E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Devon’s Mantra for 2016: Protect the Balance Sheet

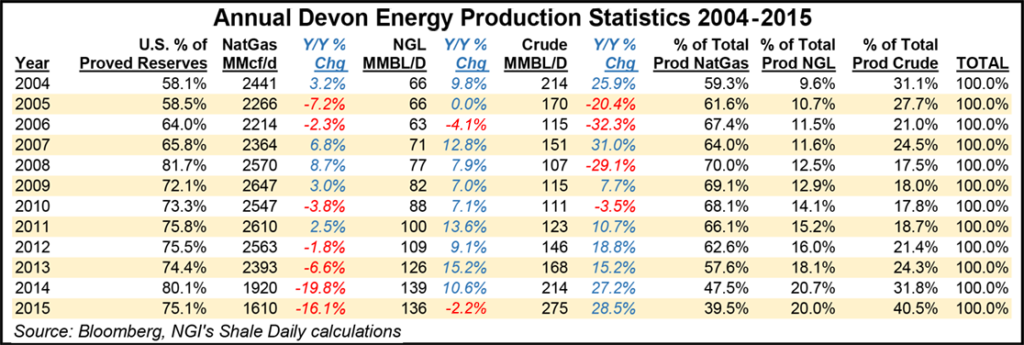

Pragmatic about what it can — and cannot — accomplish in the current environment, Devon Energy Corp. has no plans to accelerate exploration and production “in a $30.00 and $2.00 world,” CEO Dave Hager said Wednesday. Top line production is forecast to decline by 6% in 2016, led by a sharp pullback in onshore natural gas fields.

Deep cuts were announced in almost every area of Devon’s business. Capital expenditures were cut 75% from 2015, with an equal reduction to the quarterly dividend, to 6 cents from 24 cents. About 1,000 people, about 20% of the workforce, are losing their jobs by the end of March, with 700 dismissed from Oklahoma City headquarters. Devon has cut its workforce by 25% total over the past year.

Keeping the powder dry until prices cooperate is job No. 1, Hager said during a quarterly conference call Wednesday.

“Devon’s top priority in 2016 is to protect the balance sheet,” he said. “It makes no sense to increase production in a $30, $2 world.” Activity is being tailored “to current market conditions,” but with all of the spend earmarked for short-term onshore unconventionals, the producer would ramp up spending and activity as soon as commodity prices rebound. How much prices would need to rebound before Devon ramps up, Hager did not say.

Reducing the dividend is prudent, he said, “given the current commodity price environment and the uncertain duration of this downturn. This action provides us additional flexibility to balance spending with cash flow, aligns with our priority of maintaining a strong balance sheet, and moves the dividend yield and payout ratios in line with historic norms.” The adjusted dividend is expected to improve cash flow by about $320 million this year.

To cope with the prolonged slump, Devon is pulling more rabbits from its hat with continued asset sales. Up to $3 billion of onshore properties, as well as a half-stake in the Access Pipeline in Canada, which alone could fetch up to $800 million, are for sale (see Shale Daily, Dec. 7, 2015). Up to 80,000 boe/d of additional production has been identified for sale as well, including the Carthage assets in a gassy area of East Texas, property in the Mississippian Lime and Granite Wash, as well as “select” Permian assets in the Midland sub-basin.

“All these efforts are targeted at strengthening Devon’s financial position to take advantage of our top-tier assets when prices recover,” Hager said.

Spending will be tied to cash flow, with most of the capital directed to Oklahoma’s STACK, otherwise known as the Sooner Trend of the Anadarko Basin, (mostly in) Canadian and Kingfisher counties. Another $200 million is budgeted for both the Eagle Ford Shale and the Permian’s Delaware sub-basin, while Canadian oilsands projects would receive $175 million. The Rockies budget this year is $75 million, and the Barnett Shale is to receive $25 million.

To match lower spend, the onshore rig count is set at about 10, down from 18 at the end of 2015. Four rigs are operating in the STACK, with the Delaware and Eagle Ford scheduled to have two to three rigs each.

Lower spending and fewer rigs mean less output. Overall production from core assets is expected to decline by 6% at the midpoint of guidance, while oil production likely to fall by 3% and natural gas production down by 6% from 2015. Total oil production averaged 278,000 b/d in 4Q2015, 16% higher year/year. Oil now is the largest component of the product mix at 43% of total production. Last year Devon’s oil production from the core properties was 26% higher than in 2014. Based on 2016 guidance, the first quarter should be the peak for oil volumes.

Estimated proved reserves totaled 2.2 billion boe at the end of 2015, with proved developed reserves accounting for 83%. During 2015, Devon added 118 million of reserves through organic drilling, with 90% from oil-focused programs in the United States that were led by operations in the Delaware and STACK. However, a $5.34 billion writedown on the value of the reserves reduced the figure by 444 million boe.

Fourth quarter losses, damaged by the price revisions, totaled $4.53 billion (minus $11.12/share), versus a year-ago loss of $408 million (minus $1.01). Along with the $5.34 billion writedown on the value of the reserves, there was a $78 million restructuring charge. Revenue tumbled by more than half to $2.89 billion. Excluding the writedowns, core earnings nearly were flat year/year at $319 million (77 cents/share) from $316 million (76 cents). Oil and gas hedges were a big factor in keeping profits flat, helping to lift revenue by more than $700 million, or $11.50/boe, to $29.49/boe from $17.85.

Although the oil price was 42% lower year/year, operating cash flow in 4Q2015 rose by 12% to $1.1 billion. Also contributing was Devon’s majority investment in its pipeline partnership EnLink Midstream, which generated $219 million in operating profits for the final period. In 2015, EnLink’s operating profits rose by 8%, which helped supply Devon with steady cash flow.

Field-level operating costs, which include both lease operating expenses (LOE) and production taxes, declined 20% from a year earlier to $8.82/boe. For the full-year 2015, field-level costs were nearly $400 million lower. The most significant operating cost savings came from LOE, which declined to $479 million, or $7.66/boe, a per-unit decrease of 18% from 4Q2014. Led by additional LOE savings, field-level costs are slated to fall by an incremental $300-400 million this year.

Net debt at the end of 2015, excluding EnLink obligations, totaled $7.7 billion. No “significant” debt maturities are due until December 2018, with the weighted-average cost of outstanding debt at 5%.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |