Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

DRBC to Conduct Separate Public Hearings on Proposed PennEast Pipeline

The Delaware River Basin Commission (DRBC) will be conducting an independent series of public hearings on the proposed PennEast Pipeline, the multi-state agency told FERC Monday.

DRBC had initially asked the Federal Energy Regulatory Commission to conduct a joint public hearing on the Pennsylvania-to-New Jersey pipeline but opted to withdraw that request this week. In a letter to FERC Monday, DRBC said it will “conduct its public process independently of FERC’s.”

DRBC said it anticipates conducting multiple hearings “because of the high level of interest in the PennEast project.” Those meetings will be held along the route in Pennsylvania and New Jersey, but DRBC said it “does not currently anticipate holding hearings during calendar year 2016. These yet-to-be-scheduled hearings for the proposed PennEast project will be conducted separately from the DRBC’s regularly scheduled quarterly public hearings.”

DRBC’s four member states are New Jersey, Delaware, Pennsylvania and New York.

The DRBC’s announcement comes just as another Northeast Marcellus Shale takeaway project, the Constitution Pipeline, was denied a Clean Water Act permit by the New York Department of Environmental Conservation (see Daily GPI, April 25).

DRBC said planning for its public input process “will advance concurrently with DRBC’s ongoing technical review of PennEast’s application throughout 2016. A formal public comment period will be announced and comments will be actively solicited upon publication of the DRBC’s draft docket.” Additional details will be posted to www.drbc.net.

FERC has said it plans to issue a final environmental impact statement for PennEast on Dec. 16, with the 90-day deadline for coordinating agencies arriving March 16, 2017 (see Daily GPI, March 30).

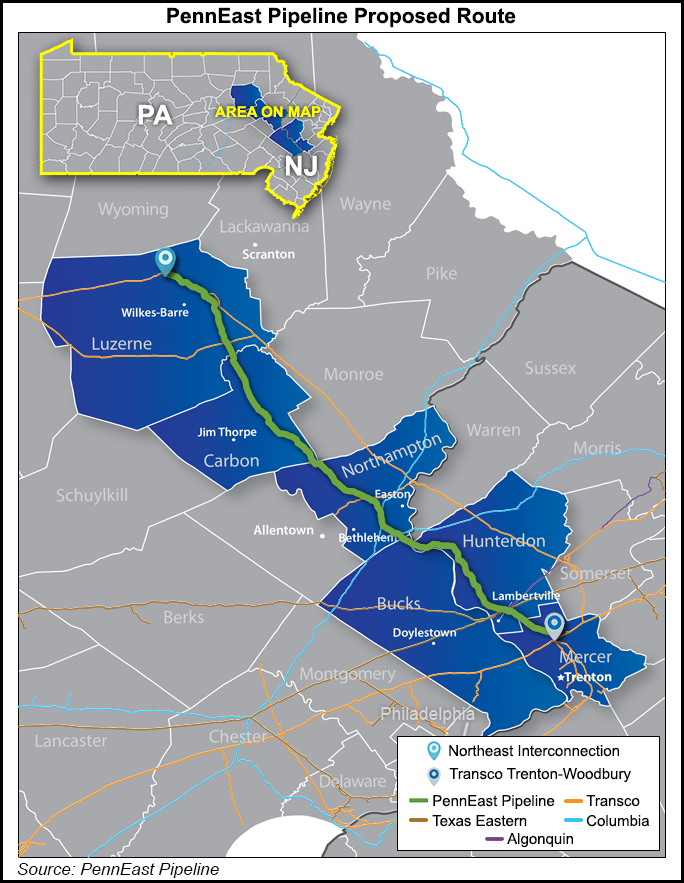

The 114-mile, 36-inch diameter greenfield PennEast would transport 1.11 million Dth/d of eastern Marcellus Shale gas to markets in Pennsylvania and New Jersey. About 990,000 Dth/d of that capacity is spoken for, according to the company’s filing at the Federal Energy Regulatory Commission [CP15-558] (see Shale Daily, Sept. 25, 2015). New Jersey Natural Gas Co. is the largest taker with 180,000 Dth/d. PSEG Power LLC and Texas Eastern Transmission each have 125,000 Dth/d. South Jersey Gas. Co. has 105,000 Dth/d, and Consolidated Edison Company of New York Inc., Elizabethtown Gas, and UGI Energy Services LLC each have 100,000 Dth/d.

PennEast is a joint venture owned by AGL Resources Inc. unit Red Oak Enterprise Holdings Inc. (20%); New Jersey Resources’ NJR Pipeline Co. (20%); South Jersey Industries’ SJI Midstream LLC (20%); UGI Energy Services LLC’s UGI PennEast LLC (20%); PSEG Power LLC (10%); and Spectra Energy Partners LP (10%). The partnership is managed by UGI Energy Services.

Like many Northeast pipeline projects in recent years, PennEast has faced its share of opposition from environmental groups, such as a recently released study backed by the New Jersey Conservation Fund that asserted the pipeline isn’t needed and would create excess transportation capacity (see Shale Daily, March 22).

The Delaware Riverkeeper Network has also been fighting PennEast, with the group recently suing FERC over what it alleged is a bias towards approving natural gas projects due to the Commission’s fee-based funding structure (see Daily GPI, March 4).

Last year, in a FERC filing, PennEast’s backers responded in detail to a long list of the objections lodged against the project (see Shale Daily, Nov. 20, 2015).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |