E&P | NGI All News Access | NGI The Weekly Gas Market Report

Rigs, Permits, Completions Still Falling After 2015’s Productivity Gains

The average count of U.S. active drilling rigs in March was 478, down a whopping 632 units from the 1,110 rigs that were running in March 2015, according to Baker Hughes Inc. (BHI).

Some analysts see a bottom coming in the rig decline. In the meantime well permitting and completions in Texas are still down from year-ago levels. When rigs do come back, they’ll be doing more with less, based on analysts’ findings about the industry’s performance last year.

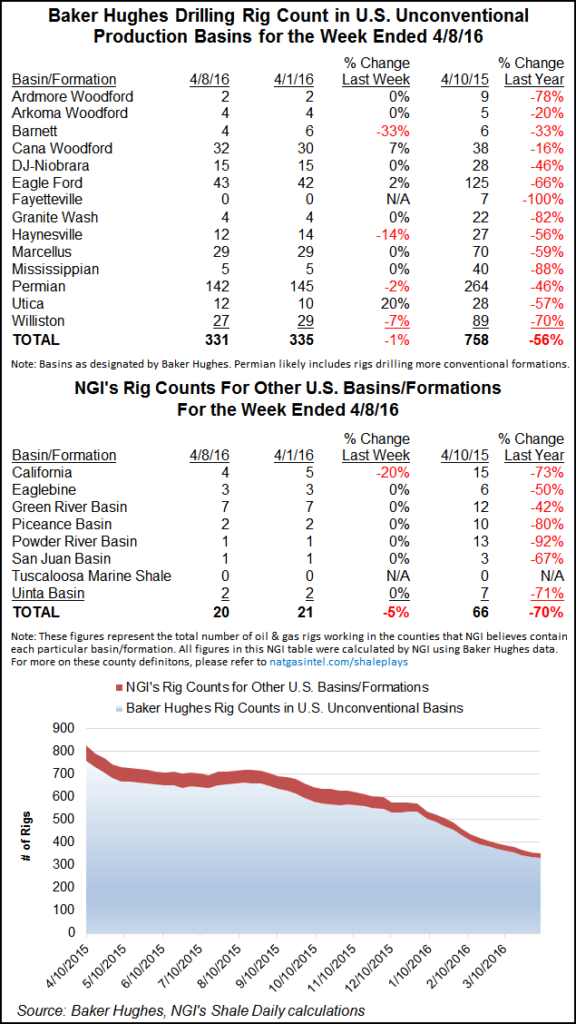

The latest BHI count trekked lower still in the latest census, released on Friday.

For the week ending April 8, BHI said the number of U.S. land rigs running fell by six to 414. The offshore lost one unit for a net U.S. decline of seven rigs to 443 active (414 on land).

Eight U.S. oil-directed rigs left service while one gas-directed rig returned. The horizontal and vertical tribes each saw five of their kind leave, offset by the return of three directional units. Texas lost the most rigs, dropping seven units to end at 197 active. That’s down from 427 one year ago.

In Canada, three oil-directed rigs departed, joined by five natural gas rigs for a net decline of eight units to end at 41 active for the week. Alberta dropped four rigs; British Columbia, three, while Saskatchewan added one unit to end with a total of two active, and Newfoundland-Labrador offshore lost two units.

“We continue to see the North American rig count bottoming some time in 2Q and beginning to increase in 4Q16,” Cowen and Company analysts said in an April 5 note. “International and offshore will be slower to respond as activity has yet to adjust to sub-$60/bbl oil prices. We continue to expect a range-bound commodity environment with U.S. production responding to any strength in commodity prices. As a result, we see a choppy recovery…”

Indeed, U.S. producers have proven that they know how to produce, and then some. When rigs do get called back to the patch, they will likely be more prolific than ever if the trend holds true.

“…[N]early every major play saw some improvements in productivity in 2015 measured via initial production rates, but the rate of improvement varied drastically as some areas are quite mature in their development (Bakken and Eagle Ford),” BTU Analytics said in a recent note. “The Central Midland area in the Permian Basin has been a clear winner in growth in initial production rates, with 677 horizontal wells reporting an average initial production rate 27% higher than the 648 wells that were reported in 2014.”

Coming in second, BTU Analytics said, was the Powder River Basin, where results from Devon Energy Corp., EOG Resources Inc., Chesapeake Energy Corp., and Encana Corp. continue to improve.

In Texas for now, though, well permitting and completions are still down from year-ago levels.

The Railroad Commission of Texas (RRC) issued 511 original drilling permits in March compared to 923 in March 2015. The March total included 407 permits to drill new oil or gas wells, five to re-enter plugged wellbores and 99 for recompletions of existing well bores. The breakdown of well types for those permits issued included 129 oil, 30 gas, 312 oil or gas, 30 injection and 10 other permits.

In March RRC staff processed 947 oil, 194 gas, 33 injection and eight other completions compared to 1,547 oil, 305 gas, 109 injection and nine other completions in March 2015. Total well completions for 2016 year to date are 3,452, down from 5,946 recorded during the same period in 2015.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |