Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Marcellus-Focused PennEast Pipeline Not Needed, Consultant Says

The proposed greenfield PennEast Pipeline, which would tap the eastern Marcellus Shale to serve Northeast markets, is not needed and would create excess transportation capacity, according to a study by consultant Skipping Stone and commissioned by the New Jersey Conservation Foundation (NJCF). Pipeline backers dispute the findings.

“Local gas distribution companies in the eastern Pennsylvania and New Jersey market have more than enough firm capacity to meet the needs of customers during peak winter periods,” the Skipping Stone report said. “Our analysis shows there is currently 49.9% more capacity than needed to meet even the harshest winter experienced in 2013 (the Polar Vortex Winter).”

PennEast is a joint venture owned by AGL Resources Inc. unit Red Oak Enterprise Holdings Inc. (20%); New Jersey Resources’ NJR Pipeline Co. (20%); South Jersey Industries’ SJI Midstream LLC (20%); UGI Energy Services LLC’s UGI PennEast LLC (20%); PSEG Power LLC (10%); and Spectra Energy Partners LP (10%). The partnership is managed by UGI Energy Services.

About 990,000 Dth/d of the up to nearly 1.11 million Dth/d of planned PennEast capacity is spoken for, the project backers told FERC last year (see Shale Daily, Sept. 25, 2015).

NJCF is an environmental organization whose purpose is “to preserve New Jersey’s land and natural resources for the benefit of all,” according to its website. PennEast is a threat to state land, according to the group. “…[W]e call upon FERC to immediately suspend review of PennEast’s application and to initiate a full evidentiary hearing to determine what demand is supposedly being met by the proposed pipeline,” said Tom Gilbert, the group’s director of its PennEast campaign.

Separately, PennEast opponent Delaware Riverkeeper Network recently filed a lawsuit against FERC alleging a bias “toward approving jurisdictional natural gas pipeline projects” (see Daily GPI, March 4).

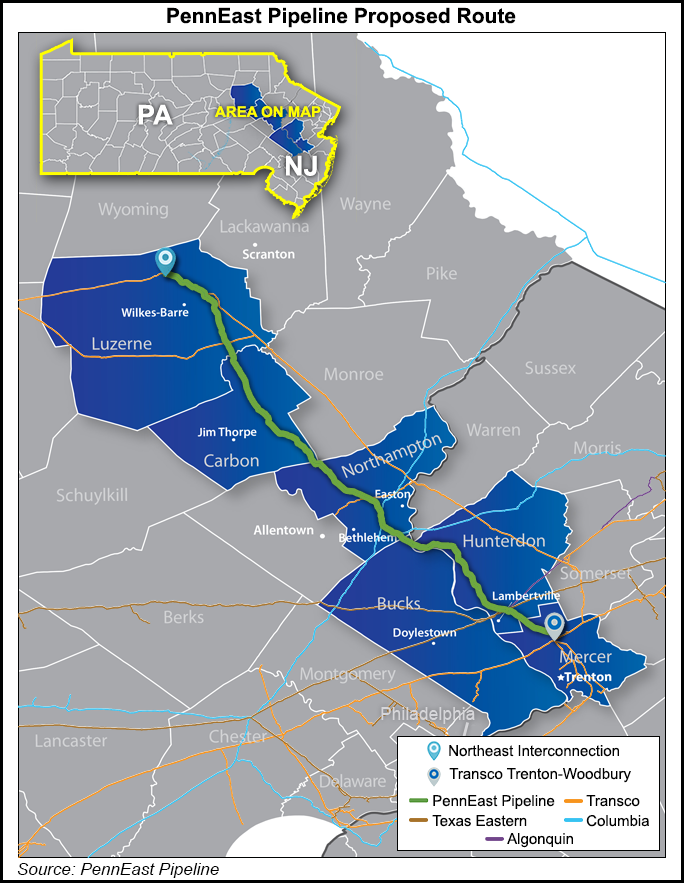

The 114-mile, 36-inch diameter PennEast would access receipt point interconnections in the eastern Marcellus region with Transcontinental Gas Pipe Line Co. LLC (Transco) and gathering systems operated by UGI Energy Services LLC, Williams Partners LP, and Energy Transfer Partners LP, all in Luzerne County, PA, according to a filing at the Federal Energy Regulatory Commission.

It would extend to delivery point interconnections in the “heart” of major northeastern natural gas-consuming markets, including interconnections with UGI Central Penn Gas Inc. in Carbon County, PA; UGI Utilities Inc. and Columbia Gas Transmission LLC in Northampton County, PA; and Elizabethtown Gas, NRG REMA LLC, Texas Eastern Transmission LP, and Algonquin Gas Transmission LLC in Hunterdon County, NJ. The terminus of the project would be at a delivery point with Transco in Mercer County, NJ. A handful of pipeline laterals also are planned.

Skipping Stone said in its report that would-be PennEast shippers accounting for nearly 40% of the project’s subscribed capacity “stated in their application that they intend to shift their gas supplies from existing competitor pipelines to PennEast, leaving excess and unutilized capacity on other pipelines.”

PennEast spokesperson Pat Kornick said the analysis “demonstrates a clear lack of understanding” of how energy markets work.

“The NJCF analysis overstated the natural gas capacity available to serve gas utility customers in the region, while understating the natural gas demand for which gas utilities plan,” Kornick said.

“Additionally, there is absolutely no evidence that there will be excess or unutilized capacity on other pipelines as a result of PennEast being constructed. There is significant demand for pipeline capacity, as is clear by the numerous proposals to add pipeline capacity from the Marcellus to serve markets in the mid-Atlantic, Southeast and Midwest; PennEast’s capacity is nearly fully subscribed under long-term contracts, which clearly demonstrates that it represents a viable alternative for potential shippers.”

“Additional pipeline capacity increases competition, enhances consumer choice and expands access to natural gas, all of which provide benefits to energy consumers. PennEast is expected to decrease and stabilize costs to energy consumers in eastern Pennsylvania and New Jersey, and there is no basis or support for the NJCF’s allegations to the contrary.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |