Markets | NGI All News Access | NGI Data

‘Bullish’ NatGas Storage Figures Greeted With A Yawn

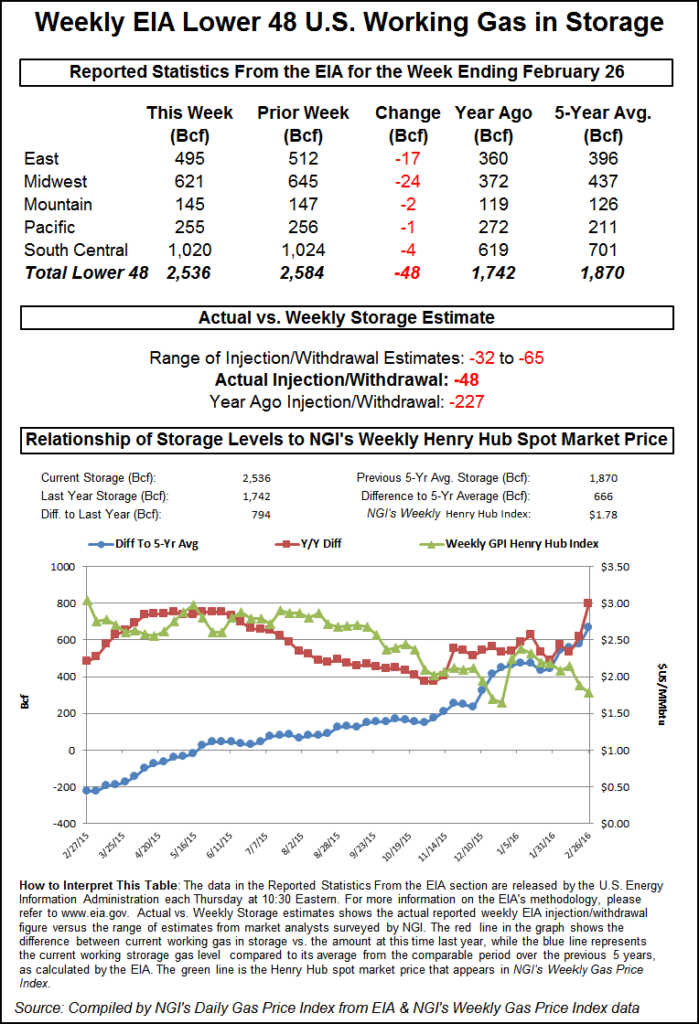

Natural gas futures moved little Thursday morning after the Energy Information Administration (EIA) reported a storage withdrawal that was somewhat greater than what traders were expecting.

EIA reported a 48 Bcf withdrawal in its 10:30 a.m. EST release, about 8 Bcf greater than expectations, and the market did not move out of the session’s trading range. The April high for the day prior to the release of the number was $1.682 and the low was $1.633. Once the number was released, April futures rose to a high of $1.660, and by 10:45 a.m. April was trading at $1.645, down 3.3 cents from Wednesday’s settlement.

“If you look at it last year was a draw over 200 and the five-year average is 137. It would have had to have been a much higher draw to affect the market,” a New York floor trader told NGI. “There’s no upward momentum off these numbers. Next week I’m hearing about the same.”

Randy Ollenberger, an analyst at BMO Nesbitt Burns said, “We believe the storage report will be viewed as positive since the draw exceeded expectations. Weather will remain the key driver of natural gas prices over the next month; however, the winter heating season ends this month and storage levels are more than ample.”

Inventories now stand at 2,536 Bcf and are a plump 794 Bcf greater than last year and 666 Bcf more than the five-year average. In the East Region 17 Bcf was pulled, and the Midwest Region saw inventories fall by 24 Bcf. Stocks in the Mountain Region fell 2 Bcf, and the Pacific Region was lower by 1 Bcf. The South Central Region withdrew 4 Bcf.

Salt cavern storage was higher by 4 Bcf to 285 Bcf, while the non-salt cavern figure fell 8 Bcf to 735 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |