NGI Archives | NGI All News Access

NatGas Forwards Rally Amid Market Tightening, Looming Heat

It was quite the week in natural gas forwards markets as prompt-month prices rose an average 17 cents between April 15 and 21 in the face of slowing production and long-term outlooks for warmer-than-normal weather, according to NGI’s Forward Look.

The Nymex May contract climbed 16.6 cents during that time to settle at $2.068 on April 21, the same day the U.S. Energy Information Administration offered some rather bearish news to the gas market.

The EIA reported a 7 Bcf build to gas inventories for the week ending April 15, above market estimates of around 3 Bcf.

But while the reported build appeared bearish, the 7 Bcf build paled in comparison to last year’s 82 Bcf build for the week.

“Storage remains at record levels, but the level of injections is well below last year and points to a rebalancing over the course of the summer,” analysts at BMO Capital said.

“We believe that U.S. working gas in storage could exit the summer season at five-year lows, assuming normal weather,” the financial services provider said.

The folks at RBN Energy agree there could be more rebalancing over the course of the summer.

In a blog posted April 21 on RBN’s website, analyst Sheetal Nasta said the latest storage data reflects a surplus contraction to 856 Bcf and 806 Bcf versus the corresponding week last year and the five-year average, respectively.

Furthermore, RBN’s models show the market will inject a net 275 Bcf between this week and the week ending May 13.

“While that’s close to the five-year average (284-Bcf injection), it is well below last year’s 362-Bcf injection for the same period,” Nasta said.

RBN’s model is based on the 15-day weather outlook, storage facility data, pipeline flow data and other supply/demand inputs.

Just this week, forecasters at the National Oceanic and Atmospheric Administration said the Northeast and other high-population centers can expect unusually high temperatures in May.

NOAA issued a similar temperature forecast for the three-month period beginning in May, favoring above-average temperatures for much of the West, the northern tier of the country and much of the East.

And the case for a hotter-than-normal summer appears likely as conditions transition from El Nino to La Nina.

If cooling demand rises faster than normal, the rate of storage injections could lead to a quicker tightening of the market, especially as production appears on pace to finish out the remainder of the year below 2015 levels.

The latest analysis from Genscape shows shows Lower 48 production for the remainder of the year sliding about 4% year over year.

Genscape, based in Louisville, KY, is a real-time data and intelligence provider for energy and commodity markets.

Producer-guided production declines will be led by drops in the Fayetteville, Pinedale, Permian and Haynesville, Genscape said.

In the Northeast, however, production is expected to continue growing, with guidance pointing toward a 13% (1.4 Bcf/d) year-over-year increase amid greater takeaway capacity and persistently strong hedging programs.

“Northeast Marcellus is showing minimal growth as that area isn’t seeing as many capacity additions and likely won’t until 2017 as major projects (Constitution and Sunrise) have been delayed,” Genscape said.

“As a result, producers there continue shutting in volumes due to low prices, halting new drilling, and some are starting to work through their drilled-but-uncompleted (DUC) well inventory,” the company said.

Genscape’s Equity Group tracks and forecasts the production of 25 major exploration and production companies that account for nearly 50% of Lower 48 production. Its collection of Northeast producers account for more than 60% of Northeast production.

Indeed, the Northeast was dealt another blow when Kinder Morgan announced April 20 it would be suspending work on the proposed Northeast Energy Direct (NED) project, citing insufficient contractual commitments (see Daily GPI, April 21).

The greenfield project had two components — the 1.2 Bcf/d Supply Path would have transported Northeast Pennsylvania production to the Wright interconnect with Iroquois and TGP in NY, while the Market Path would have provided 1.3 Bcf/d of eastbound flows from Wright to Dracut, MA.

The project was proposed after back-to-back basis blowouts during the winters of 2013-2014 and 2014-2015, when cash basis at TGP Zn6 averaged $11.36/MMBtu and $5.77/MMBtu, respectively.

Since then, more normal winter weather, increased LNG imports and the implementation of dual-fuel incentives in the New England ISO, led to an average $1.05/MMBtu cash basis at TGP Zn6 during this past winter.

The announcement sent forward prices in the Northeast surging, particularly in winter strips further out the curve.

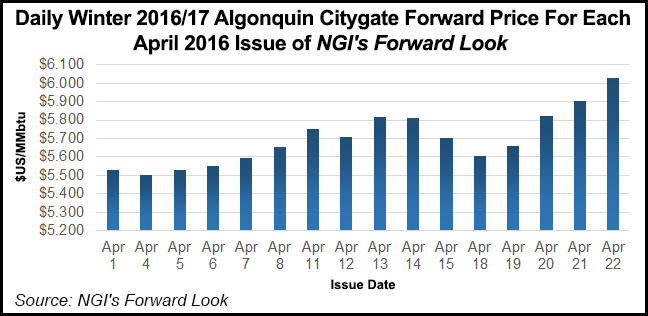

At Algonquin Gas Transmission citygates, the winter 2016-2017 strip shot up 42 cents between April 15 and 22 to reach $6.03, according to NGI’s Forward Look.

At Transco zone 6-New York, the winter ”16-’17 jumped 30 cents to $5.53.

Nationally, the same winter strip climbed 19 cents on average, Forward Look data shows.

For the winter 2017-2018 strip, AGT surged 30 cents to $5.99, while NY climbed 19 cents to $5.83.

Elsewhere, prices for the same winter strip were up less than 10 cents.

For the winter 2018-2019, AGT was up 35 cents between April 15 and 22 to $5.98, while NY was up 17 cents, according to Forward Look.

Prices rose about 5 cents on average nationally.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |