Markets | NGI All News Access | NGI Data

Futures Exhale Despite Bullish Storage Data

Natural gas futures worked lower Thursday morning despite the fact that the Energy Information Administration (EIA) reported a storage withdrawal that was somewhat greater than what the market was expecting.

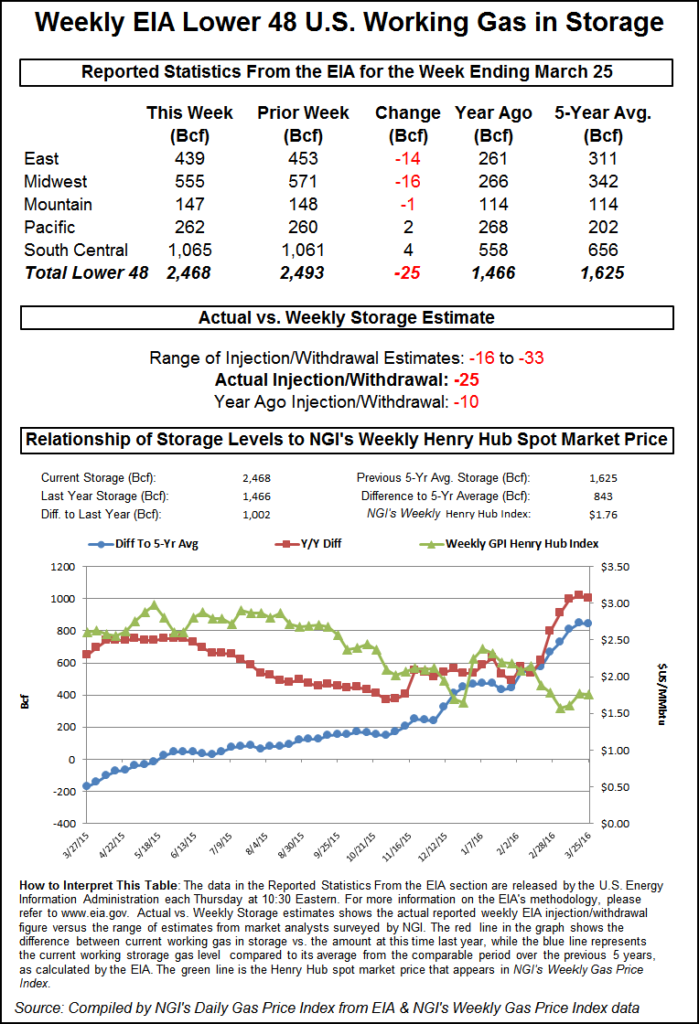

EIA reported a 25 Bcf pull in its 10:30 a.m. EDT release of data for the week ending March 25, about 3 Bcf more than what traders were anticipating. May futures were trading at $2.015 just prior to the release of the data. By 10:45 a.m. May was trading at $1.985, down 1.1 cents from Wednesday’s settlement.

“I had heard a 22 Bcf withdrawal, but others were telling me -27 to -28, so the 25 Bcf draw doesn’t come as much of a surprise,” said a New York floor trader. “We are solidly in the $2 range, and I look for trading between $1.90 to $2.10.”

Could supply be getting a little tighter? “The 25 Bcf draw for last week was somewhat more than expected and marginally supportive compared with the 22 Bcf five-year average for the date,” said Tim Evans of Citi Futures Perspective. “It also suggests a somewhat tighter supply-demand balance baseline that may carry over into future periods.”

Inventories now stand at 2,468 Bcf and are a stout 1,002 Bcf greater than last year and 843 Bcf more than the five-year average. In the East Region 14 Bcf was withdrawn, and the Midwest Region saw inventories fall by 16 Bcf. Stocks in the Mountain Region fell 1 Bcf, and the Pacific Region was higher by 2 Bcf. The South Central Region added 4 Bcf.

Salt cavern storage was higher by 3 Bcf to 315 Bcf, while the non-salt cavern figure rose 1 Bcf to 750 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |