Markets | NGI All News Access | NGI Data

Puzzling Market Response to Plump Storage Data

Natural gas futures worked higher Thursday morning and had traders scratching their heads after the Energy Information Administration (EIA) reported a storage build that was somewhat greater than what the market was expecting.

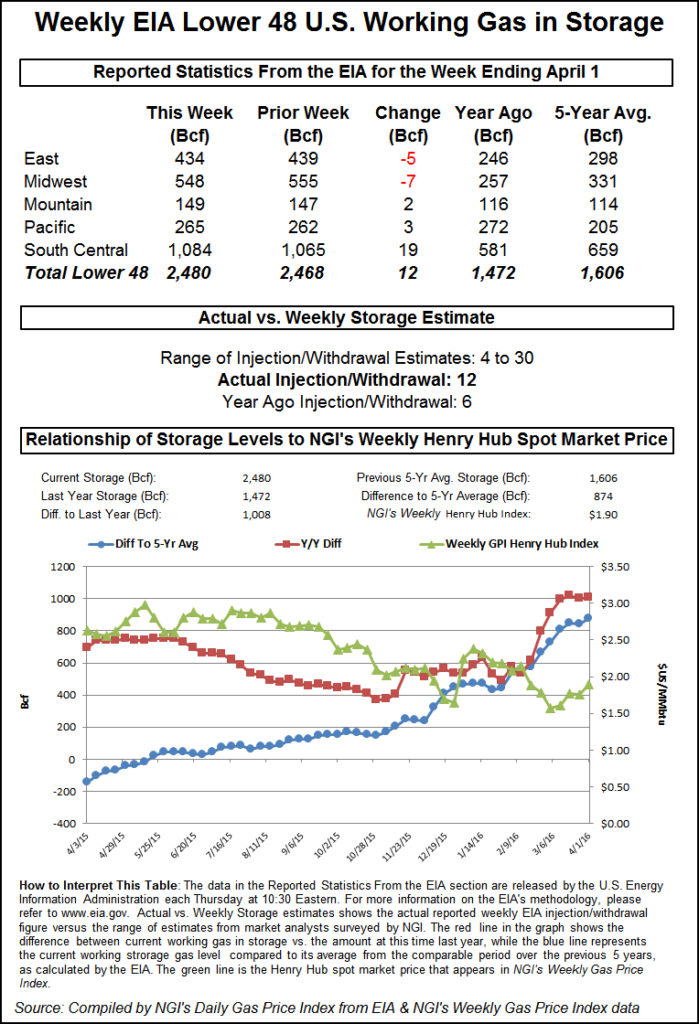

EIA reported a 12 Bcf storage build in its 10:30 a.m. EDT release, about 4 Bcf more than traders had been anticipating in the report for the week ending April 1. May futures were trading at about $1.940 just prior to the release of the data, and by 10:45 a.m. May was trading at $1.978, up 6.7 cents from Wednesday’s settlement.

“We were looking for a +6 to +8 [Bcf] build, but the market rallied. Why? I can’t tell you,” a New York floor trader said. “I’m looking at the market and I see +12 Bcf so maybe we should come off a little bit, but maybe not make new lows. I’m seeing this thing climb higher, and I’m saying to myself, ‘What am I missing here?'”

Analysts seem to think the market is more focused on eastern and Midwest weather than storage data.

“The 12 Bcf net injection was more than the consensus for a smaller 8 Bcf gain, although still within the range of forecasts,” said Tim Evans of Citi Futures Perspective. “The report was also bearish relative to the 19 Bcf five-year average net withdrawal. However, this may not be enough of a shock to offset the late-season heating demand due to the current forecast for colder than normal temperatures. Prices may be able to absorb the bearish storage surprises and still test higher.”

Inventories now stand at 2,480 Bcf and are a stout 1,008 Bcf greater than last year and 874 Bcf more than the five-year average. In the East Region 5 Bcf was withdrawn, and the Midwest Region saw inventories fall by 7 Bcf. Stocks in the Mountain Region rose 2 Bcf, and the Pacific Region was higher by 3 Bcf. The South Central Region added 19 Bcf.

Salt cavern storage was higher by 8 Bcf to 323 Bcf, while the non-salt cavern figure rose 11 Bcf to 761 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |