NatGas Cash, Futures Part Company; May Eases by Couple of Pennies

Natural gas for delivery Thursday worked higher in Wednesday’s trading as gains in Texas, California and the Midcontinent were able to outlast declines at eastern points. The NGI National Spot Gas Average added 3 cents to $1.85, but the East saw quotes average a couple of pennies lower.

Although futures settled modestly in the loss column, it was not until after the spot May contract posted a new 60-day high of $2.137. At the close, May settled at $2.069, down 1.9 cents from Tuesday, and June was off by 8-tenths of a cent to $2.180. May crude oil continued on its upward trajectory adding $1.55 to $42.63/bbl.

Gains were widespread, and outside the East only two points followed by NGI fell into the loss column. NGI Markets Analyst Nate Harrison observed that about 69 points, or more than half of the points followed by NGI, made new 30-day highs.

Major market hubs posted robust gains. At the Chicago Citygate, next-day gas changed hands 6 cents higher at $1.98, and deliveries to the Henry Hub rose 12 cents to $2.02. Gas on El Paso Permian was seen 9 cents higher at $1.87, and gas at the PG&E Citygate added 8 cents to $2.09.

The only negative on the day’s price advance was a weak power market in the East that kept a lid on next-day gas prices. Intercontinental Exchange reported that on-peak power for Thursday delivery at the ISO New England’s Massachusetts Hub fell $1.65 to $27.45/MWh, and peak power at PJM West eased 34 cents to $34.96/MWh.

Gas at the Algonquin Citygate fell 17 cents to $2.28, and deliveries to Iroquois, Waddington fell 3 cents to $2.19. Gas on Tenn Zone 6 200L gave up 24 cents to $2.10.

Deliveries to Tetco M-3 fell 8 cents to $1.42, and gas headed to New York City on Transco Zone 6 was quoted 8 cents lower at $1.46.

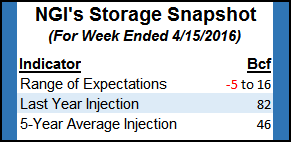

The slow pace of storage builds recently has, for the moment, energized the bulls, but after this week’s Energy Information Administration report, the pace of injections should increase. Tim Evans of Citi Futures Perspective calculated a 3 Bcf build for this week’s report, well below last year’s 82 Bcf input and a five-year average of 46 Bcf.

Going forward, Evans is forecasting that the year-on-five-year surplus currently at 849 Bcf will decrease slightly to 833 Bcf by May 6. He doesn’t seem to be buying the notion that lean storage builds were part of Tuesday’s rally.

In Evans’ view, it was “either based on some other intermediate-term idea, such as declining production or the forecast for a warmer than normal summer, or that it is more technical in nature.”

Other estimates of Thursday’s storage report include ICAP Energy at plus-5 Bcf and Ritterbusch and Associates at a plus-6 Bcf build.

Market technicians see seasonal factors in play.

“With natural gas inching above the prior high at $2.074, it very much looks like the up trend has been reestablished,” said United ICAP market analyst Brian LaRose in closing comments Tuesday. “So just how high can we go from here?

“Assuming an ABC-type pattern is unfolding from the $1.611 low [March 4] the A=C objectives will be our initial upside targets; 0.618 of (A)=(C) cuts at $2.158. (A)=(C) is up at $2.335. Reminder, $2.324-2.400 also represents our ideal objective for a seasonal advance.”

Other market technicians see gains continuing.

“We had the market in a wave 3 coming into this week, and we have a target for the wave 3 up to as high as $2.45,” said Powerhouse LLC’s Elaine Levin, vice president at the Washington DC-based trading and risk management firm. “Elliott Wave projections have at least another dime in this move.”

On the weather front, conditions moderated slightly. WSI Corp. in its Wednesday morning outlook said, the 11-15 day period forecast “features above average temps across the northern tier and the eastern U.S. Below average temperatures are most likely across the southwestern U.S.”

The forecast Wednesday “is warmer over the East and cooler over the central U.S.,” WSI said. Continental U.S. gas-weighted heating degree days “are down 2.1 for days 11-14 and are now forecast to be 20.2 for the period.”

Tom Saal, vice president at FCStone Latin America in Miami, in his work with Market Profile said to follow the breakout of the week’s initial balance, which he places at $2.091 to $1.890. Breakout targets higher are the 50% level at $2.192, and 100% at $2.292. Other trading targets include Tuesday’s value area at $2.060 to $2.010, as well as value areas at $1.990 to $1.976, and $1.943 to $1.913.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |