NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

Barclays Reduces 2016 NatGas Price Outlook, Sees Breakout in 2017

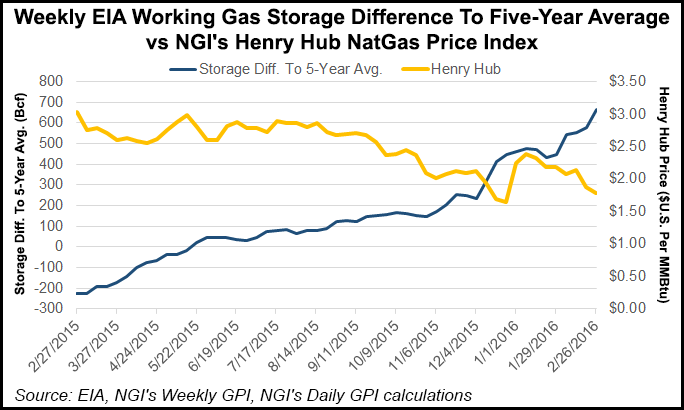

Higher-than-expected end-of-winter inventories will pressure natural gas prices through this year, but in 2017, look for a higher breakout, according to Barclays Capital.

Analysts Nicholas Potter and Michael Cohen on Wednesday reduced their 2016 gas price outlook to $2.50/MMBtu from $2.56 because storage levels aren’t declining as expected.

“There is the potential that the entire curve flattens under the weight of high storage levels,” they wrote. “However, we think it is more likely that a steeper contango will emerge to incentivize production.”

Recent quarterly earnings calls have indicated that some of the largest U.S. gas producers, including Chesapeake Energy Corp. (No. 2) and Southwestern Energy Corp. (No. 4) have reduced gas output forecasts for the year. Oil producers also are sharply reducing spending and development, dragging down associated gas volumes.

“In our view, the market will have to find a way to differentiate and time the bearish effects of storage levels that we forecast will end winter 2015-2016 at 49% above the five-year average, and longer-term supply and demand fundamentals that seem to be presenting a more bullish picture for gas,” the analysts wrote.

Prices should inch higher in 2017, however, as storage surplus eases and volumes are reduced. Barclays’s early forecast is for 2017 prices to average $3.05/MMBtu, with a price of $2.90 through June 2017 and $3.20 in the second half of next year.

While the Northeast continues to see strong gas production growth, it may not be enough to support the demand story as associated volumes decline.

“In our view, the major unknowns for 2017 will come on the production side and will specifically focus on the Northeast’s ability to grow and the levels of associated gas production potentially re-entering the market when oil prices rebound,” analysts said. “Although we do forecast a tick up in associated gas as oil moves higher it is unlikely to be sufficient in both quantity and required lead time.”

Meanwhile gas demand is going to gather speed into the next year, with growing gas exports, both liquefied and through pipelines to Mexico. In addition, industrial demand is expected to be stronger as more gas-powered facilities come online.

“We see power burn as a potential swing factor that could present an even more bullish picture than our 2017 price forecast suggests,” Potter and Cohen wrote. It’s still uncertain regarding “what demand elasticity will look like as prices move higher in the face of a significant amount of coal plant retirements in recent years.”

With the exception of the Northeast, all other regions are showing declining gas output to 2017, based on Barclays modeling. Almost 8.1 Bcf/d of infrastructure in the Northeast region has been fully subscribed and is scheduled to ramp up in 2017, which would continue to accelerate growth.

Barclays is forecasting that the exit rate growth in the Northeast for 2016-2017 will be about 4 Bcf/d, with a 2016 exit rate of 22.8 Bcf/d and a 2017 rate of 26.8 Bcf/d. Most of the 2017 pipeline projects are in the southwestern portion of the Marcellus and Utica shales, which potentially could strengthen price points. But how much capacity actually is built remains a question.

“If prices do in fact stay lower for longer, there is a risk of producer bankruptcies affecting anchor shipper arrangements on pipelines,” the Barclays analysts said. “This could potentially result in unused pipeline capacity becoming available, meaning rates would likely trend down to variable costs, a bearish case for prices as it would lower delivered gas costs.”

If all of the proposed capacity were built, it also raises questions about the ability of producers to fill the new pipelines, the Barclays analysts said. Regional operators have not been immune from capital spending reductions, which could constrain output even more next year.

Tudor, Pickering, Holt & Co. (TPH) said Thursday gas prices have a better shot of increasing by late this year or early in 2017. TPH is forecasting storage levels to exit the withdrawal season at 2.4 Tcf, in line with 2012’s 10-year storage highs.

“The 2012 storage overhang cleared up over the course of that year and the same will happen this year,” said the TPH team. “Gas prices do need to stay low for much of 2016 to incent sufficient gas power generation market share. Spot price has moved down from $2.05/MMBtu three weeks ago to $1.85/MMBtu last week…Ironically, low prices today mean better chance of higher prices late 2016 early 2017.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |