NatGas Cash, Futures Continue Grind Lower; May Drops Another 4 Cents

Both physical natural gas for Thursday delivery and futures struggled in Wednesday’s trading. Only a handful of points, primarily in the Rockies and a few in the Northeast, managed to make it to the positive side of the trading ledger, while most points retreated a few pennies to a nickel or more.

The NGI National Spot Gas Average dropped 7 cents to $1.80, and locations in the East on average plunged close to 30 cents. Futures continued their trek lower, having posted only one winning session in the last five. At the close, May had fallen 4.3 cents to $1.911, and June was down 4.6 cents to $2.004. May crude oil jumped $1.86 to $37.75/bbl.

Eastern traders Wednesday were paying more attention to next-day power prices than they were to reports of scheduled maintenance on Algonquin Gas Transmission (AGT) and forecasts of early-spring blasts of cold weather marching through the Northeast.

Intercontinental Exchange reported that on-peak power Thursday at the ISO New England’s Massachusetts Hub fell $11.32 to $33.88/MWh, and next-day peak power at the PJM West terminal fell $4.11 to $28.78/MWh.

Next-day gas at the Algonquin Citygate tumbled $1.74 to $2.52, and deliveries to Iroquois, Waddington shed 30 cents to $2.12. Gas on Tenn Zone 6 200L dropped $1.81 to $2.69.

“Round after round of these cool blasts have come in the midst of major spring maintenance events which has prompted AGT to issue an OFO effective until May 1,” industry consultant Genscape Inc. said. “The current maintenance work taking place at the Stony Compressor has limited throughput to just 1.15 Bcf/d, placing pressure on the system and downstream receipt interconnects.

“Operational capacity through Stony Point will be elevated to 1.4 Bcf/d on Thursday, but will be restricted to a new year to date low of 1.03 Bcf/d on Saturday.”

Elsewhere, gas in the Midwest and at major trading centers declined. Gas on Alliance shed 4 cents to $1.92, and deliveries to the Chicago Citygate lost 4 cents to $1.92. Gas on Consumers was quoted 6 cents lower at $1.96, and parcels delivered to Michigan Consolidated fetched a nickel less at $1.93.

Gas on Dominion South changed hands a penny less at $1.47, and deliveries to the Henry Hub fell a nickel to $1.86. Gas on El Paso Permian eased 3 cents to $1.71.

Futures traders had a hard time pinpointing any significant support areas as prices fell in light trading. They pointed out that prices had traversed this area many times, and for the most part had failed to find much in the way of technical support.

“I don’t think you will find any significant selling until you get down to the $1.75 level,” a New York floor trader told NGI.

In spite of supportive weather conditions, analysts pointed to Tuesday’s failure as a sign that the market is going to need more help than weather can offer if it is going to punch through $2.00.

“The natural gas futures market came under selling pressure on Tuesday after failing to clear Monday’s price high, calling attention to the limited support of cooler than normal temperatures that will boost late-season heating demand over the coming week,” said Citi Futures Perspective analyst Tim Evans in closing comments Tuesday.

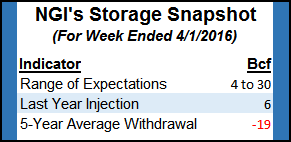

Short-term traders suggested that a quick bail by recent longs playing the run higher may have also prompted May’s demise, but Evans was looking at traders exiting ahead of Thursday’s Energy Information Administration (EIA) storage report. Evans said the early consensus is running at a 5-10 Bcf injection, “with a bearish comparison with the 19 Bcf five-year average net withdrawal for the date.”

Evans is forecasting a build of 13 Bcf, and if his data is correct, the current year-on-five-year surplus of 843 Bcf would fall to 799 Bcf by April 15.

“With the surplus ending the forecast period at a lower level than it started, we see this as confirming the market will become at least somewhat tighter on a seasonally adjusted basis than it has been,” he said. “This gives the market at least a chance to move higher, although it may not be enough to wedge the price above $2.00.”

He recommended standing aside the market until a low-risk opportunity can be identified.

May futures may be discounting any significant weather impact, but spot traders in eastern markets had some active weather and cooler temperatures to deal with.

The National Weather Service reported Wednesday morning that a low-pressure system would move across the upper Midwest and Great Lakes, bringing rain and snow to those regions.

“In its wake, another round of cold temperatures will invade areas from the Midwest to the Mid-Atlantic and Northeast,” weather forecasters said. “Scattered rain and snow showers will persist across the Midwest and Great Lakes on Thursday as colder air moves in, and the same will hold true for the eastern U.S. on Thursday night and Friday.

“While temperatures will remain 5-10 degrees below average today across the East, the colder air mass arriving behind this front will result in temperatures 10-20 degrees below average for Thursday and Friday across a wide area from the Midwest to the Mid-Atlantic.”

Thursday’s EIA storage report will likely continue to increase the long term average surplus. Last year 6 Bcf was injected, yet the five-year average is for a 19 Bcf pull. Ritterbusch and Associates calculated a 4 Bcf increase, and PIRA Energy is looking for a 6 Bcf build. A Reuters survey of 20 traders and analysts revealed an average 8 Bcf with a range of +4 Bcf to +30 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |