NGI Archives | NGI All News Access

NatGas Forwards Stuck in Rut as Mild Temps Loom, Storage Swells

It’s going to take some significant heating demand or bullish storage news to end the slide natural gas forwards prices have been on, but this wasn’t the week that was going to happen.

The Nymex March gas futures contract slid 6.7 cents between Feb. 5 and 11 to settle at $1.994, and most other gas markets lost anywhere from 5 to 10 cents, according to NGI’s Forward Look.

The weakness comes as the U.S. Energy Information Administration reported a 70 Bcf draw from storage that was well below market expectations.

At 2,864 Bcf/d, gas inventories are now 25% above year-ago levels and 23.4% above the five-year average.

“While we still expect to exit March at a level lower than the record set in 2012, with not that many weeks left in the withdrawal season, we have to acknowledge that the exit will inevitably be very strong,” said Societe Generale’s Breanne Dougherty.

Indeed, the remainder of the storage withdrawal season is shaping up to be rather mild.

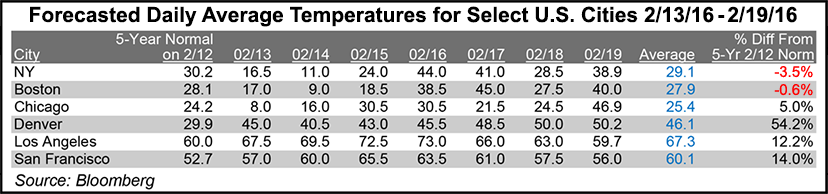

While next week should bring a weather system to the Upper Midwest and Northeast that will drop temperatures to sub-freezing levels, the cold blast is expected to be short lived and to be followed by a return to milder temperatures, according to forecasters with NatGasWeather.

The weather agency indicated there should be some cooler weather arriving to close out the month, but the most recent data is still not intimidating enough.

“The nat gas markets were hopeful end-of-season supplies could drop below 2.0 Tcf to ease hefty supplies, but that isn’t likely unless there are a couple fairly cold weeks at the end of February through March,” NatGasWeather said in a Friday note to clients.

“After the next three draws are accounted for, supplies will be around 2.4 Tcf, with the rest of the seasonal weekly draws according to the five-year average taking out another 265 Bcf or so. This would leave end-of-winter season supplies between 2.1 and 2.2 Tcf unless colder patterns find ways to return, which would not be a good [thing] going into Spring with production showing recent strength,” the forecaster said.

Looking at forward curves across the country, there were some standouts.

New England’s Algonquin Gas Transmission citygates continued to post the sharpest declines across the curve as demand is projected to tumble from Friday’s expected peak.

Genscape shows demand reaching 4.06 Bcf/d Friday and then falling to 3.24 Bcf/d by Feb. 19 and edging back up to 3.33 Bcf/d by Feb. 26.

Genscape, based in Louisville, KY, is a real-time data and intelligence provider for energy and commodity markets.

The projected drop in near-term demand appears to have squashed the hopes of unloading an incremental cargo at the Northeast Gateway LNG Terminal as that ship has reportedly left the area amid continuing declining prices in the region.

AGT citygates March dropped 26.8 cents between Feb. 5 and 11 to reach $3.38, while April fell 22.9 cents to $2.75, according to Forward Look. The balance of summer (May-October) was down 12.4 cents to $2.63.

Forward prices across the country in the Pacific Northwest also fell considerably more than most other markets as temperatures in the region continue to average above seasonal levels.

Northwest Pipeline-Sumas March slid 14.2 cents from Feb. 5 to 11 to reach $1.56, April dropped 5.6 cents to $1.51 and the balance of summer lost 5 cents to hit $1.66, Forward Look data shows.

Meanwhile, Genscape shows demand in the Pacific Northwest averaging 1.874 Bcf/d next week, down from the recent seven-day average of 2.28 Bcf/d. For the five-day period between Feb. 22 and 26, demand is forecast to average 2.15 Bcf/d.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |