E&P | NGI All News Access | NGI The Weekly Gas Market Report

Linn Energy Shutting in 1,000 Wells, Eyeing Potential Bankruptcy

Houston-based Linn Energy LLC, which made its name as a top onshore natural gas producer, warned Tuesday that bankruptcy may be unavoidable because of the continuing drain on finances from low commodity prices.

The independent does not expect to remain in compliance with all of the restrictive covenants in its credit facilities unless they are waived or amended. The uncertainty associated with its ability to meet its obligations as they become due “raises substantial doubt about the company’s ability to continue as a going concern,” management said.

“We are continuing to work with our advisors to review a full range of strategic alternatives to reduce the company’s overall debt,” said CEO Mark Ellis. “In addition, we have been in discussions with certain lenders in an effort to reach a mutually agreeable resolution and remain focused on right sizing the balance sheet in order to position the company for long-term success.”

Besides having debt issues, Linn also is being squeezed by unsustainable commodity prices, which has led it to shut in up to 1,000 wells in the onshore.

“Given the low commodity price environment, the company is implementing a strategy for marginal well shut-ins,” management said. Production is expected to decline by about 50 MMcfe/d as a result of the reduced production strategy.

No details were provided as to where the production would be shuttered. Linn has a diverse set of onshore assets in the United States, with its focus areas spread across the country. It is the biggest operator in the Hugoton Basin of Kansas (see Shale Daily, May 22, 2014). Linn also has substantial reserves in the Rockies, the Permian Basin, California, East Texas/North Louisiana, South Texas, the Midcontinent, Michigan and Illinois.

The board of directors and management are in the process of evaluating strategic alternatives to help strengthen the balance sheet and maximize the company’s value. As part of the process, the company elected to exercise its 30-day grace period regarding interest payments that were due Tuesday (March 15) of $30 million on 7.75% senior notes due February 2021; $12 million on 6.50% senior notes due September 2021; and $18 million on the Berry Petroleum Co. LLC senior notes due September 2022.

If Linn fails to make the interest payments within the 30-day grace period and does not obtain a waiver or other relief from the noteholders, a default would occur, management said.

The announcement to not make interest payments was included in Linn’s 4Q2015 results, a quarter in which it recorded a net loss of $2.5 billion (minus $7.05/unit), including $3 billion (minus $8.63) for impairments because of depressed pricing. For full-year 2015, Linn reported a net loss of $4.8 billion (minus $13.87/unit), which included an impairment charge of $5.8 billion (minus $16.93/unit).

Total revenues were $647 million in the fourth quarter, including a derivatives gain of $274 million.

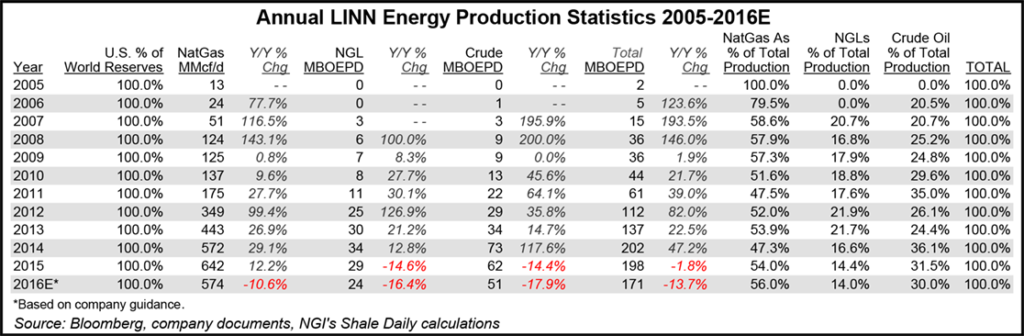

Production during the final three months of 2015 averaged 1.134 Bcfe/d, while full-year output was 1.188 Bcfe/d. Lease operating expenses were $150 million ($1.44/Mcfe) in 4Q2015 and $618 million ($1.42) for the year.

This year Linn has set capital expenditures at $340 million, a 44% reduction from oil and gas spend in 2015. Linn also plans to spend $75 million for its plant and pipeline infrastructure. This year’s spend is to be generated “primarily from internally generated cash flow,” it said.

Production for 2016 is expected to average 980-1,070 MMcfe/d, 56% weighted to natural gas, 30% to oil and 14% to natural gas liquids.

“The 2016 oil and natural gas capital budget remains focused on a well-diversified mix of development and optimization projects,” management said. About 38% of the budget is to be directed to the stacked reservoirs in the Midcontinent, primarily in Oklahoma. Nearly one-quarter of the capital spend is to go to optimization projects, with 16% of capital directed to the Williston Basin, 13% to California and 10% to the Green River Basin.

Almost one-third of this year’s capital budget will go to projects that Linn does not operate. It currently has an overall base decline rate of 13%, and full-year output is forecast to be 14% lower year/year.

At the end of 2015, Linn was operating only two drilling rigs, one in California and the other in the Tuttle area of the South Central Oklahoma Oil Province, aka SCOOP.

Eight to 10 operated wells are scheduled to be drilled, and Linn also plans to participate in several other wells in the Tuttle area to further derisk its 35,000 net acres.

Last month the company borrowed $919 million under its credit facility, representing the remaining undrawn amount available. Total debt now stands at $3.6 billion. The next borrowing base redetermination is scheduled for next month.

Linn has hedge agreements for all of its consolidated, expected gas production through 2017 at average prices ranging from $4.48/MMBtu to $5.00. The company currently does not hedge the portion of gas production used to economically offset gas consumption related to its heavy oil operations in California. About 80% of the consolidated expected oil production in 2016 also is hedged at an average price of $90/bbl.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |