Markets | NGI All News Access | NGI Data

NatGas Cash Eases as California Generators Feel the Squeeze; Futures Drop 7 Cents

Both next-day physical natural gas prices and futures took it on the chin in Thursday’s trading as a combination of weather forecasts, soft power prices and an uninspired government storage report kept a damper on pricing.

Nearly all points followed by NGI were in the red, and the NGI National Spot Gas Average fell 9 cents to $1.75.

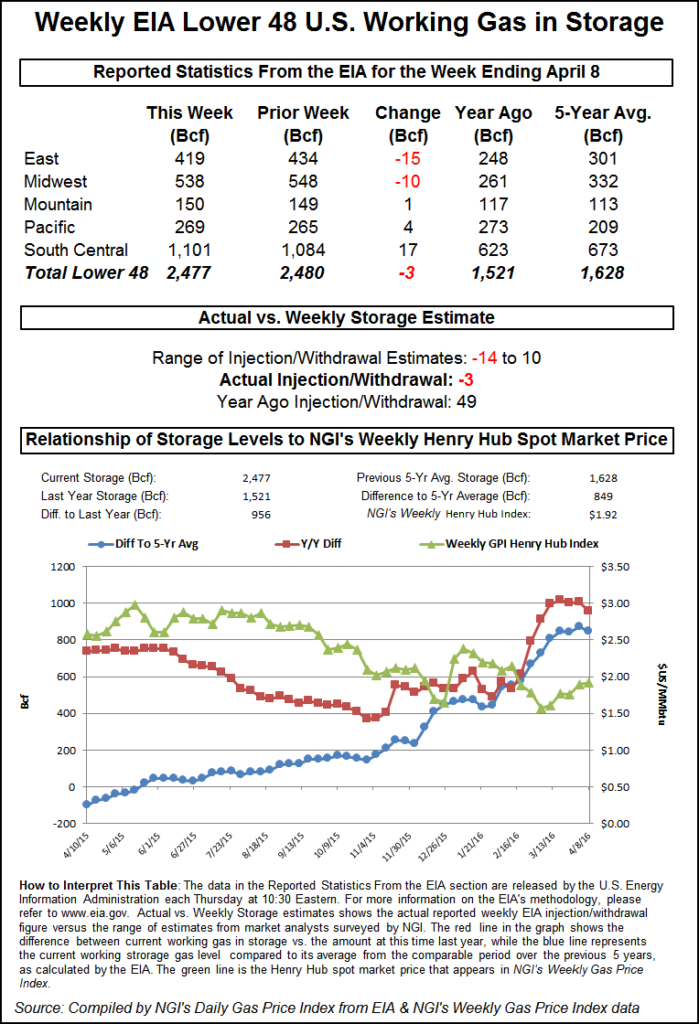

The Energy Information Administration (EIA) reported a withdrawal of 3 Bcf from storage for the week ended April 8, about 3 Bcf higher than what traders were expecting, and prices made an initial move to the upside, but ended lower on the day, as the $2 threshold once again proved elusive.

At the close, May had fallen 6.6 cents to $1.970, and June was down 5.6 cents to $2.063. May crude oil dropped 26 cents to $41.50/bbl.

Natural gas prices in California fell about a nickel and remain under pressure as gas-fired electrical generation facilities face increased competition from renewables and hydro. And on-peak power prices in California and the Northwest reached significant lows.

Intercontinental Exchange reported that on-peak next-day power at SP-15 fell 26 cents to $15.13/MWh, and power at COB eased 7 cents to $16.13/MWh. At Mid-Columbia, next-day power fell 88 cents to $12.44/MWh.

Next-day gas at Malin fell a nickel to $1.73, and parcels at the PG&E Citygate shed 4 cents to $1.93. Gas at the SoCal Citygate was lower by 3 cents to $1.94. Gas priced at the SoCal Border Avg. was quoted 4 cents lower at $1.77.

“In Southern California, when you’ve got high wind and high renewable days in the form of solar, you end up where gas units are still on, but they are losing money on the power and making it on the ancillary services,” said an Energy GPS analyst in Portland, OR. “We’ve seen high ancillary services prices, but very low power prices especially in the middle of the day.”

Ancillary services are payments from the ISO to power generators to keep their units running in the event that loads increase, and which ISO would call, sometimes quickly, for the generators to ramp up production.

Heat rates at SP-15 are pushing 7, the heat rate of state-of-the-art gas-fired combined cycle power generators.

“This is reasonable to say that we are at the all-time lows,” the analyst said. “The shift in California to higher use of renewables has been underway for a couple of years, and it was masked last year by low hydro. It has become apparent that you are displacing a tremendous amount of natural gas. It’s hard to imagine a build of a new merchant power plant under these conditions. If you look at the forward curve, it’s not pretty either.”

Points in the Northeast weakened as well, as next-day power proved unsupportive. Intercontinental Exchange reported on peak power at the ISO New England’s Massachusetts Hub fell $4.36 to $29.82/MWh. Friday on-peak power at the PJM West terminal fell $1.84 to $31.16/MWh.

Gas at the Algonquin Citygate shed 35 cents to $3.22, and deliveries to Iroquois, Waddington fell 9 cents to $2.10. Gas on Tenn Zone 6 200L tumbled $1.14 to $2.65.

Going into the day’s trading, estimates of the EIA storage report were coming in around flat, but any way it was sliced, it is likely to come across as bullish. Last year, a stout 49 Bcf was injected, and the five-year average is for a 22 Bcf build.

Energy Metro Desk publisher John Sodergreen said his survey came in at plus 2 Bcf with a range of minus 9 Bcf to plus 12 Bcf.

“While demand was up nicely week/week due to the weather — about 20% colder than the week prior — production and imports from Canada were healthy, offsetting much of that storage draw,” he said. “Many folks think it may be much lower than the editor’s 5 Bcf handle.

“Last year, the EIA reported a surprise injection of about 10 Bcf higher than market expectations. This year, this week, the odds are for a lower report than the consensus, but, in our view the weatherman just didn’t deliver that result. Our gas weighted degree days (GWDD) model came in at plus 1 Bcf.”

Other estimates included Stephen Smith Energy & Associates Inc. at a minus 7 Bcf and PIRA Energy at plus 4 Bcf. A Reuters survey of 23 traders and analysts revealed an average of 0 Bcf with a range of minus 14 Bcf to plus 10 Bcf.

May futures were trading at about $1.978 rior to the release of the data, and by 10:45 a.m., May was trading at $2.015, down 2.1 cents from Wednesday’s settlement.

The release of the data did not affect the day’s trading range which was already in place with a low of $1.971 and a high of $2.048.

The significance of the data will await a final settlement on the day’s trading.

“We have to see if this market can settle over $2,” said a New York floor trader. “That could be significant if we trade above $2 and stay above $2.”

“The net withdrawal of 3 Bcf was somewhat more supportive than the consensus expectation for a 0-3 Bcf build, and also bullish compared with the 22 Bcf five-year average net injection,” said Tim Evans of Citi Futures Perspective. “However, we expect the market to pivot to the upcoming warming trend that will translate into weak heating demand over the next two weeks. We don’t think the storage surprise was bullish enough to tip the balance in the market.”

Inventories now stand at 2,477 Bcf and are a stout 956 Bcf higher than last year and 849 Bcf more than the five-year average. In the East Region 15 Bcf were withdrawn, and the Midwest Region saw inventories fall by 10 Bcf. Stocks in the Mountain Region rose 1 Bcf, and the Pacific Region was higher by 4 Bcf. The South Central Region added 17 Bcf.

Market technicians suggested that bulls be patient.

“Only one way to signal the uptrend is intact, clear resistance,” said United ICAP technical analyst Brian LaRose in closing comments Wednesday. “That requires a push through the $2.059-2.097-2.0112 zone. Successfully clear resistance and the bulls have a green light to proceed up to $2.324-2.400 next, our seasonal target. In the event the bulls can not punch through resistance, further consolidation near the highs becomes possible.”

The weather picture is interesting, especially in the West, but unlikely to materially alter supply demand balances.

“The calendar may say April, but a major snowstorm will target parts of the Rockies and High Plains this weekend, with the potential for feet of snow and strong winds that could snarl travel and cause power outages, said Wunderground.com meteorologist Jon Erdman.

“The instigator for this is a classic upper-level low pressure system that eventually becomes cut off from the jet stream and parks itself over the Four Corners region for several days starting this weekend. The atmospheric ingredients for the weekend Rockies snowstorm are on the east side of that swirling, slow-moving low, deep moisture from the Gulf of Mexico will be pulled northwestward in what’s called a ”warm conveyor belt’ into the High Plains and Front Range of the Rockies.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |