May NatGas Futures Expire Sub-$2; Cash Mixed and Mostly Lackluster

National next-day natural gas cash prices were muted and mixed on Wednesday for Thursday delivery as most of the attention on the day was directed toward the May futures contract’s expiration and Thursday morning’s fresh round of storage data. As for May Bidweek, prices are looking like they might jump a bit over April levels.

For it’s part, the May 2016 futures contract rolled off the board Wednesday afternoon, but relinquished the $2 handle just prior to doing so. After putting together more than a week of $2-plus daily settles, May expired at $1.995 on Wednesday, down 3.7 cents from Tuesday’s finish. June, the newly-minted prompt-month contract, slid six-tenths-of-a-cent on the day to $2.153.

Over in the cash market arena, it would appear traders are waiting for better optics on what kind of summer temperatures are expected as a vast majority of points across the country added or dropped less than a nickel. While prices within individual regions were mostly mixed, Texas and Midwestern points mostly fell between 1 and 4 cents, while South Louisiana, Midcontinent, Rockies and California points were in the black by the same margins.

Northeastern points were split down the middle for the most part, with small gains and losses except for the usual suspects, where volatility continued to reign. Algonquin Citygate picked up 16 cents to average $2.90, while Tenn Zone 6 200 Line added 26 cents to $2.87 and Tennessee Zone 5 200 Line increased 22 cents to average $2.36.

In a sea of price bearish fundamentals, there are a few bright spots for the bulls. May Bidweek looks set for an uptick and an oilfield services giant reported Wednesday that the rig pullback isn’t finished just yet.

Nationally, May Bidweek prices are currently set to range between $1.19 and $2.54, with many points showing a significant increase over April Bidweek levels, according to NGI‘s Bidweek Alert.

“Many price points are set to increase about 20 cents or so over last month even though May as a shoulder month is not expected to bring much in the way of heating or cooling load,” said NGI Markets Analyst Nathan Harrison. However, he added that “traders are watching the storage picture closely as this summer may bring us close to the EIA demonstrated maximum storage level of 4,343 Bcf.”

Meanwhile, the production pullback is expected to continue at least through the second quarter, perhaps longer, according to Baker Hughes Inc. (see Shale Daily, April 27), which issued its second quarter results on Wednesday but did not hold a conference call because of the pending merger with Halliburton Co.

Baker Hughes expects the North American rig count will “begin to stabilize” in the second half of this year, but things are expected to get worse before they get better, CEO Martin Craighead said. The Houston oilfield services giant, the global authority on onshore and offshore rig counts, is forecasting the North American rig count will fall by 30% sequentially in the second quarter.

“For the second half of the year, we project the U.S. rig count will begin to stabilize, although we do not expect activity to meaningfully increase in 2016,” Craighead said.

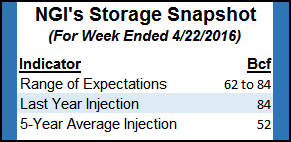

Turning attention to Thursday morning’s natural gas storage report for the week ending April 22, many are expecting an inventory build that falls between last year’s 84 Bcf addition for the week and the five-year average of a 52 Bcf injection. Citi Futures Perspective analyst Tim Evans is on the record with an 81 Bcf injection expectation, while a Reuters survey of 22 industry experts produced a 62 Bcf to 84 Bcf build range with a consensus estimate of a 70 Bcf injection.

Whether it turns out to be a an injection in the low 60s to the mid-80s, it will be significantly larger than the 7 Bcf build that was realized last Thursday for the week ending April 15.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |