Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

U.S. Shale Gas to Take Ontario, Provincial Regulator Says

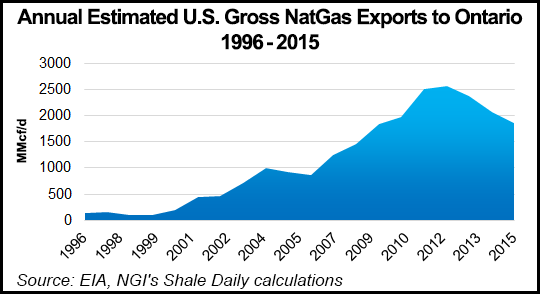

U.S. shale production exports will take nearly three-fourths of the most populated Canadian natural gas market, Ontario, within five years, according to the province’s public utilities commission.

Prices will drop by 35% off previous five-year projections as imports from the United States compete with traditional Alberta gas sources, said a new forecast by the Ontario Energy Board (OEB).

The volume and price trends are emerging into sharpening focus from a “continuing pivot” of the central province’s gas buyers towards the nearby U.S. Appalachian Basin and away from the remote Western Canada Sedimentary Basin (WCSB), the OEB said.

In 2015 imports of Appalachian gas from the Marcellus and Utica shale formations averaged 18%, or 400 MMcf/d of an Ontario market for 2.2 Bcf/d, according to a report done for the OEB by Navigant Consulting.

After canvassing 50 organizations representing a cross-section of the provincial gas market, the OEB projects that imports from the U.S. in 2021 will be 74%, or 2.1 Bcf/d of Ontario consumption of 2.9 Bcf/d.

The board lowered its forecast of benchmark average prices for 2021 at the Dawn storage and trading hub in southern Ontario to US$3.72/MMBtu from its previous prediction of US$5.68/MMBtu.

Instead of supply and price trends, the biggest variables in the Ontario outlook are an evolving cap-and-trade regime for greenhouse gas emissions and renovations required by aging atomic power plants. The environmental program is expected to restrain gas demand to the OEB’s current modest growth forecast by acting as a brake on thermal electricity generation. But the as-yet uncertain extent and duration of work on nuclear plants is rated as liable to inject an element of volatility into the market.

The OEB, and a commentary on its report by TransCanada Corp., agree that after generations as a captive market for Alberta gas from the WCSB, Ontario is reaping benefits of growing ability to shop around among “basin diversity” and “path diversity.”

As Appalachian Basin production capacity increases, the board and Canada’s top gas transporter observe that pipelines are catching up by developing new delivery paths.

Northbound routes are poised to proliferate beyond the traditional conduit to the Dawn hub beneath the St. Clair River between southwestern Ontario and Michigan, say the forecasts.

The old route to the Dawn hub run by Union Gas (Spectra) has been carrying about three-quarters of Canadian gas imports, and Ontario pipeline projects are expanding its role. New paths include imminent flow reversals on three former TransCanada export conduits that for decades carried WCSB supplies into the United States.

As of the next heating season in the 2016-2017 winter, TransCanada reports awarding firm transportation contracts for imports of 1.1 Bcf/d from the U.S. via flow reversals on its Niagara Falls and Chippawa border crossings. More capacity increases are available with low-cost pipeline modifications, TransCanada adds.

Farther east, TransCanada said flows will reverse on the Iroquois line across New England, New Jersey and New York in time for the 2017-2018 heating season. The Iroquois plan includes connections with two U.S. pipeline projects aimed at carrying Appalachian gas, called Constitution and Northeast Energy Direct,the latter of which was just canceled by Kinder Morgan Inc.’s Tennessee Gas Pipeline.

The OEB and TransCanada also said that potential new northbound paths for U.S. gas include branch lines off proposed Appalachian Basin routes to U.S. markets, the Nexus and Rover projects currently advancing through the regulatory process.

But the WCSB is still a live competitor, TransCanada says in a pitch for Ontario buyers to stay interested in production delivered by its old west-to-east Mainline from its Alberta and British Columbia supply collection network, Nova Gas Transmission Ltd.

TransCanada says, “Although Marcellus-Utica supply has been and is becoming a key supply source for the Ontario market, the WCSB is not in decline and should continue to be included in a balanced portfolio for Ontario to enhance supply and path diversity and to mitigate commodity cost risks.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |