NGI Archives | NGI All News Access

Weekly NatGas Cash Eases As Industry Enters ‘Brave New World’ Of Limited Storage Space Availability

It turned out to be more of the same for weekly spot gas prices for the week ended March 11. The NGI Weekly Spot Gas Average fell 5 cents to $1.46, but broad overall gains at market points outside the Northeast couldn’t offset the sharp declines from within.

Broad gains were recorded in Texas, Gulf, Rockies, and California points. The week’s strongest performing market point was Chicago-Nicor Gas with a 12-cent advance to $1.80, closely followed by PG&E Citygate with an 11-cent rise to $1.87. The week’s biggest loser turned out to be Algonquin Citygate with a drop of $1.74 to average $1.19. Regionally the Northeast suffered the greatest setback losing 40 cents to $1.12, and California proved to be the biggest gainer adding 7 cents to average $1.62.

Both the Midcontinent and the Midwest added 2 cents to $1.50 and $1.66, respectively, and the Rocky Mountains rose by 3 cents to $1.39.

South Louisiana and East Texas rose by 5 cents to $1.57 and $1.56, respectively, and South Texas rose by 6 cents to average $1.57.

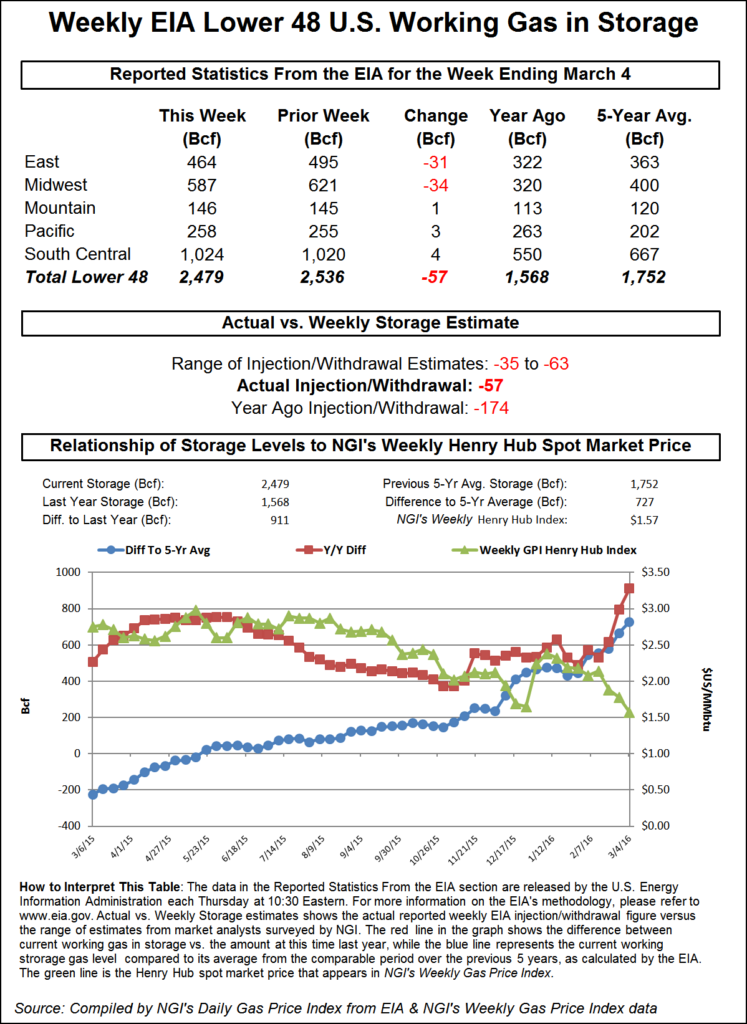

Although the week’s storage draw for the week ending March 4 reported by the Energy Information Administration (EIA) at 57 Bcf was right on target with trader expectations, it was light years less than historical averages. April futures moved a few pennies after the number was released, and at the close April had recorded a gain of 3.6 cents to $1.788 and May had risen 3.7 cents to $1.883. April finished the week at $1.822, up 15.6 cents from the previous Friday’s finish.

The jury is out on next week’s storage change, but with the reported 57 Bcf pull inventories now stand at a plump 2,479 Bcf, and it looks as though the industry may be entering a ‘Brave New World’ in which production will be competing for very limited storage capacity.

There is a strong likelihood that current storage may be etched in the record books as the highest season-ending level ever. According to EIA data the next highest ending inventory was recorded during February 2012 at 2,449 Bcf, and according to a Reuters survey next week’s early numbers suggest a build of 21 Bcf to a draw of 6 Bcf with an average 6 Bcf increase.

The likely record setting season ending inventory was already in the cards inasmuch as last year at the same time, 174 Bcf was pulled from storage and the five-year average came in at a 118 Bcf pull. For the week ended March 4 estimates were coming in at less than half of those numbers.

IAF Advisors calculated a 62 Bcf decline, and Bentek Energy, utilizing its flow model, calculated a 60 Bcf withdrawal. A Reuters survey of 20 traders and analysts showed an average 57 Bcf draw with a range of 44 Bcf to 65 Bcf draws.

With supplies as burdensome as they are, analysts were expecting a limited market reaction once the number hit trading screens. “Stocks are now nearly 800 Bcf higher than this time last year — a whopping 45.6% surplus. High side surprise or not, we can’t imagine the price action following this week’s EIA report to do anything but fizzle,” said John Sodergreen, editor of Energy Metro Desk.

Going forward all indications are that storage will be limited. “A big chunk of the market in the summer is storage,” said an industry pipeline veteran. “If that decreases by 40% you will need to see a change in pricing by an equivalent amount. It’s supply and demand. Do we see more gas being shut-in because of it?”

In Friday’s trading weekend and Monday natural gas were mostly steady as weakness in the Mid-Atlantic and Marcellus was offset by firm markets in Texas and the Gulf Coast.

The NGI National Spot Gas Average was flat at $1.52, and eastern points, on average, were seen about a nickel lower. Futures managed to squeak higher once again to make it six straight advances. At the close April had gained 3.4 cents to $1.822 and May had risen 3.2 cents to $1.915. April crude oil rose 66 cents to $38.50/bbl.

Forecasters were calling for a return to seasonal temperatures at major market centers by Monday, but over the weekend temperatures were seen at least 10 degrees above normal. Wunderground.com predicted the high in Boston Friday of 50 degrees would jump to 60 by Saturday before dropping to 44 Monday, the norm. New York City’s Friday high of 68 was expected to slide to 60 Saturday before dropping further Monday to 48, the seasonal norm. Chicago’s Friday maximum of 50 was anticipated to climb to 54 Saturday and reach 57 by Monday, 12 degrees above normal.

New England prices were mixed, but Mid-Atlantic quotes softened. Gas at the Algonquin Citygate fell a penny to $1.11, and packages on Iroquois, Waddington rose 22 cents to $1.85. Deliveries to Tenn Zone 6 200L shed 5 cents to $1.19.

Weekend and Monday packages at Texas Eastern M-3, Delivery fell 18 cents to 85 cents, and gas bound for New York City on Transco Zone 6 fell 14 cents to 88 cents.

In the Midwest quotes firmed. Gas on Alliance rose 2 cents to $1.76, and deliveries to the Chicago Citygate also added a penny to $1.78.. Gas on Michigan Consolidated changed hands 4 cents higher to $1.81, and deliveries to Consumers were unchanged at $1.76.

Mild weather and low usage by customers has a Michigan marketer thinking they may not be buying spot gas anytime soon. “I think we have more than we want. It’s been a very warm time and next week is supposed to be warm. We may not buy for a while.” he said. “The pipelines tell us we can’t withdraw more than they allow, but that has not been a problem.”

Analysts see the market’s recent strength as a response to earlier oversold conditions.

“The stage for the ongoing price advance appears to have been set by the April contract’s ability to hold support at the $1.61 level at the start of the week,” said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning note to clients. “The advance was accentuated this week by violation of a down trend line that extended back to the beginning of last month. The market had become oversold technically to the point that even minor supportive headlines have proven capable of forcing a substantial spree of short-covering. Most of the outlooks have been gradually favoring some below-normal temperature trends that should be moving into the nation’s Midcontinent later next week with some overnight freezing temperatures expected within the upper Midwest.

“While we don’t view this cool start to the official spring period as altering the supply-demand balances appreciably, it could potentially slow injections at the start of the shoulder period. Nonetheless, a whopping supply surplus of more than 900 Bcf against last year and some 725 Bcf versus five-year averages will be offering a huge obstacle toward sustainable price gains. And although producers may be reluctant to establish short hedges at current price levels, a huge supply overhang will require some hedge placement amid an environment in which utilities will be reluctant to establish long hedges, especially in the huge price premiums further down the curve.”

Gas buyers for ERCOT power generation over the weekend were expecting to have plenty of wind power to offset gas purchases. Forecaster WSI Corp. in its Friday morning report said, “A slow-moving storm system will plague Texas during the next one to two days with additional rounds of rain. Temperatures will range in the mid 50s, 60s and 70s. Fair, dry and much warmer conditions will likely return by Sunday into early next week with highs in the upper 70s and 80s.

“A north-northeast breeze will steadily decrease today into early Saturday. Boosts of elevated wind gen are possible during the weekend into early next week. Output will occasionally peak in excess of 10 GW.”

In the six- to 10-day period, WSI said the “forecast is for above-average temperatures across the East, West Coast and desert southwest. Near to below average temperatures are expected over much of the interior west and adjacent portions of the central U.S. Today’s forecast is colder over central and eastern U.S., but warmer over the West. CONUS GWHDDs are up 7.1 to 76.2 for the period.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |