Bankrupt North American E&Ps Racked Up $18.9B of Debt Since 2015, Firm Says

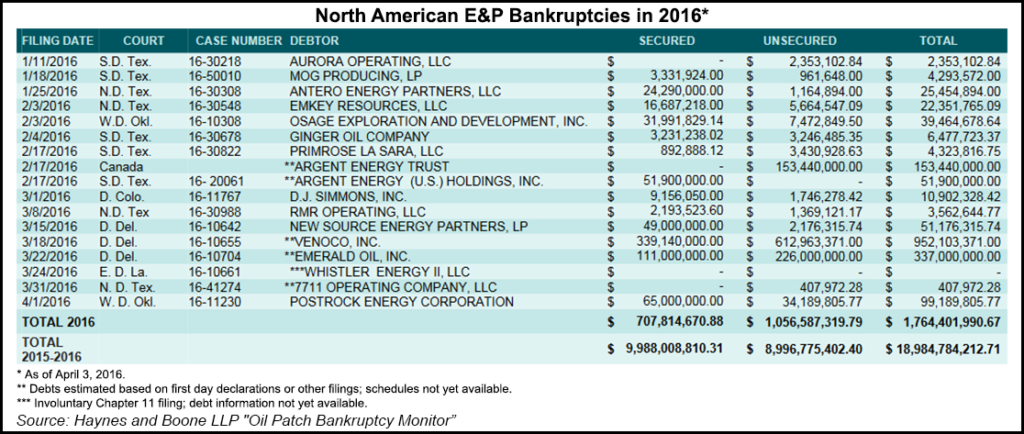

Forty-two North American exploration and production (E&P) companies filed for bankruptcy protection last year, and another 17 have filed since the beginning of 2016, according to a report by law firm Haynes and Boone LLP.

In the latest version of its “Oil Patch Bankruptcy Monitor,” the firm found the 42 E&Ps that filed for bankruptcy last year had more than $17.2 billion in cumulative secured and unsecured debt. When coupled with the more than $1.7 billion in similar debt from the 17 filers so far this year, the total comes to 59 E&Ps indebted by more than $18.9 billion.

“All indications suggest many more producer bankruptcy filings will occur during 2016,” the firm said, adding that the filings since the beginning of 2015 include requests for protection under Chapters 7, 11 and 15 of the U.S. Bankruptcy Code, plus some Canadian cases as well.

Haynes and Boone said that with ongoing low commodity prices, the firm was also following recent midstream bankruptcy filings. As an example it cited SouthCross Holdings LP, which filed on March 27 with approximately $616 million in funded debt obligations.

According to Haynes and Boone, last year’s E&P bankruptcies included $9.28 billion in secured debt and $7.94 billion in unsecured debt, for a total of $17.22 billion. So far in 2016, E&P bankruptcies include about $9.99 billion in secured debt and $9.0 billion in unsecured debt, for an overall total of $18.99 billion.

In terms of secured debt from last year, Tulsa-based Samson Resources Corp. topped the list with $1.95 billion. It filed for Chapter 11 bankruptcy protection last September (see Shale Daily, Sept. 17, 2015). Houston-based Sabine Oil & Gas Corp. was second on the list ($1.66 billion) after filing last July (see Shale Daily, July 15, 2015), followed by Fort Worth, TX-based Quicksilver Resources Inc. ($1.1 billion) in March 2015 (see Shale Daily, March 18, 2015). The fourth-highest E&P for secured debt was Fort Worth, TX-based Energy & Exploration Partners Inc. (ENXP), which filed for Chapter 11 last December and reported $776.5 million of debt (see Shale Daily, Dec. 8, 2015).

In order, the top four E&Ps on the unsecured debt list were Samson ($2.38 billion), Sabine ($1.2 billion), Quicksilver ($976 million) and Swift Energy Co., ($908 million) which filed in the waning hours of 2015 (see Shale Daily, Jan. 4).

Denver-based Venoco Inc. filed for Chapter 11 last month (see Shale Daily, March 18), and is at the top of the secured debt list for bankruptcy filers this year at $339.1 million. Another Denver-based E&P, Emerald Oil Inc., also filed for Chapter 11 this year (see Shale Daily, March 24) and is second on the secured debt list at $111 million. Venoco and Emerald also topped the unsecured debt list for 2016, at $612.97 million and $226 million, respectively.

Of the 42 bankruptcy filings made last year, 18 were filed in federal bankruptcy courts in Texas, while eight were filed in Delaware. There were six filings in Canada, four in Colorado, three in Louisiana, and one each in three states — Alaska, Massachusetts and New York.

Nine of the 17 bankruptcy filings made so far in 2016 have been filed in Texas courts, followed by three in Delaware, two in Oklahoma, and one each in Canada, Colorado and Louisiana.

Meanwhile, bankruptcy filings in Canada from 2015 and 2016 so far total about than $414.23 million, followed by Colorado ($259 million), Louisiana ($229.7 million), Alaska ($215.5 million), Oklahoma ($138.7 million) and Massachusetts ($3.58 million).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |