NGI Archives | NGI All News Access

Alberta Budget Hit Hard by Slumping Oil/NatGas Prices; Recovery in Sight?

Canada’s main natural gas- and oil-producing jurisdiction braced Thursday for another 36 months of hard times, with commodity prices and revenues seen likely to fall far short of fully recovering.

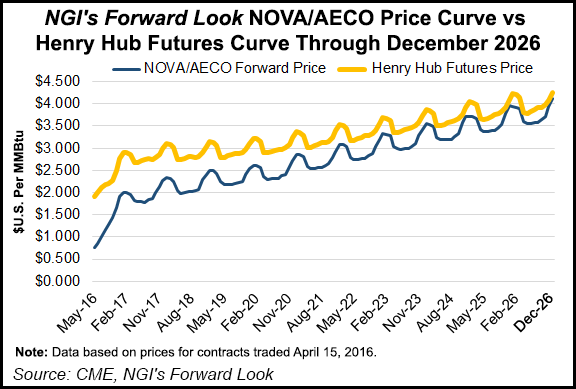

The Alberta budget predicted that gas will hover at C$2.40/gigajoule (GJ) (US$1.94/MMBtu) for the fiscal year ending March 31, 2017, C$2.80/GJ (US$2.26/MMBtu) in 2017-2018, and C$3.00/GJ (US$2.42/MMBtu) in 2018-2019.

Finance Minister Joe Ceci said oil prices are most likely to average US$42/bbl in 2016-2017, US$54/bbl in 2017-2018 and US$64/bbl in 2018-2019. But his budget also rated as conceivable a “low scenario” of US$36/bbl this year, US$43/bbl in 2017-2018 and US$54/bbl in 2018-2019.

“The immediate outlook for natural gas continues to be weak, with abundant supplies keeping prices low. North American natural gas storage is at record levels, after weather in both the summer and winter was mild, and from continued growth in U.S. shale gas production,” Ceci’s budget documents said.

NGI Daily’s price survey Friday showed AECO C hit an all-time low of C$0.88 cents/gj for weekend and Monday delivery, April 16-18.

The official Alberta view ahead for oil and liquids is slightly brighter, seeing “supply and demand beginning to rebalance in 2017.”

Ceci’s budget said, “The impact of lower drilling in North America, reduced investment elsewhere and production disruptions in war-torn regions should slow supply growth over the next year, even with added Iranian production, while demand should pick up in response to low prices. This in turn will support increasing prices, as a portion of incremental supply comes from higher-cost production.”

But for provincial treasury revenues from publicly owned gas and oil resources — nearly all of them in Alberta — the result is devastating shrinkage.

Total government royalty and production lease sale income is forecast to contract to C$1.4 billion (US$1.08 billion) in 2016-2017 — down by 85% from C$8 billion (US$6.2 billion) in 2014-2015, the last fiscal year before the commodity price dive.

Provincial energy revenues, like prices, are forecast to recover partially into the C$4 billion (US$3.08 billion) area by 2018-2019, still only half of their level two years ago.

But the New Democratic Party government elected last May, ousting a 44-year-old Conservative regime, has adopted an economic stimulus approach reminiscent of the 1930s New Deal in the United States.

Rather than worsen unemployment and contribute to spreading the slump beyond the gas and oil sector by tightening the budget belt, the government is increasing spending on public works, such as urban transit and schools, while also refraining from cutting civil service jobs. Annual deficits are projected to run in the C$10 billion (US$7.7 billion) area for the foreseeable future. Much further planning and investment is promised for job-creating economic diversification policies aimed at reducing provincial dependence on gas and oil.

Only marginal increases in corporate and personal income taxes are being adopted. Alberta remains the only Canadian jurisdiction without a retail sales tax.

The biggest new burden, forecast to collect about C$3.2 billion (US$2.5 billion) over the next 36 months, falls on gasoline and natural gas consumption, dressed in environmental green with a “carbon levy” label and rates derived from greenhouse gas emissions.

The new Alberta carbon levy tacks a charge of C$1.01/GJ (US$0.82/MMBtu) onto natural gas consumption as of Jan. 1, 2017, rising to C$1.52/GJ (US$1.23/MMBtu) on Jan. 1, 2018. The levy on gasoline works out to C$0.045 per liter (US$0.13 per U.S. gallon) in 2017 and C$0.067/ liter (US$0.19 per U.S. gallon) in 2018. The government promised to rebate the carbon levy to low-income earners.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |