Northeast NatGas Gains Tug Market to Strong Advance; Futures Flounder

Next-day physical gas prices soared on Wednesday as East Coast buyers made sure of adequate supplies ahead of a storm, with forecasters expecting cold temperatures could send overnight lows below zero. Strength at eastern locations was more than able to lift overall pricing by double-digits, and the NGI National Spot Gas Average jumped 18 cents to $2.38.

Outside of Northeast market points, prices for next-day delivery fell about a nickel, but eastern prices jumped an average close to $1.50, with several points tallying $2-plus gains.

Futures journeyed south on a forecast warm spell expected to follow the weekend cold. At the close, March had dropped 5.2 cents to $2.046, and April was down 3.8 cents to $2.111. March crude oil fell 49 cents to $27.45/bbl.

Along the Eastern Seaboard, next-day gas vaulted higher as temperature forecasts called for temperatures to remain on a downward path through the weekend. Wunderground.com predicted Boston’s high Wednesday of 34 would slide to 30 on Thursday and 27 on Friday, then to 17 Saturday and 14 on Sunday. The normal high in Boston is 38. New York City’s Wednesday high of 39 was seen dropping to 30 Thursday and Friday, before a weekend dive to 21 Saturday and 23 Sunday, 18 degrees below normal.

Gas on Texas Eastern M-3, Delivery rose $2.45 to $4.69, and deliveries to New York City via Transco Zone 6 jumped $2.53 to $5.99.

Gains at New England points almost matched the exuberance of the Mid-Atlantic. Gas at the Algonquin Citygate rose $2.00 to $6.50, and deliveries to Iroquois, Waddington added 94 cents to $3.64. Gas on Tenn Zone 6 200L jumped $1.93 to $6.37.

In the Great Lakes, buyers were laying in supplies ahead of forecast cold.

“What I hear is cold heading our way for the weekend,” said a Michigan marketer. “We’ve been buying a good deal of gas and hopefully we’ll need it. Sunday morning it’s supposed to be minus 2. We had to buy on top of our baseload and paid $2.20 on Consumers.”

Midwest and Great Lakes points weren’t as exuberant. Gas on Alliance shed 5 cents to $2.17, and deliveries to the Chicago Citygate fell 6 cents to $2.17. Gas on Consumers changed hands at $2.16, down a nickel, and deliveries on Michigan Consolidated shed 4 cents to $2.16.

“A quick but intense shot of blustery cold will sweep across the Northeast U.S. this weekend, reminiscent of the polar vortex outbreaks from the last two winters,” said Wunderground.com meteorologist Jeff Masters. “Compared to the multi-day blasts of cold that were common in early 2014 and 2015, this will be more of a glancing blow, but stout breezes will push wind chills far below zero in many areas.”

Although spot markets, and to a lesser extent futures markets, are grappling with a near-term weather event expected to pound the Midwest and East, analysts suggested that the next bearish weather forecast could prompt another visit to below $2.

“The warm temperatures this winter have limited natural gas demand across the country,” according to Portland, OR-based EnergyGPS in a note to clients. “Currently, residential and commercial natural gas demand is an average of 2.5 Bcf/d below normal for the U.S. this winter.”

Year-on-year demand profiles look “fairly similar between now and Feb. 14, before this year’s demand forecast is driven down by warm temps. The downside after Feb. 14 is so substantial that residential/commercial demand is expected to be 6.4 Bcf/d below last year on average over the next 15 days.

“During February 2015, total natural gas withdrawals from storage were around 720 Bcf, considering the substantial difference in the weather forecasts, it seems unlikely that this year’s withdrawals will match, placing March 1 storage above 2.2 Tcf,” EnergyGPS said.

“Natural gas production continues to rise and is near a five-year high. The forecasts for the remainder of the winter continue to track below normal, with the exception of a short-lived cold snap this weekend.

“When we add all these factors, the current prompt month begins to feel heavy as production and storage remain robust and demand wanes. It also calls into question if we are near a tipping point in which the next bearish weather forecast could drive the price back down below $2,” said the consultant.

Followingvthe blast of cold expected to hammer New England and portions of the East, temperatures “will gradually moderate early next week, with natural gas demand easing even as weather systems impact the Northwest and Northeast corners with rain, snow and colder temperatures,” said Natgasweather.com in a Tuesday update.

“This milder U.S. pattern will likely last from Feb. 16-21 before the next better opportunity for colder Canadian air arrives around Feb. 22-25. Overall, [it’s] a relatively bullish setup over the Midwest and eastern U.S. through the weekend, but then becoming bearish as next week progresses” because of falling natural gas demand.

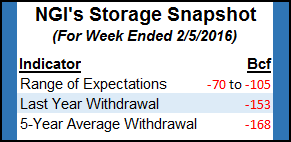

Expectations for Thursday’s storage report by the Energy Information Administration place injections well below seasonal norms. Last year 153 Bcf was withdrawn and the five-year average stands at a 168 Bcf pull.

Analysts at ICAP Energy forecast a pull of 77 Bcf, and IAF Advisors is looking for a withdrawal of 76 Bcf. A Reuters poll of 23 traders and analysts revealed an average 82 Bcf draw with a range of 70 Bcf to 105 Bcf. Similarly, a Bloomberg survey of 14 participants came in with the exact 70 Bcf to 105 Bcf range and a median draw of 78 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |