Markets | NGI All News Access | NGI Data

NatGas Cash Zigs, Futures Zag as April Sheds 7 Cents

Physical natural gas for Thursday delivery worked higher in trading Wednesday as firm quotes in the Gulf, Texas and Northeast were able to offset a weaker Rockies and flat California. The NGI National Spot Gas Average rose 2 cents to $1.66, and eastern points were able to tack on about 7 cents on average.

After early gains, futures prices turned tail and ended up with losses on the day as traders cited some spillover from a weak petroleum complex. April settled 6.9 cents lower at $1.794, and May finished down 6.9 cents also to $1.868. May crude oil tumbled $1.66 to $39.79/bbl.

Prices in and around the Upper Midwest held their premium to the rest of the market as a major Chicago LDC said it would be adjusting deliveries. Nicor Gas said beginning on Gas Day 22 it “will be adjusting pipeline caps for deliveries to their city-gate. The OFO Cap Day is necessary due to forecasted warm weather resulting in reduced system demand.”

Gas at the Chicago Citygate was quoted at a stout $1.90, up 2 cents on the day, and deliveries to Nicor Gas rose a penny to $1.94. Chicago NIPSCO packages rose a penny to $1.87, and Chicago Peoples advanced a nickel to $1.84.

Elsewhere in the region, gas on Alliance added 2 cents to $1.88, and parcels on Consumers changed hands at $1.91 up 2 cents. Deliveries to Michigan Consolidated changed hands 2 cents higher at $1.93.

With the exception of PG&E Citygate, quotes at major market centers were significantly less. The Henry Hub was seen at $1.80, up 5 cents, and gas on Transco Zone 6 NY rose 2 cents to $1.26. Gas on El Paso Permian was up a cent to $1.61, and deliveries to the PG&E Citygate added a penny to $2.01.

Steady to slightly lower next-day power made incremental purchases for power generation unappealing. Intercontinental Exchange reported that on-peak power for Thursday delivery at the ISO New England’s Massachusetts Hub rose $1.87 to $21.90/MWh, and power at the PJM West terminal eased 19 cents to $25.11/MWh. Next-day on-peak power at the Indiana Hub dropped $1.25 to $24.25/MWh.

Analysts are expecting declining supply throughout 2016 and have hinted at a rebalanced market with stout season-ending inventories.

“Our 21-basin gas supply model shows U.S. dry production down by 5.2% in 2016,” said Jefferies LLC analyst Jonathan Wolff in a report. “Appalachia is the only region in which our model shows growth, with…supply up by about 900 MMcf/d in 2016. Supply gains in this basin are offset by declines across all additional basins that we track, with the largest declines coming from the Eagle Ford (minus 900 MMcf/d), Anadarko Basin (minus 650 MMcf/d) and Barnett, Fayetteville and East Texas (all falling by about 500 MMcf/d).

“We model total supply decline of 6.2%, with increased exports to Mexico and a decrease in net imports from Canada,” Wolff said. “We model supply down by 1.7 Bcf/d during the summer ‘refill season.'”

The Jefferies analysts didn’t make any specific price predictions but said “longer-dated strips are holding up. Despite squishy cash markets (April trading at about $1.85/MMBtu), 2017-plus ($2.73/MMBtu) have held up well” because of reduced industry capital spending and slowing growth trends.

“The better tone to gas has surfaced in recent private market transactions that seem to confirm long-term value in gas,” Wolff wrote.

Gas exports continue unabated as well. Industry consultant Genscape Inc. reported that Clean Ocean left the Sabine Pass facility March 15 carrying 3.31 Bcf. Liquefaction at Train 1 appears to be ongoing as delivery nominations continue to Sabine. Another vessel, Energy Atlantic was waiting ain the Gulf of Mexico.

Thursday’s storage report is expected to show the season’s first build.

“We are expecting an 11 Bcf injection this week, which would be the first injection of 2016,” said Genscape researchers in a report. “DTI and TCO posted 1 Bcf and 1.7 Bcf withdrawals, respectively, while ANR, NNG and several South Central facilities posted injections.” Gas-weighted heating degree days (HDD) “declined by 23 week/week, which suggests a decline in space heating demand of close to 25 Bcf, while power demand also appears to have declined slightly,” Genscape said.

“Although milder temps led to a large decline in power loads, coal took most of the decline this week, allowing gas generation to fall by only (0.2 Bcf/d). Supply declined by 16 Bcf, driven by a decline in both production and imports (minus 6 and minus 9 Bcf, respectively).”

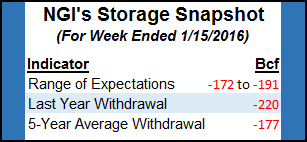

Ritterbusch and Associates is forecasting a 14 Bcf build,and ICAP Energy sees an estimated 20 Bcf increase. A Reuters poll of 22 traders and analysts revealed a 20 Bcf average, with a range from plus-5 Bcf to plus-32 Bcf. Last year 4 Bcf was withdrawn, and the five-year pace stands at a 24 Bcf decline.

A build in next week’s storage report looks likely as well.

The National Weather Service (NWS) is forecasting below-normal heating load in key eastern and Midwest markets. For the week ended March 26, NWS predicted New England would see 162 HDDs, or 28 below normal. New York, New Jersey and Pennsylvania were likely to experience 146 HDD, or 23 below its seasonal tally, and the greater Midwest from Ohio to Wisconsin is likely to have 158 HDD, or 19 below normal.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |