Markets | NGI All News Access | NGI The Weekly Gas Market Report

Season-High Demand, Large Storage Draw Ignored by NatGas Forward Prices

When we mentioned during the second week of February that it would take either significant heating demand or bullish storage news to end the slide natural gas prices have been on, we were wrong.

Last weekend (Feb. 13-14) brought the highest demand levels so far this season in the key Northeast region. This week’s storage report was considered bullish by the market, yet natural gas forwards prices fell by an average of more than 10 cents for the period between Feb. 12 and 18, according to NGI’s Forward Look.

Markets were closed Feb. 15 in observance of the Presidents’ Day Holiday.

Appalachia and New England set winter-to-date demand records as population-weighted average daily temperatures plummeted during Valentine’s weekend to 4.9 degrees F in New England and 10.6 degrees F in Appalachia, according to Genscape.

Genscape, based in Louisville, KY, is a real-time data and intelligence provider for energy and commodity markets.

“Prior to the seasonal chill, month-to-date average daily temperatures in New England and Appalachia were 32.3 degrees F and 34.1 degrees F, respectively,” said Genscape’s Rick Margolin, senior natural gas analyst.

Demand in Appalachia peaked Feb. 13, reaching 21.37 Bcf/d, while demand in New England hit 4.02 Bcf/d. Appalachia’s figure came in 1.93 Bcf/d over its previous winter-to-date record set on Jan. 18. New England eclipsed its winter-to-date high by only 0.11 Bcf/d, Genscape said.

And yet despite the spike in demand, the Nymex March contract tumbled 11.4 cents between Feb. 12 and Feb. 18 as market players looked ahead to forecasts for mild, springlike across most of the country during the next couple of weeks.

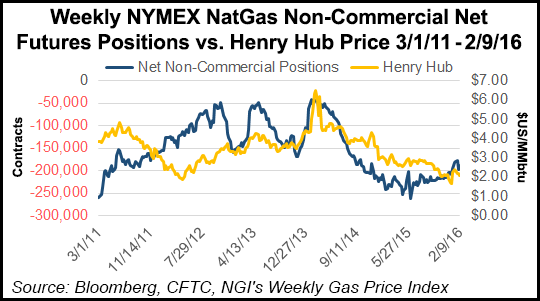

According to data from the Commodity Futures Trading Commission, NGI’s Weekly Gas Price Index and Bloomberg, natural gas prices continue to slide, despite the fact that the number of net short Nymex natural gas futures positions held by non-commercials has fallen over the last year.

The latest weather forecasts indicate that conditions will be “exceptionally comfortable” into next week, with a couple of weather systems providing only a modest increase in demand for the Northeast, according to NatGasWeather.

The forecaster cautioned, however, that conditions next weekend require close watching due to an impressive temperature gradient between frigid Canadian air and much milder temperatures just to the south, which will lead to wild swings in the amount of natural gas demand expected between successive runs or between weather models.

“Overall, we view weather patterns as at least somewhat bearish unless cold can prove it will arrive into the U.S. next weekend and last, which teases, but has yet to happen,” NatGasWeather said.

The mild outlooks squashed any support from the U.S. Energy Information Administration’s weekly storage report.

The EIA reported a 158 Bcf withdrawal from storage, which was above market expectations in the low to mid-150 Bcf range.

Despite the surprise withdrawal, inventories remain 24.5% above year-ago levels and 25.8% above the five-year average.

“Our current supply-demand balances imply that a 2.1+ Tcf end of March storage finish is becoming an increasing certainty,” said Societe Generale’s Breanne Dougherty.

Regional storage constraints start appearing around 4.1 Tcf, as seen during last year’s rise toward an aggregate storage record, Dougherty said in a Friday note to clients.

“With this level in mind, the level at which the market exits March is critical in setting the extent of the tightening requirement for the injection season,” she said.

Societe Generale has projected a base-case end-of-March finish at just over 2.2 Tcf, assuming the 15-day weather forecast and then a reversion to normal weather.

“A storage trajectory that shifts that number under 2.1 Tcf should provide enough support to keep prices in the $1.85-2.10/MMBtu range through March,” Dougherty said. “But a finish in line with our base-case, or higher, should encourage the market to test lows again. We expect good resistance at $1.75/MMBtu, but prices could easily be pushed through that level under the right storage circumstance.”

Taking a look at forward curves across the country, New England prices got some modest support from the approaching maintenance events taking place this spring along the Algonquin Gas Transmission (AGT) pipeline.

While most markets posted double-digit losses for both March and April, AGT citygates March fell 5.7 cents between Feb. 12 and Feb. 18 to reach $3.365 and April slipped just 2.2 cents to $2.73, according to Forward Look.

Interestingly, last year, March prices at AGT averaged around $7.60 and only fell below the current March fixed price on two occasions during the month, NGI historical data shows.

Further out the curve, the balance of summer (May-October) at AGT was down 4.1 cents from Feb. 12 to Feb. 18 to $2.585, about 3-4 cents less than most other markets across the country. The winter 2016-2017 strip also fell 4 cents to $5.25.

Meanwhile, the restrictions imposed on the AGT system could offer some support to AECO prices since the region will need additional supplies from Canada to cope with demand.

Forward curves aren’t reflecting that support just yet, however.

AECO’s April package dropped 8.8 cents this week to $1.28, while the balance of summer slid 8.5 cents to $1.365, generally in line with other markets.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |