our Bakken rig count will be reduced from three to two rigs in the third quarter and is expected to remain at this level until the WTI price is closer to $60/bbl.”

In the Utica where 1Q2016 production averaged 29,000 boe/d, compared to 17,000 boe/d for the quarter a year earlier, Hess has shut down its last rig and will not resume any drilling until the $60/bbl threshold is approached, he said. “No further drilling is planned in the Utica this year.”

Between the Bakken and Utica, along with some of its best offshore plays, Hess hopes to add up to 35,000 boe/d of production over the next two years. Overall, its net production was 350,000 boe/d, compared to a slightly higher net average in the first quarter last year (355,000 boe/d). The Bakken average of 111,000 boe/d was above the company’s guidance range, Hess said.

“Our Bakken team reduced average well completion costs by 25% from the year-ago quarter to an average of $5.1 million/well,” Hess said.

A key to continuing efficiency gains is Hess’ stated move from a 35-stage to a 50-stage fracking process, said Hill, noting that 1Q2016 production (111,000 boe/d) was reached with four rigs, compared to 12 rigs operating in the same period a year earlier when production averaged less (108,000 boe/d). Nineteen wells were drilled in 1Q2016 and 31 new ones were brought online, compared to totals of 60 and 70 wells, respectively, a year earlier.

This year, Hess expects overall to drill 62 wells and bring 87 new ones online in the Bakken, compared to the 182 wells drilled and 219 new ones brought online in 2015.

Similar to the company’s Bakken position, Hess’s Utica acreage is largely held by production, allowing the reduction of activity there in the short term and preserving its options for the price turnaround when it comes, Hill said. “We plan to run [Utica] assets for cash in 2016 and resume drilling following a sustained recovery in commodity prices and further third-party infrastructure build out that will narrow currently wide basin differentials.”

In 1Q2016, Hess’s joint venture in the Utica drilled six new wells and brought nine wells on production. Hess has realized a 75% drop in drilling costs, including a 50% decrease in fracking costs in the Utica, Hill said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |