NGI Archives | NGI All News Access

Freeport-McMoRan’s E&P Management Team Ousted

Freeport-McMoRan Inc., which spent more than $9 billion in late 2012 to build its U.S. oil and natural gas business, on Tuesday said the executive management team of its exploration and production arm has been sacked.

The overhaul of Freeport-McMoRan Oil & Gas (FM O&G) reflects “our focus on reducing costs throughout our global organization in response to a challenging commodity market environment,” CEO Richard Adkerson said.

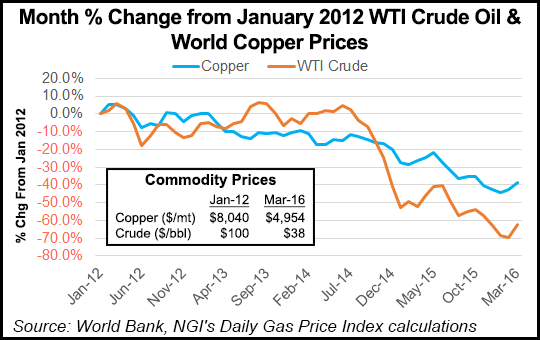

Freeport, one of the largest copper/gold mining conglomerates in the world, sharply increased its debt and drew shareholder scorn when it agreed to buy frequent partners Plains Exploration & Production Co. (PXP) and McMoRan Exploration Co. (see Daily GPI, Oct. 22, 2013; Dec. 6, 2012). The transaction, which led to the creation of FM O&G, failed to ignite shareholder enthusiasm, and then oil prices plunged. Copper prices also have plunged, further weighing on the company’s financials.

FM O&G since has dropped offshore and onshore rigs, laid off employees and delayed projects. Last October management confirmed that “strategic alternatives” were being eyed for the unit, and two months later Freeport’s dividend was scrapped (see Daily GPI, Dec. 9, 2015; Oct. 6 2015). FM O&G only last year was considered a candidate for a public spinoff (see Daily GPI, June 25, 2015). Instead, it is being restructured as an operating division of Freeport.

The shakeup has led to the ouster of FM O&G’s executive management team, including CEO Jim Flores, the former chief of PXP. Also gone are FM O&G COO Doss Bourgeois, CFO Winston Talbert and General Counsel John Wombwell.

Mark Kidder has been named executive vice president of operations for FM O&G and is to lead the operating team. Kidder previously served as Freeport’s vice president of operations.

“FM O&G will focus on conducting its operations safely and efficiently to preserve and enhance the values of its assets for anticipated future improvement in market conditions,” management said. “Further steps will be taken to reduce costs and capital expenditures,” and Freeport plans to continue to evaluate whether to sell FM O&G assets.

Freeport’s U.S. oil and gas assets are mostly concentrated in the deepwater Gulf of Mexico, but it also has substantial natural gas leaseholds in the Haynesville Shale and the Inboard Lower Tertiary/Cretaceous gas trend onshore in South Louisiana, as well as projects onshore and offshore California.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |