NGI Archives | NGI All News Access

Weekly NatGas Cash Outdone By Soaring Futures

It was a tale of two markets in natural gas trading for the week ending April 22. In physical trading most points outside the Northeast had to settle for nominal gains of a nickel to a dime while the Northeast wallowed in losses averaging about a dime. The NGI Weekly Spot gas average rose 2 cents to $1.78.

Futures, on the other hand, bounded higher as observers began putting the pencil to just what kind of pricing environment would be necessary to forestall anticipated falling production brought on by a precipitous decline in drilling activity.

Of actively traded points it was a three-way tie atop the podium for the week’s top gainer with OGT, Dawn, and Parkway/Union all adding 13 cents to $1.80, $2.11, and $2.12, respectively. Algonquin Citygate and Tennessee Zone 6 200 L were on the opposite side of the spectrum with 78 cent losses to $2.35 and $2.24, respectively.

All regions of the country made it to the positive side of the trading ledger with the exception of the Northeast which fell 9 cents to average $1.65.

Rocky Mountain market points posted a minuscule 2 cent advance to average $1.64, and the Midcontinent and South Louisiana added 4 cents to$1.75 and $1.84, respectively.

California was higher by a nickel to $1.87 and the Midwest added 7 cents to $1.93. East Texas gained 8 cents to $1.86 and deliveries to South Texas on average rose 9 cents to $1.85.

The big price move for the week was in the futures arena with the spot May contract vaulting 23.8 cents to $2.140. Although the Energy Information Administration (EIA) weekly storage report Thursday will often figure prominently in futures price moves, such was not the case this week. After what appeared on paper to be a bearish report, futures settled mixed with the May contract on Thursday easing one-tenth of a cent to $2.068 and the remainder of the board posting gains of about 2 cents.

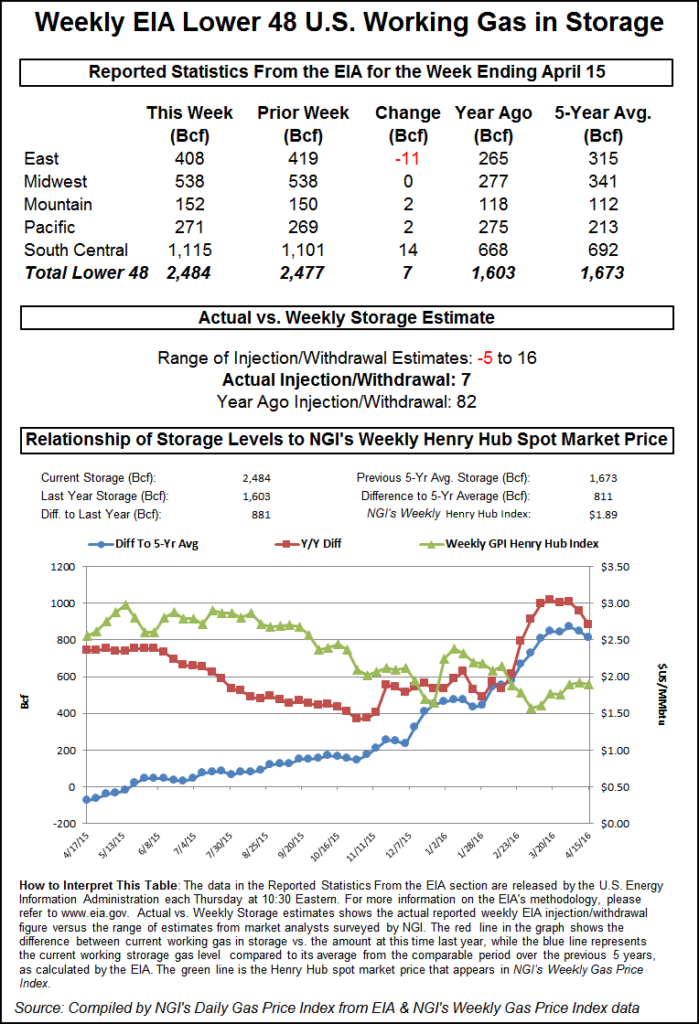

The EIA reported a build of 7 Bcf for the week enbding April 15, about 3 Bcf more than what traders were anticipating, but traders, for the most part, ignored the bearish implications. May futures were trading at about $2.077 just prior to the release of the data. and by 10:45 a.m. May was trading at $2.099, up 3.0 cents from Wednesday’s settlement.

Prior to the release of the data, estimates were coming in somewhat lower. A Reuters survey of 21 traders and analysts revealed an average 4 Bcf build, thus making the report somewhat bearish. If the assumption is made of a bearish report and the market is still able to post gains, that is often construed as a sign of underlying market strength.

“The build of 7 Bcf was modestly more than the consensus expectation and therefore a bearish influence on market sentiment, although the figure was still supportive on a seasonally adjusted basis compared with the 46 Bcf five-year average gain,” said Tim Evans of Citi Futures Perspective. “The larger than expected build does imply a somewhat weaker supply/demand balance, however, which may carry over into the reports to follow.”

Inventories now stand at 2,484 Bcf and are a robust 881 Bcf greater than last year and 811 Bcf more than the five-year average. In the East Region 11 Bcf was withdrawn and the Midwest Region saw inventories unchanged. Stocks in the Mountain Region rose 2 Bcf, and the Pacific Region was higher by 2 Bcf as well. The South Central Region added 14 Bcf.

In Friday’s trading gas for weekend and Monday delivery slipped as plentiful supply and the ease of making prompt purchases with cell phones and laptops gave buyers little incentive to commit to three-day purchases.

The NGI National Spot Gas Average shed 3 cents to $1.78 as solid pricing at eastern points could not overcome weakness at Rockies, California and Midwest locations. Futures trading began in the loss column but quickly picked up steam and was able to post new 11-week highs. At the close, May had risen 7.2 cents to $2.140 and June added 5.9 cents to $2.267. June crude oil gained 55 cents to $43.73/bbl.

Quotes in New England were the exception to an otherwise soft price environment as forecasts for increased demand rattled through the market. Gas at the Algonquin Citygate gained 12 cents to $2.33, and deliveries to Iroquois, Waddington gained a nickel to $2.20. Gas on Tenn Zone 6 200L changed hands 14 cents higher at $2.21.

Following the weekend, cooler weather was anticipated to roll in, possibly sending demand to two-week highs. “New England and Appalachia demand forecasts are projecting two-week highs may be reached Tuesday, [and] is expected to dip to 2.1 Bcf/d Saturday, but quickly return Monday and reach a peak of 2.6 Bcf/d by Tuesday,” industry consultant Genscape said in a report. “Appalachia demand will bottom out at 7.6 Bcf/d on Saturday, then climb to a peak on Tuesday at an estimated 10.6 Bcf/d.

In the Mid-Atlantic prices were mixed. Gas on Tetco M-3 Delivery eased 5 cents to $1.30, but gas on Transco Zone 6 into New York City added a nickel to $1.42.

“Southeast/Mid-Atlantic demand is projected fairly flat next week, averaging 11.9 Bcf/d, roughly in line with what we saw this week. Similarly, Midwest demand is projected to average 8.5 Bcf/d, also in line with its average this week,” Genscape said.

Marketers in the Great Lakes have been watching prices creep higher, but “We didn’t buy gas until today,” said a Michigan buyer. “If it gets as hot this summer as they are saying, there will be more usage, but the weather has been kind of hard to follow.

“We bought on Consumers and Michigan Consolidated, and paid $2.06 and $2.08 on Consumers and $2.03 on Michigan Consolidated.” The marketer said they “didn’t have all their numbers yet” and were not sure how strongly they would participate in upcoming May bidweek trading.

Midwest quotes were soft. Gas on Alliance shed 9 cents to $1.90, and deliveries to the Chicago Citygate fell 4 cents to $1.89. Gas on Consumers was quoted 4 cents lower at $2.06, and parcels on Michigan Consolidated changed hands a penny lower at $2.04.

A New York floor trader said, “I am assuming some stops were triggered up near the previous highs, and volume was high. The trading range is now $2 to $2.25, and the $1 handle is off the table.”

Prices may be on the rise, but industry observers see weak activity levels at least for the next three months. In a Friday morning conference call Schlumberger CEO Paal Kibsgaard said, “During the first quarter of 2016, the decline in global activity and the rate of activity disruption reached unprecedented levels as the industry displayed clear signs of operating in a full-scale cash crisis. Budgeted E&P spend fell again and substantially affected our operating results. This environment is expected to continue deteriorating over the coming quarter given the magnitude and erratic nature of the disruptions in activity.”

Analysts are taking a close look at the steepening price curve. “This market is showing a similar pattern to that of the oil as consolidation is developing in the aftermath of an early week price up-spike,” said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning note to clients.

“Fundamental supportive forces also appear parallel as a declining pace of production that has begun to spin off of a plunge in rig counts is attracting much attention. The fact that this market is well supported despite some short term one- to two-week temperature views that appeared tilted bearish provides further testament to a firm market undertone. However, a substantial supply surplus and limited weather-related demand is keeping physical pricing well discounted against the nearby screen. These discounts have translated to a sizable contango expansion in the front switch since early last week that has seen carrying charges stretch from around 8 cents to almost 14 cents.

“This unusually large contango could eventually drive renewed speculative selling given the advantage of favorable roll yields that will prove appealing to investment-type entities. For the time being, short speculators still appear on the defensive in the aftermath of this week’s chart improvement that has seen futures advance to highest levels since Feb. 12th.”

The best cure for high prices is often high prices, and Ritterbusch sees the June contract as a tempting sale. “Although we will be raising downside [support] possibilities well off of the $1.83 level, we also feel that the large premiums in June futures upon attaining prompt status next week will prove enticing to the commercials.”

Market technicians see the current advance as intact. “[We are] still viewing this congestion near the highs as a pause in the up trend,” said Brian LaRose, a market technician with United ICAP, in closing comments Thursday. “To jeopardize the case for a march to the $2.324-2.400 neighborhood bears would need to push natgas back below 1.929.

“Until and unless they can make that happen, we have little reason to assume the rally is over. Suspect we may need to see the rest of the petro complex keel over for this move higher to end in an abrupt manner.”

Gas buyers looking at weekend supply for power generation across the wet, soggy ERCOT footprint may be able to rest easy. WSI Corp. in its Friday morning report said, “Conditions will likely dry out and trend warmer during the next couple of days, but the chance of scattered storms may return during Saturday night into Sunday. Temperatures will generally top out in the upper 70s and 80s. Partly cloudy, warm and humid conditions will develop early next week, though this warmth may trigger a few isolated storms. High temps may peak in the 80s to low 90s along with [lows] in the upper 50s, 60s to low 70s.

“Light wind generation is expected to continue [Friday]. A moderating southerly flow will likely cause wind gen to ramp up and become elevated at times tonight through early next week. Output may occasionally peak 9-11 GW.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |