Markets | NGI All News Access | NGI Data

NatGas Cash Off Slightly, But Futures Continue to Grind Higher

Next-day natural gas values eased lower in Wednesday’s trading as modest overall gains in the Northeast were unable to offset broad losses of a few pennies at most market points in the Gulf, Midwest, Rockies and California. The NGI Daily Spot Gas Average eased 2 cents to $1.61, and gains in the Northeast averaged about 3 cents.

Futures managed to continue their march higher, and at the close April had added 1.7 cents to $1.868, and May had added 1.0 cents to $1.955. April crude oil jumped $2.12 to $38.46/bbl.

Next-day gas at a few eastern points declined as temperature forecasts refused to come anywhere close to seasonal norms. AccuWeather.com predicted Boston’s high of 51 on Wednesday would rise to 60 Thursday before retreating to 52 on Friday, 6 degrees above normal. New York City’s 62 was seen inching to 63 Thursday before dropping 10 degrees Friday — still holding a 3-degree edge over the seasonal norm. Philadelphia’s forecast maximum of 69 Wednesday was seen easing to 66 Thursday then to 55 Friday, 2 degrees above normal.

Gas at the Algonquin Citygate fell 22 cents to $1.47, and deliveries to Iroquois, Waddington declined 5 cents to $1.88. Gas on Tenn Zone 6 200L shed 18 cents to $1.49.

Prices firmed at other eastern locations. Gas on Texas Eastern M-3, Delivery rose 3 cents to $1.16, and packages bound for New York City on Transco Zone 6 added a penny to $1.18.

Some unusual fluctuations were seen in and around the Chicago Citygate. Next-day gas on Alliance fell 3 cents to $1.79, and gas averaged $1.87 at the Chicago Citygate, unchanged, but Naperville, IL utility Nicor Gas changed hands at $1.95, down 3 cents.

An industry veteran suggested that on occasion Nicor Gas “would have issues. They like suppliers to bring in a certain amount of gas to the gate.” He speculated that a shortfall in deliverabilities may have caused the price discrepancy.

Analysts saw Tuesday’s gain as a response to a somewhat cooler temperature forecast, which added some heating load to the near-term supply balance.

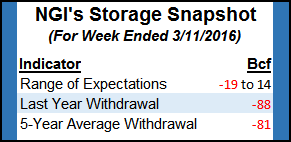

Tim Evans of Citi Futures Perspective said expectations for Thursday’s Energy Information Administration storage report “are still being compiled, but…what we’ve seen so far suggests the consensus is running at roughly a 5 Bcf net withdrawal for the week ended March 11. While that looks more supportive than the 7 Bcf net injection our model produced, we note it would still fall well below the 82 Bcf five-year average draw, allowing the 726 Bcf year-on-five-year average surplus from March 4 to expand further.”

Evans is expecting temperatures going forward to translate into more bearish storage comparisons in the weeks ahead. His figures show the year-on-five-year surplus mushrooming to 921 Bcf by April 1, “confirming that the market is still becoming more overstocked on a seasonally adjusted basis. While somewhat less bearish than a day ago, this rising surplus still puts an increased downward fundamental pressure on prices, reducing the upside potential and leaving the downside open.”

Evans suggested opening a short May futures position at $1.95 with a stop at $2.15 to limit risk on the trade. “On a trade back below $1.80 we would lower the buy stop to $2.05.”

For all intents and purposes, analysts see no gas being withdrawn from storage for the week ended March 11. The surpluses relative to both last year and the five-year average are expected to swell once again.

Last year 88 Bcf was pulled from storage and the five-year average comes in at an 81 Bcf withdrawal. Analysts at ICAP Energy predicted a 0 Bcf withdrawal, and IAF Advisors calculated a 3 Bcf decline. A Reuters survey of 23 traders and analysts revealed an average 2 Bcf withdrawal with a range running from a 19 Bcf draw to a 14 Bcf injection.

From a technical standpoint, analysts noted something of a breakthrough.

“The 12-month strip has managed to push through key resistance,” said market analyst Brian LaRose of United ICAP. “The question now, can flat price do the same?” He said his firm was still pegging “$1.892-1.917-1.963-1.979 as the gatekeeper.

“Bulls will need to punch through this band of resistance for our trend to shift to up. Succeed, and we can start plotting a course for a seasonal cycle advance. An average seasonal advance of 49% from the $1.611 low would target $2.400.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |