LNG | NGI All News Access | NGI The Weekly Gas Market Report

Jordan Cove LNG Backers Sign First Major Deal with Japanese JV

A week after a major setback at FERC for its proposed liquefied natural gas (LNG) export terminal in Oregon, Canadian-based Veresen Inc. on Tuesday signed a long-term capacity agreement for its Jordan Cove LNG facility with Tokyo-based electric utility joint venture JERA Co. Inc.

The preliminary 20-year agreement includes JERA’s purchase of 1.5 million tonnes/annum (mtpa) of natural gas liquefaction capacity, or a quarter of the 6 mtpa total capacity at the proposed export terminal in the international port of Coos Bay.

In April 2015, Tokyo Electric Power Co., Inc. (TEPCO) and Chubu Electric Power Co. Inc. jointly established JERA Co. as a “comprehensive alliance covering the entire energy supply chain, from upstream investments and fuel procurement through power generation.” At the time, the two electric utilities said JERA’s mission was “to ensure the stable supply of energy on an internationally competitive basis.”

JERA would reportedly become the world’s largest LNG buyer by volume in July, when TEPCO and Chubu are scheduled to complete the integration of their respective fuel procurement businesses into JERA (see Daily GPI, March 1).

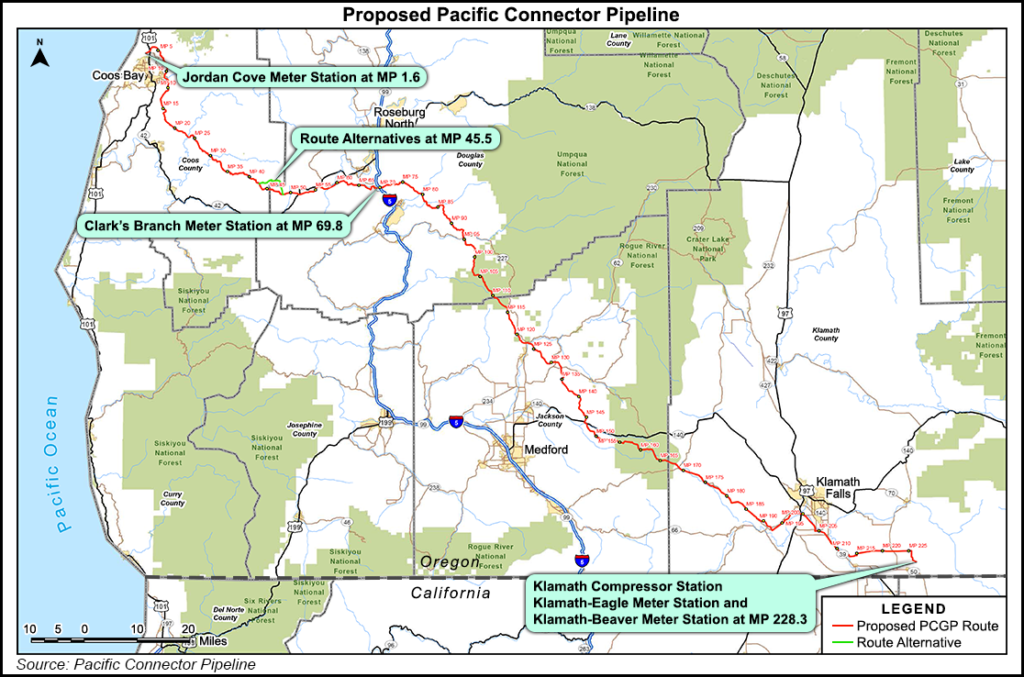

Earlier this month, the Federal Energy Regulatory Commission rejected Veresen’s proposed Jordan Cove project, citing problems with its Pacific Connector pipeline link to tap western Canadian and U.S. Rockies supplies, along with the project’s lack of contracts from buyers (see Daily GPI, March 14). FERC did not reject the project on environmental grounds, and it dismissed “as moot the environmental concerns” raised by the Sierra Club and others.

In response, Veresen said it would file for a rehearing of the decision with FERC on behalf of both Jordan Cove and the 232-mile proposed connecting pipeline. CEO Don Althoff said the company would “continue to advance negotiations with customers to address FERC’s concern.”

Startled Canadian industry analysts and investors discounted Veresen shares after FERC refused to grant construction approval to the project. But the Washington, DC, office of law firm Hogan Lovells said the ruling was much less of a departure from standard practice in the United States than it appeared to be to Canadians.

In a note to clients, the law firm attributed the FERC action to lack of demonstrated need at the time of the ruling for a critical part of the LNG project, a proposed 157-mile pipeline called Pacific Connector.

Jordan Cove was unable to identify any customers for itself or Pacific Connector that would have enabled FERC to justify approving the pipeline, Hogan Lovells said. The pipeline also had an uncertain future because right-of-way easements had only been obtained from less than 5% of 630 landowners along the route.

In regard to the JERA agreement, a Veresen spokesperson said it is subject to customary conditions, including execution of a detailed liquefaction tolling agreement, which the two sides will continue to work together to conclude, along with provisions that the project obtain all applicable regulatory approvals.

Veresen said negotiations for the facility’s remaining 4.5 mta liquefaction capacity are ongoing with other parties.

Althoff said the agreement with JERA “signals strong market support” for the Jordan Cove project, given that the deal involves the world’s largest LNG buyer and “represents a significant step forward” for Jordan Cove’s ultimate development. The $7.5 billion project is designed to export about 1 Bcf/d of LNG to Asian markets.

The Western Slope chapter of the Colorado Oil and Gas Association (COGA) touted the new Veresen agreement as its members are anxious to sell long-term supplies to Jordan Cove shippers. Last year, a contingent of western COGA members and local government officials from the gas-rich Colorado area wrote FERC urging expedited approval of the Jordan Cove project (see Daily GPI, Feb. 24, 2015).

David Ludlam, executive director of the West Slope COGA, praised the announcement from Veresen, noting that JERA will soon be in a position to pursue free trade and business relations with western Colorado producers. “If the world’s largest, most reliable purchaser of LNG, who also happens to be the most important U.S. Pacific ally, isn’t enough to convince FERC of a market need for Jordan Cove LNG, then certainly nothing will,” Ludlam said.

He noted that the Jordan Cove project manager is scheduled to be in Grand Junction, CO, in April on an information tour that is dubbed “Colorado to the Cove.” COGA CEO Dan Haley reiterated the importance of Jordan Cove to Colorado producers and the state’s economy overall.

On Monday a contingent of western Colorado local governments wrote U.S. Sen. Michael Bennet (D-CO) seeking his help in getting FERC’s rejection of Jordan Cove reversed, arguing that the federal regulatory panel’s own final environmental impact statement affirms the LNG export project. The local government officials complained that FERC has treated the Jordan Cove project unfairly.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |