Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Continental Reports 9% Reduction in 2015 Year-End Reserves

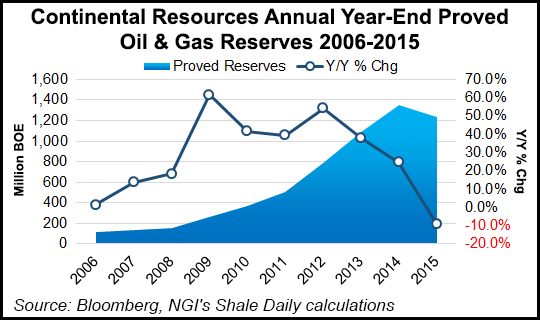

Continental Resources Inc. ended 2015 with 1.23 billion boe in proved reserves, a 9% decrease from 1.35 boe at year-end 2014, the company said Wednesday.

Year-end 2015 reserves were 57% crude oil, while 87% were operated and 43% proved developed producing (PDP), the Oklahoma City-based exploration and production (E&P) company said.

The company reported 297 million boe in net negative revisions to its year-end proved reserves, driven largely by 251 million boe in price-related reductions, with expiring proved undeveloped assets (PUD) also contributing.

Continental said the net present value discounted at 10% (PV10) of its 2015 year-end proved reserves was $8 billion, with 663 million boe ($4.4 billion PV10) in the Bakken Shale and 413 million boe ($2.5 billion PV10) in the Woodford and Springer plays in the SCOOP (South Central Oklahoma Oil Province). The E&P also said it completed initial wells in the over-pressurized window of the STACK (Sooner Trend Anadarko in Canadian and Kingfisher counties) in 2015.

PDP reserves increased 6% year/year to 521 million boe as of Dec. 31. Proved reserves decreased 81 million boe by production, with 253 million boe added by drilling. Continental reported 1,860 gross (995 net) PUD locations as of Dec. 31, with 1,292 gross (705 net) in the Bakken.

Total production in 2015 reached 80.9 million boe (221,700 boe/d), up 27% from full-year 2014 totals. Crude oil made up 66% of the company’s 2015 production at 53.5 million bbl, while total natural gas production was 164.5 Bcf.

Continental said its price deck for calculating 2015 year-end proved reserves was $50.28/bbl for crude and $2.58/MMBtu for gas, compared with $94.99/bbl and $4.35/MMBtu in 2014.

CEO Harold Hamm said the relatively modest reduction in proved reserves compared to the steep drop in commodity prices “clearly validates” the quality of Continental’s inventory.

Continental said last month that it would be reducing its 2016 non-acquisition capital expenditures budget by 66% to $920 million, compared with $2.7 billion in 2015 (see Shale Daily, Jan. 27). The E&P said it expects production to average 200,000 boe/d in 2016 as it grows its inventory of drilled but uncompleted wells.

Continental is the largest acreage holder in both the Bakken and the SCOOP at 1,074,000 and 445,000 acres, respectively, as of December. It was the fifth-largest acreage holder in the STACK as of December at 146,300 acres.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |