Eagle Ford Shale | E&P | NGI All News Access

Marathon Oil Slashes Capex, Targets Non-Core Asset Sales to Protect Balance Sheet

Marathon Oil Corp. (MRO) will be slashing its capital budget again in 2016, focusing on short-cycle investments as it looks to protect its balance sheet during the downturn.

CEO Lee Tillman told analysts during the Houston-based exploration and production (E&P) company’s 4Q2015 earnings call Thursday that it plans to spend $1.4 billion in 2016, 50% below 2015 capital expenditures (capex) and 75% below 2014 capital spending.

The 2016 capex budget “reflects the current challenging environment and our clear objective of balance sheet protection,” Tillman said. Having taken a number of cost-cutting steps in 2015, including more than $300 million in non-core asset sales and a 20% workforce reduction, the company “responded as oil prices have fallen dramatically and are doing the same in 2016, with our capital program calibrated to a view of WTI [West Texas Intermediate] in the upper-$30s/bbl and assuming success in our non-core asset sale program.”

After targeting $500 million in non-core asset sales in 2015, MRO has raised that target for 2016, aiming to generate revenues of $750 million-1 billion.

Tillman expressed confidence that MRO will be able to meet this target despite a softened market compared to a year ago.

“When we initially set our non-core asset target last year, we stated that we had identified a pretty broad pool of non-core assets that were well in excess of that original $500 million, and what I’ll say is based on our progress today, the transactions that we’ve been able to complete and the quality as well as the diversity of the identified non-core assets that we still have in the hopper, we’re comfortable increasing that target to” a range of $750 million-$1 billion, he said.

The assets up for sale are “primarily U.S. upstream and midstream; they’re both operated and non-operated, but the list is very diverse, and we’re very satisfied taking some singles and doubles. Some will be bigger, but there’s quite a few that will be smaller, and thus far the market has shown an ability to digest some of those smaller transactions quite readily.”

Tillman wouldn’t rule out the possibility of issuing equity to ensure adequate liquidity in 2016. “Although our business plan assumes the successful execution of our non-core assets program to really contribute to our goal of free cash flow in neutrality, we have to continue to keep options on the table and available to us to give us that financial flexibility going forward,” he said.

MRO plans to focus its 2016 capex on investments in its U.S. resource plays; Tillman said the company wants to “minimize allocation” to conventional resource plays while completing certain long-cycle projects “that contribute production.”

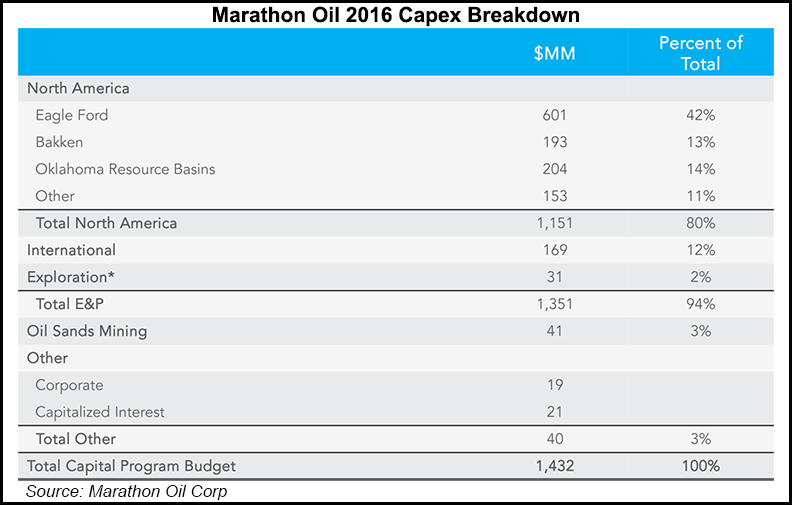

MRO said it expects to spend 42% of 2016 capex in the Eagle Ford Shale ($601 million), with 14% ($204 million) going to the Oklahoma liquids plays and 13% ($193 million) to the Bakken Shale. The rest will be divided up among international prospects, other North American development, oil sands mining and other expenses.

Lance Robertson, vice president of Resource Plays, said current cost allocation provides MRO with flexibility “in a volatile commodity market. If needed, we have the option to reduce spending down further with substantially all of our acreage held by production in the Bakken, the Eagle Ford and in the SCOOP [South Central Oklahoma Oil Province] Woodford. We also have relatively few leases with continuing drilling obligations and no long-term rig commitments in these plays.”

Robertson said the E&P plans to scale down to five rigs in the Eagle Ford by the end of 1Q2016 while maintaining “sufficient inventory to keep the completion crew operationally efficient.” MRO will focus on maintaining core leases across Oklahoma in 2016, he said, while continuing to delineate certain resource windows in both the SCOOP and the Sooner Trend Oilfield Anadarko Basin in Canadian and Kingfisher Counties (STACK).

Bakken activity will focus on completing the company’s water gathering system later this year, as MRO recently released its last operated rig but expects “to have intermittent development activity later in the year primarily to address continuing drilling obligations,” Robertson said.

MRO’s production guidance for 2016 is 335,000-355,000 boe/d from E&P activities and 40,000-50,000 boe/d from oil sands mining. Total company production for full-year 2015 was 422,000 boe/d adjusted for divestitures.

MRO reported a net loss for the quarter of $793 million (minus $1.17/share), compared with a net income of $926 million ($1.37/share) in the year-ago period. MRO saw a net loss for the third quarter of $749 million (minus $1.11/share).

For full-year 2015, MRO reported a net loss of $2.2 billion (minus $3.26/share), compared with a net income of a little over $3 billion in 2014.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |