NGI Data | NGI All News Access

Weekly NatGas Continues Slump; Market Bottom Nowhere In Sight

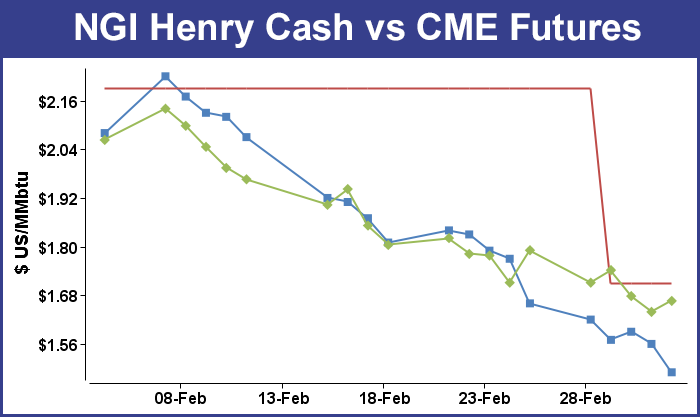

Weekly natural gas prices may not be out but for the week ended March 4 they recorded their third strike and are now 80 cents lower than just three weeks ago.

The NGI Weekly Spot Gas Average fell 14 cents to $1.51 and all but a handful of points in the Northeast racked up hefty double digit losses. The week’s biggest setback was seen on Transco Zone 6 non New York North serving southeasternmost Pennsylvania with a loss of 25 cents to $1.43, and the week’s greatest gainers were Algonquin Citygate with a rise of 79 cents to $2.93 followed closely by Tennessee Zone 6 200 L with a rise of 64 cents to $2.86.

Regionally, South Louisiana and South Texas tied for the cellar with losses of 20 cents to $1.52 and $1.51, respectively, and the Northeast squeaked into positive territory with a 2-cent improvement to $1.52.

Three points came in with 18-cent losses, California down to $1.55, East Texas slipped to $1.51, and the Rocky Mountains fell to $1.36.

The Midcontinent dropped 15 cents to $1.48 and the Midwest was seen 14 cents lower to $1.64.

April futures lost 12.5 cents on the week to $1.666 and although Thursday’s Energy Information Administration (EIA) storage report on the surface looked bullish, with natural gas inventories bursting at the seams futures continued on their path downward. At the close April had lost 3.9 cents to $1.639 and May had shed 3.3 cents to $1.767.

The reported withdrawal of 48 Bcf was a bit more than the market was looking for. Last year 227 Bcf was pulled and the five-year pace was for a 137 Bcf withdrawal. Citi Futures Perspective calculated a 35 Bcf withdrawal, and a Reuters poll of 22 traders and analysts revealed an average 41 Bcf decline with a range of -32 Bcf to -65 Bcf.

The market, however, did not move out of the session’s trading range once the figure was released. The April high for the day prior to the release of the number was $1.682 and the low was $1.633. Once the number was released April futures rose to a high of $1.660, and by 10:45 a.m. April was trading at $1.645, down 3.3 cents from Wednesday’s settlement.

“If you look at it last year was a draw over 200 and the five-year average is 137. It would have had to have been a much higher draw to affect the market,” a New York floor trader told NGI.

“There’s no upward momentum off these numbers. Next week I’m hearing about the same.”

Randy Ollenberger, analyst at BMO Nesbitt Burns said “We believe the storage report will be viewed as positive, since the draw exceeded expectations. Weather will remain the key driver of natural gas prices over the next month; however, the winter heating season ends this month and storage levels are more than ample.”

Inventories now stand at 2,536 Bcf and are a plump 794 Bcf greater than last year and 666 Bcf more than the five-year average. In the East Region 17 Bcf was pulled, and the Midwest Region saw inventories fall by 24 Bcf. Stocks in the Mountain Region fell 2 Bcf, and the Pacific Region was lower by 1 Bcf. The South Central Region withdrew 4 Bcf.

In trading Friday physical natural gas prices for weekend and Monday delivery beat a hasty retreat as buyers saw little need to commit to three-day deals and weather forecasts for the coming week continued to moderate.

No points followed by NGI traded in positive territory and most found themselves with solid double-digit losses. The NGI National Spot Gas Average fell 14 cents to $1.40, and eastern locations averaged about a 25-cent loss. Futures managed a modest gain in uninspired trading. At the close April had added 2.7 cents to $1.666 and May had risen 2.0 cents to $1.787. April crude oil gained $1.35 to $35.92/bbl.

Observers see California gas between a rock and a hard place. A combination of healthy hydro supplies along with gas volumes attempting to make their way west out of the Rockies to West Coast markets does not bode well for California prices in what was once a premium market.

“Gas is on a collision course,” said Jeff Richter, principal with EnergyGPS, a Portland, OR-based gas and power consulting firm. “Obviously, you can’t inject in Aliso Canyon, and you can’t put gas in storage until April 1 because of [pipeline] minimum turn requirements. There is contractual capacity that is lower than physical capacity in storage right now so that is a problem. That is why you are seeing cash disconnect from prompt month [April futures].

“Where is the bottom? Who knows. SoCal [Citygate] traded $1.34 for the three day piece, and that’s 15 cents under Henry Hub. Weekends are going to get annihilated.”

Perhaps not quite annihilated but lower nonetheless. PG&E Citygate fell 3 cents to $1.73, and gas at the SoCal Citygate plunged 29 cents to $1.39. Deliveries priced at the SoCal Border Avg. Average saw quotes 15 cents lower at $1.34, and gas on Kern Delivery shed 16 cents to $1.34. Gas on El Paso S. Mainline changed hands 19 cents lower at $1.32.

Major market trading points also lost ground. Gas at the Henry Hub fell 7 cents to $1.49, and deliveries to Opal were quoted 13 cents lower at $1.28. Parcels on El Paso Permian shed 14 cents to $1.29, and gas at the Chicago Citygate dropped 9 cents to $1.57.

Futures traders are equally unimpressed. “We are still looking at $1.60 to $1.75, it was only a 6-cent range and we are still stuck on these numbers,” said a New York floor trader.

The weakness in the cash market in California and elsewhere is likely to lead to further declines in futures and any change in price direction will require a supply response from eastern producing basins. “Spot values at Henry Hub fell to around $1.55 [Thursday], and we view this ongoing weakening in the cash basis as suggestive of additional futures declines,” said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning note to clients.

“These discounts for physical product are also forcing further expansion in the carrying charges, and we still see even wider contangoes, especially within the spring-fall portion of the gas curve. The increasing possibility that storage space will eventually need to be allocated via even lower prices will continue to act as a driver of larger spot price discounts in comparison to fourth quarter futures. As the contangoes stretch, additional incentive will be provided to longer-term or investment-type speculative shorts that will realize the advantages of rolling sequentially into much higher priced futures.

“With weather-related demand expected to subside during the next few months and coal to gas displacement progressing slowly, a supply side reaction to this year’s price plunge will be required in order to force a long-term price bottom. However, such a development has not been evidenced, and we will await even a minor indication of slowed output within the eastern region before considering an end to this extended bear move.”

In the PJM footprint wind generation over the weekend was expected to reach only nominal levels. WSI Corp. in its Friday morning outlook said, “Low pressure and its associated snow and rain will depart and give way to a clearing trend [Friday]. It will be seasonably cold with highs in 30s to mid 40s. Another weak frontal system will drop into the power pool, with a chance of light rain and snow during Saturday into the start of Sunday, [and] a mild southerly flow will usher unseasonably warm spring like weather into the power pool next week. High temperatures may climb into the upper 50s, 60s to low 70s by Tuesday.

“Relatively light and changeable wind generation is expected during the remainder of the week into the weekend. A mild and increasing southerly wind will drive up wind gen potential during Sunday night through early next week. Output may climb 4-5 GW by Tuesday.”

In its longer term 11- to 15-day forecast WSI said, “Once again, today’s forecast is warmer than previous forecasts over the northern and eastern U.S. CONUS GWHDDs are down another 3.1 for days 11-14 and are now forecast to be 61.4 for the period. This is nearly 43 HDDs below average.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |