Markets | NGI All News Access | NGI Data

April Futures Greet Bullish NatGas Storage Stats With Big Yawn

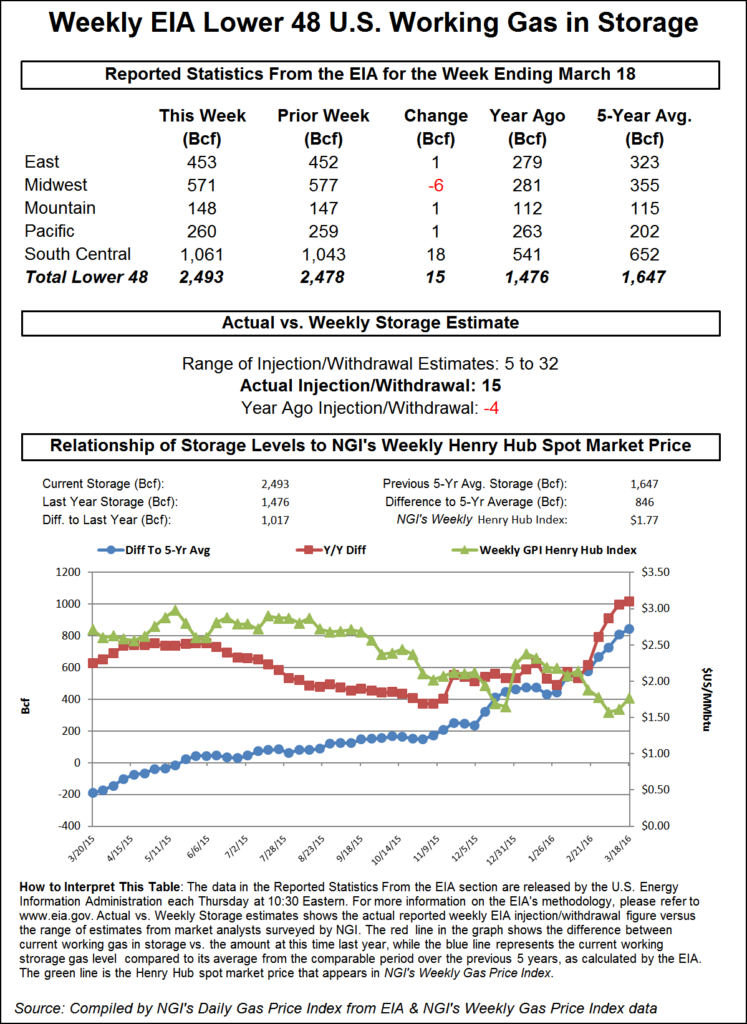

Natural gas futures inched higher Thursday morning after the Energy Information Administration (EIA) reported a storage build for the week ending March 18 that was somewhat lower than what traders were expecting.

EIA reported a 15 Bcf injection in its 10:30 a.m. EDT release, about 5 Bcf less than what traders were anticipating. The market rose to a high of $1.807 following the release of the data and by 10:45 a.m. April was trading at $1.804, up 1.0 cents from Wednesday’s settlement.

“Traders were expecting 18 Bcf, but I think market sentiment is still bearish,” a New York floor trader told NGI. “The market is short, so any time you see a blip it is money being taken off the table, not new long-term positions.”

“For the third week in a row, the EIA announced data that has come almost perfectly in line with our expectations,” said Harrison, NY-based Bespoke Weather Services. “Again this week we have seen the number come in slightly more bullish than the market expectation, but the immediate reaction has been relatively neutral. A +15 Bcf build is still bearish compared to the five-year average of -22 Bcf, but at least the build is smaller than the massive 2012 one.”

Inventories now stand at 2,493 Bcf and are a stout 1,017 Bcf greater than last year and 846 Bcf more than the five-year average. In the East Region 1 Bcf was injected, and the Midwest Region saw inventories fall by 6 Bcf. Stocks in the Mountain Region rose 1 Bcf, and the Pacific Region was higher by 1 Bcf. The South Central Region added 18 Bcf.

Salt cavern storage was higher by 9 Bcf to 312 Bcf, while the non-salt cavern figure rose 9 Bcf to 749 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |