Infrastructure | Markets | NGI All News Access

Eastern Shippers Scramble to Avoid REX Shut-Ins; NatGas Futures Tumble

Next-day natgas gained ground in trading Wednesday as stout gains at eastern points to the tune of about 20 cents tugged the overall market higher. The Rockies and California advanced by about a nickel, but gains in the Gulf, Midcontinent, and Texas came in just a few pennies higher.

The NGI National Spot Gas Average rose 4 cents to $1.60, and forecasts called for pivotal Midwest markets to experience near-term temperatures well below normal. Futures took out December lows and settled at prices not seen in 17 years.

At the close, April had fallen 6.4 cents to $1.678, and May was down by 4.8 cents to $1.800. April crude oil rose by 26 cents to $34.66/bbl.

A force majeure declared Tuesday on the east-west Zone 3 Rockies Express Pipeline (REX) expansion temporarily distorted trading at Marcellus points and market interconnects in central Illinois and Indiana (see related story). It remained in effect Wednesday and had resulted in about an 1.1 Bcf/d reduction in east-to-west flow from the recent throughput level of 1.8 Bcf/d.

At the western end of REX, eastbound gas out of the Rockies was business as normal.

“It’s a location specific outage and I have producers bringing gas from both ends of the pipe,” said a marketer working the Chicago Citygate. “Those shippers from the West are still good.”

Prices at REX Zone 3 points in the Midwest rose. Next-day gas on NGPL at Moultrie County, IL increased 7 cents to $1.62, and gas on Midwestern at Edgar County, IL added 8 cents to $1.62. Deliveries to Trunkline in Douglas County, IL changed hands 7 cents higher at $1.64.

At the other end of REX in the Marcellus, shippers were scurrying to find another delivery point.

“It seems that this point [Seneca Noble] will be the only major receipt point feeding REX’s east-to-west flows out of Ohio,” Genscape Inc. said in a note Wednesday.

“Some of the gas that normally flows onto REX from these affected points can make its way onto Tetco or Dominion; however, in this case it seems that most of the 1.1 Bcf is being shut in. Scheduled receipts from production within 70 miles remained flat, indicating that this gas has not been scheduled to flow onto another interstate pipeline as of the evening cycle” for Wednesday’s gas day.

However, gas was offered at Marcellus points such as Dominion South, Tennessee Zn 4 Marcellus, and Transco-Leidy Line.

“I guess that’s why we saw an increase in [Tuesday’s] gas day. Someone was bringing a big chunk of gas over at about 8 a.m. into our pipe,” said a Houston-based veteran who works a major interstate pipeline. “They were trying to move it over first thing Wednesday” for Tuesday’s gas day.

Next-day deliveries on Dominion South tumbled 13 cents to to $1.02, and parcels on Tennessee Zn 4 Marcellus shed 10 cents to $1.01.Gas on Transco-Leidy Line was quoted 12 cents lower as well to $1.02.

Pricing at other market hubs was more subdued. Deliveries to the Chicago Citygate were flat at $1.72, and gas at the Henry Hub rose 2 cents to $1.59. Deliveries to El Paso Permian added 5 cents to $1.48, and gas at the PG&E Citygate was unchanged at $1.76.

Fundamental analyst New York-based PIRA said with bid week pricing coming in about 50 cents lower than February indices, the weak pricing environment is likely to accelerate production declines.

“Much is riding on the demand and supply response to such prices considering the fallout on U.S. and Canadian storage tied to the collapse in heating loads during February,” PIRA said in a report. “The South Central will account for about 50% of this month’s overall expansion in the year-on-year U.S. storage surplus.

“The resulting end-February overhang is clearly an impediment standing in the way of a near-term price recovery, especially after considering the South’s increased exposure to Appalachia supply tied to pipeline capacity additions between the regions. Still, given the lack of any draw last March, that surplus is likely to start to contract. Moreover, the acute price weakness now in effect also stands to accelerate U.S. production weakness — even in Appalachia.”

Analysts said Tuesday’s modest gains may have been the result of profit-taking since April couldn’t breach 17 year lows at $1.682.

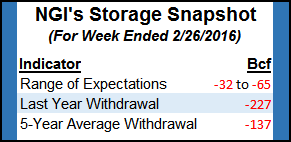

“Some of the buying may have been related to timing expectations” for the Department of Energy’s gas storage report, “although the estimates for 40 Bcf or so in net withdrawals would still fall short of the 137 Bcf five-year average for the week ended Feb. 26,” said Tim Evans of Citi Futures Perspective on Tuesday.

“The updated temperature forecast was modestly warmer than a day ago, but mostly shifted heating demand between the weeks ahead.”

Evans is forecasting below-average withdrawals in the weeks ahead, culminating in the first injection for the week of March 16 at 13 Bcf. By that time, the year-on-five-year surplus is expected to balloon to 850 Bcf.

Good news for market bulls in that the El Nino in place since November is finally dissipating. “The National Oceanic and Atmospheric Administration (NOAA) projects this El Nino to continue weakening into spring and transition to neutral conditions by late spring or early summer 2016,” said Wunderground.com. The odds of a La Nina event for 2016-2017 will be going up as autumn approaches.

The weekly sea surface temperature reading, taken within the Nino 3.4 region near the equator, is at 2.1 degrees C above average, which is down substantially from the previous week’s 2.4 degrees C above average. The +3.1 degrees C peak recorded in late November 2015 was the highest weekly value observed during any El Nino event in NOAA’s records going back to 1950.

Thursday’s storage report is expected to show a build below seasonal norms. Last year 227 Bcf was pulled, and the five-year pace is for a 137 Bcf withdrawal. Citi Futures is calculating a 35 Bcf withdrawal, and a Reuters poll of 22 traders and analysts revealed an average 41 Bcf decline with a range of -32 Bcf to -65 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |