NatGas Market Decline Expected to Continue; Cash, Futures Barely Move

It was all quiet on the natgas market front Wednesday ahead of the weekly Energy Information Administration (EIA) storage report. Prices moved only a little, with the Northeast adding about a dime overall and all other market points easing a few pennies. Small but broad losses in the Midwest, Midcontinent, Gulf, Rockies, and California offset the eastern gains.

The NGI National Spot Gas Average was down 2 cents to $1.65. Futures trading was equally uninspired with the March contract slipping four-tenths of a cent to $1.778 and April adding five-tenths to $1.834. April crude oil rose 28 cents to $32.15/bbl.

Near-term temperature forecasts across major population centers gave little reason for buyers to seek out incremental volumes. AccuWeather.com predicted Wednesday’s high in New York City of 56 would ease to 54 Thursday before dropping to 40 on Friday. The normal high in the Big Apple this time of year is 44. Chicago’s 36 on Wednesday was seen rising to 37 Thursday and returning to 36 Friday, 3 degrees below normal.

Gas on Alliance was quoted at $1.80, down 7 cents, and packages at the Chicago Citygate were seen at $1.80 as well, down 6 cents. Gas on both Michigan Consolidated and Consumers changed hands at $1.82, down 6 cents.

The overall market landscape for prices is weak, but market forces continue unabated. The price differential between Marcellus points and downstream destinations on the REX Zone 3 Expansion continued to narrow. Gas on Tennessee Zn 4 Marcellus rose 7 cents to $1.05, and gas on Transco-Leidy Line added 3 cents also to $1.04.

Deliveries to NGPL on REX Zone 3 at Moultrie County, IL shed 2 cents to $1.72, and packages on Panhandle Eastern at Putnam County, IN were seen down 2 cents to $1.72 also.

Weather forecasters see March going out like a lamb.

“March will start cold over much of the northeastern third of the United States before giving up during the middle days of the month,” said AccuWeather.com meteorologists. “It appears the last significant cold outbreak of the winter season will spread from the northern Plains to the Midwest, interior South, Mid-Atlantic and New England states at the end of February into early March,” according to meteorologist Paul Pastelok.

“The cold outbreak will follow a brief episode of chilly air in the wake of the major storm later this week and a brief warmup this weekend,” he said. “As the leading edge of the cold air sweeps eastward next week, there could be a period of snow from the northern Plains to the Northeast, followed by lake-effect snow showers in the traditional areas downwind of the Great Lakes.

Compared to other cold outbreaks this winter and in prior winters, this one will pale in comparison.”

Tuesday’s weather forecast knocked the spots off demand forecasts going into March. “The end of winter is in sight with less than a week remaining in February, and the March Nymex Henry Hub contract is approaching expiration,” said Portland, OR-based EnergyGPS in a Tuesday note to clients. “Since early last week, the March contract has steadily declined as warm weather proliferated across the country. In light of recent HDD [heating degree day] forecasts for early March, we believe the decline in the gas market is likely to continue.”

On Monday, EnergyGPS noted, the outlook for the first week in March “was relatively strong compared with what we have seen thus far this winter as HDDs in the East were expected to be well above average.

“The strength in the East drove the total continental U.S. HDD expectations above normal for the six-10 day period. While the overall outlook for the 15-day period was still below normal, thanks to a bearish one- to five-day period and widespread heat in the West, the strength in the six-10 and near-normal temperatures in the 11- to 15-day period was a welcome sight to any sellers in the market that have been tormented by the warm winter.”

The East has been “the only region with consistently above-normal residential/commercial demand expectations,” the firm said. However, by Tuesday, “we were looking at a significantly different landscape as the HDDs were stripped out of the East for the six-10 day period.”

Between Monday and Tuesday, “15.8 HDDs were taken from the six-10 day, with 11.2 coming from the East region alone. As would be expected, the residential/commercial natural gas demand forecasts followed the HDD forecast down.”

Using the Tuesday HDD forecasts to estimate residential/commercial demand over the next 15 days, “the outlook is significantly more bearish,” EnergyGPS noted.

“Total continental U.S. residential/commercial demand in now forecasted to be 7 Bcf below normal through the first eight days in March. This is a major blow to any sellers in the market hoping for near-normal demand in March. The market reacted to the bearish revision with Nymex hub trading down about 3 cents to $1.78 for the March contract.”

If Tuesday’s HDD forecast holds, “we see significant downside risk in the market. With storage levels remaining at five-year highs, we may see the prompt month prices continue to march downward until a strong signal is sent to producers to reduce production due to lack of demand.”

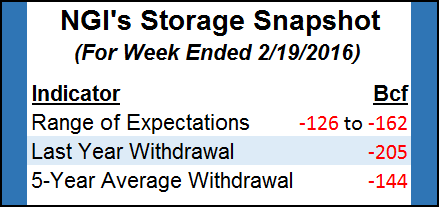

Traders Thursday likely will have the last triple-digit withdrawal from natural gas inventories to contend with for the season. Last year a hefty 204 Bcf was withdrawn, and the five-year pace stands at 144 Bcf. Estimates are coming in around 140 Bcf and may make little headway on a five-year average surplus that currently stands at a plump 555 Bcf.

IAF Advisors of Houston is estimating a pull of 128 Bcf ,and Citi Futures Perspective expects a 145 Bcf withdrawal. A Reuters survey of 22 industry cognoscenti revealed an average -139 Bcf with a range from -126 Bcf to -162 Bcf.

Tom Saal, vice president at FCStone Latin America LLC in Miami, expected the market to test Tuesday’s value area at $1.806 to $1.778. From a trading standpoint, he said to go with the weekly breakout parameters, the weekly initial balance, should prices break above $1.847 or below $1.778. “Maybe” the market will test a second value area at $1.908 to $1.874, he said Tuesday in a note to clients.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |