Bakken Shale | E&P | NGI All News Access

Technology Advances to Lower Breakeven Bakken Prices, North Dakota Official Says

Low oil/natural gas prices are driving technology advances by operators in the Bakken Shale play, and lower breakeven prices are expected to develop this year as a result, according to North Dakota’s chief oil/gas regulator.

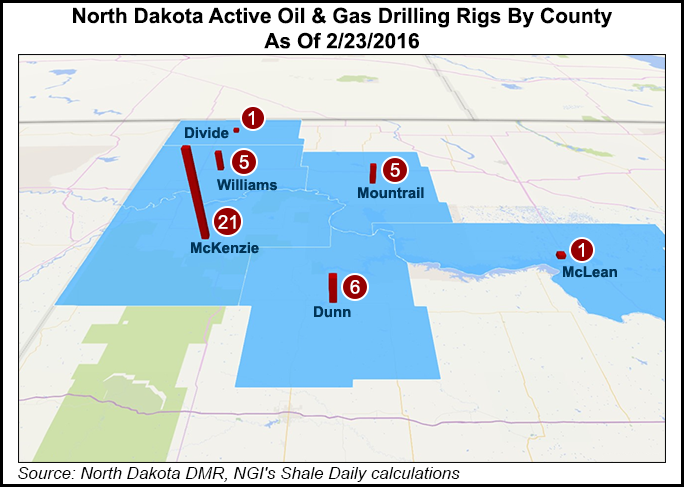

While only two counties in the state currently have breakeven prices low enough to make drilling economically viable, Lynn Helms, director of North Dakota’s Department of Mineral Resources, said advancements by operators are coming that will improve that bleak picture.

“Some really interesting things are being developed, as will be reported at this year’s Williston Basin Petroleum Conference,” in May, Helms said. “There are re-frack technologies being developed and in conjunction, so-called ‘super-fracks’ that companies have deployed.

“One company has pumped a frack next to a re-frack with 20 million pounds of sand, and it is really excited about the results. The average is now becoming close to 10 million pounds of sand and more than 8 million gallons of water, so frack volumes have gone way up and the well performance has gone up with it.”

Operators and service companies in the state think there are more efficiencies to be had. One operator told him that there should be up to 100 stages used in Bakken fracking jobs compared to the 40 stages used on average, Helms said. “This operator also wants to reduce well spacing down to 500 feet between wells, which would increase the overall recovery of Bakken oil,” he said.

A couple of large service companies are seeking federal approvals to merge, and if they do, they have told Helms that there could be up to $2 billion in annual procurement savings that could lower the cost of an average Bakken well by more than 10%.

“There is quite a bit of excitement around technology developments, so people are not sitting still,” Helms said. “Many operators are still planning to invest in enhanced oil recovery tests this year at the continued low prices as they try to position themselves to have enough capital so in 2017 when prices recover they can get back to work.”

Nevertheless, Helms said there will be further layoffs in the industry, which he called “a mixed bag.” Many companies have already been through several rounds of staff reductions, but another half of the companies are just getting started, he said.

“In terms of contractors and fracking crews [downsizing], we’re pretty much done with that, but for regular employees in the first half of this year there are going to be quite a few pink slips,” he said, noting that on a recent trip to the Gulf of Mexico coast, about half of his Uber drivers were laid-off oil/gas industry employees.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |