Lower Coal Production, Coal-to-Gas Shift Holding Keys to Higher NatGas Prices, Says Barclays

With supple storage, near-term relief is off the table, but U.S. natural gas prices should begin to recover as production continues to decline, gas-fired generation continues to increase and a forecasted hotter-than-usual summer gets underway, analysts said Monday.

Three different analysts offered a more optimistic view in the medium-term for gas prices, although not in the near-term. Their comments mirrored some issued last week by Tudor, Pickering, Holt & Co., which expects to see higher gas prices in 2017 (see Daily GPI, April 7a).

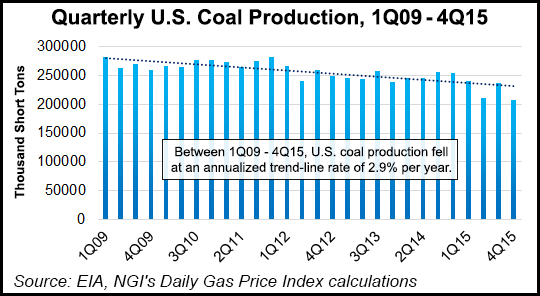

Gas market watchers should keep an eye on coal production, which looks like it could provide a price boost for gas, according to Barclays Capital’s Nicholas Potter.

The long-term sustainability of coal may be in question, but coal prices still may have some life left in them, Potter said. A rally in coal prices could coincide with the expected correction in U.S. gas markets. And that may set the stage for the two key fuels in domestic power generation to find strength in tandem in 2017.

“In the short term, things do not look that much better for U.S. coal in 2016,” Potter said. “Coal inventories ended December at almost 25% above the 10-year normal at 197 million tons,” which should limit deliveries this year.

However, gas prices likely are going to remain low at least through June, which means utilities would continue to burn cheap gas over coal. The tightening coal market is arriving at the same time as an improving gas market. At $2.00/Mcf gas, coal-to-gas switching mostly is maxed out, Potter noted.

“That means that, as natural gas prices increase in 2017, coal should gain back some of its lost market share. This could potentially mean that generators will be looking to turn to coal right when production levels are at their lowest levels in decades, and coal stockpiles are below their 10-year average.”

Coal shortages of any level would be beneficial for gas, as utilities would be forced to burn gas over coal “regardless of price,” Potter said.

Gas prices at their current levels “will strongly incentivize the ongoing shift from coal-fired to gas-fired generation as summer arrives,” energy analyst Stephen Smith said. The current National Weather Service summer outlook and some forecasters are predicting higher-than-normal cooling degree days for May through September because of the expected La Nina event (see Daily GPI, April 7b; March 2).

Along with hotter summer temps, gas production is falling.

“Marcellus-Utica gas production growth has been relentless, but it is clearly slowing,” Smith said. Gas output in the Lower 48 states, minus Appalachia, is now showing the gas production declines accelerating. In addition, gas exports to Mexico and overseas, as well as the startup of more gas-fired industrial production facilities should tighten domestic markets over 2016-2017, he said.

Henry Hub gas prices this year are expected to average $2.12/Mcf, up from Smith’s previous forecast of $2.05. Prices in 2017 also have inched higher in his forecast to $2.86 on average from $2.80.

“We are projecting a slight upward production trend for most of 2016, with a slight freeze-off weakening assumed for the 2016-2017 winter,” Smith said. “Except for Marcellus/Utica production, all other significant producing regions are now in trend decline.”

An upturn in dry gas production in 2017 assumes a tighter market balance and stronger gas prices, which would lead to a “gradual upturn” in well completions across the country. However, forecasting U.S. production has become “impossible to model, and it is purely a judgment call,” Smith said.

In its commodity price update, BMO Capital Markets said first quarter oil and gas prices were weaker than expected. Henry Hub was expected to average $2.33/Mcf between January and March but it never averaged close to that mark. Based on the average, BMO reduced its 2016 Henry Hub estimate to $2.14/Mcf from $2.31 and expects AECO to average C$1.62/Mcf from C$2.22. West Texas Intermediate prices were reduced to $38/bbl from $41.50, with Western Canadian Select cut to C$32.90 from C$37.20.

Gas “appears poised for a strong recovery in 2017 and we think it could outperform oil,” BMO’s Randy Ollenberger wrote. “As always, weather will play an unpredictable role.” Like oil, “2017 could shape up to be an interesting year for natural gas prices,” Ollenberger said. Slower production growth in 2017 sets the stage “for a strong rally…similar to 2012.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |