Markets | NGI All News Access | NGI Data

NatGas Futures Ease Following Storage Data Release

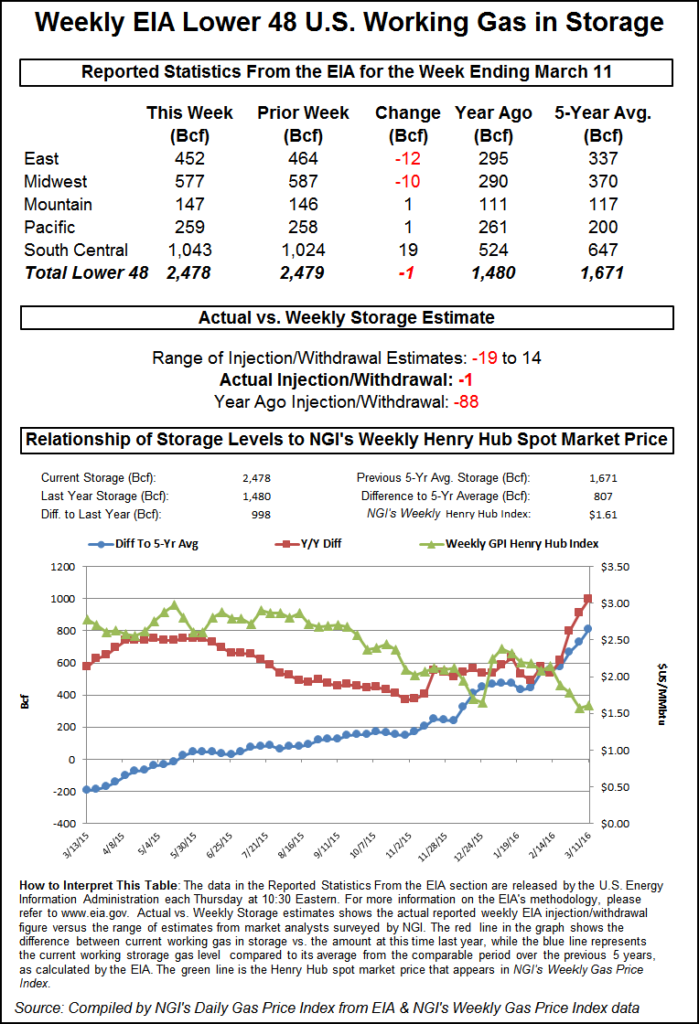

Natural gas futures worked lower Thursday morning after the Energy Information Administration (EIA) reported a storage withdrawal that was about in line with what traders were expecting.

EIA reported a 1 Bcf withdrawal in its 10:30 a.m. EDT release, about with traders were expecting. The market dropped to a low of $1.855 following the release of the data, and by 10:45 a.m. April was trading at $1.857, down 1.1 cents from Wednesday’s settlement.

“We were looking anywhere from a +6 Bcf to a -2 Bcf number,” said a New York floor trader. “We’ll see if the market can hold the $1.83 to $1.84 area.”

“The 1 Bcf net withdrawal was slightly less than the consensus expectation and so modestly bearish in terms of its immediate pressure on prices,” said Tim Evans of Citi Futures Perspective. “We see it as significantly more bearish versus the 82 Bcf five-year average, with the year-on-five-year average storage surplus a new high of 807 Bcf.”

Drew Wozniak of ICAP Energy characterized the report as “bearish.”

Inventories now stand at 2,478 Bcf and are a stout 998 Bcf greater than last year and 807 Bcf more than the five-year average. In the East Region 12 Bcf was pulled, and the Midwest Region saw inventories fall by 10 Bcf. Stocks in the Mountain Region rose 1 Bcf, and the Pacific Region was higher by 1 Bcf. The South Central Region added 19 Bcf.

Salt cavern storage was higher by 12 Bcf to 303 Bcf, while the non-salt cavern figure rose 7 Bcf to 740 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |