Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Con Edison Paying $975M For Stake in Crestwood Midstream Assets

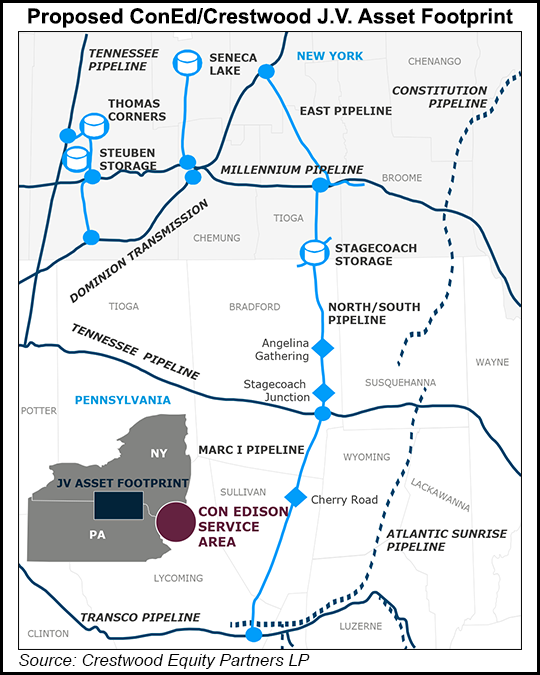

Crestwood Equity Partners LP and Consolidated Edison Inc. announced Thursday a joint venture (JV) in which Crestwood would contribute its natural gas pipeline and storage business in Northern Pennsylvania and Southern New York to a new company that will pair Marcellus Shale gas with high-demand markets in the Northeast.

Con Edison would pay Crestwood $975 million for a 50% stake in the new entity, Stagecoach Gas Services LLC, in exchange for the revenue the system is expected to generate and the stability it would provide to the electric and gas utility’s ratepayers. For Crestwood, the deal strengthens its competitive position during a particularly challenging time for midstream master limited partnerships (MLP) and gives it a strong partner to target more expansion opportunities in the high-growth markets of New York and New England.

“The partnership with Con Edison will reposition Crestwood’s Northeast pipeline and storage assets to more effectively compete for future expansion opportunities as Northeast demand for natural gas increases in the future,” said Robert Phillips, CEO of Crestwood’s general partner.

The high-yield MLPs of recent years have had a cost of capital advantage that has locked out utilities from midstream investments. But with oil’s staggering fall and persistently low natural gas prices, MLPs have taken a beating, with revenue threatened by a lack of committed volumes, commodity price risk baked into contracts and counterparty credit risks turning the tide for better positioned utilities (seeDaily GPI, Oct. 22, 2015). Con Edison’s 50% stake in the JV follows a deal it made earlier this year for a pair of 20-year transportation agreements to move 250,000 Dth/d on the Mountain Valley Pipeline and the connected Equitrans system to the Northeast (see Daily GPI, Jan. 26).

Crestwood said it would cut its quarterly cash distribution by 56% to 60 cents/unit to help drive additional savings and long-term growth.

“With the proceeds from the Con Edison transaction and the decision to reduce our distributions to a more appropriate level given the realities of the current energy market, Crestwood will materially reduce our long-term debt and gain the flexibility to invest retained available cash to drive long-term value creation for the partnership,” Phillips said.

The deal is expected to close sometime this quarter. Con Edison’s $975 million contribution would be financed with a combination of equity and debt and the money would help Crestwood deleverage its balance sheet and generate more liquidity.

Stagecoach would be managed by Crestwood and operated by a newly formed services company. Stagecoach’s assets would consist of four natural gas storage facilities with a capacity of 41 Bcf and three pipelines (MARC 1, North/South and the East Pipeline) with a combined capacity of nearly 3 Bcf/d. For the first two years after the JV closes, Con Edison would receive 65% of the cash distributed by Stagecoach and 60% of the cash in the third year. After that, Crestwood said, each company would receive 50% of the cash distributed.

Con Edison serves millions of electric and gas customers in New York City and Westchester County, NY, and hundreds of thousands of customers in New York State, New Jersey and Northeastern Pennsylvania. Outside of Appalachia, Crestwood operates midstream assets in the Bakken, Niobrara, Barnett, Fayetteville and Haynesville shales in addition to the Permian Basin. Crestwood said the JV’s operations are expected to generate $145 million in earnings before interest, taxes, depreciation and amortization this year.

The companies said that they’ve identified numerous growth opportunities for Stagecoach that would be jointly pursued in the coming years.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |