E&P | NGI All News Access | NGI The Weekly Gas Market Report

Recent Employment Data Points to Impact of Oil/Gas Downturn

While the latest jobs report from the U.S. Bureau of Labor Statistics (BLS) showed the national unemployment rate falling again to reach 4.9% in January, the trend lines haven’t been nearly so encouraging for energy sector employment.

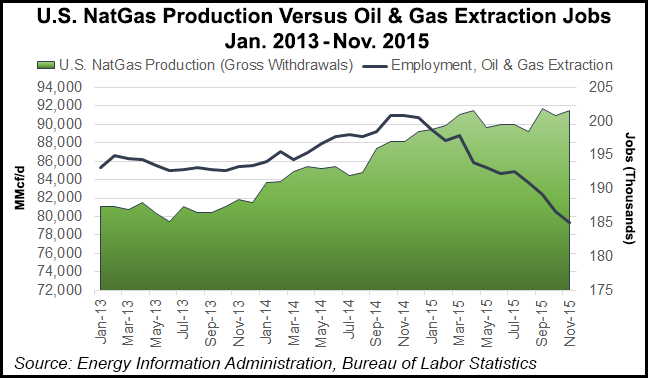

U.S. jobs in oil and gas extraction fell steadily throughout 2015, BLS data shows, reflecting a difficult year for many producers forced to lay off workers and cut costs to survive a depressed commodity price environment.

For January, BLS reported a seasonally adjusted 183,000 jobs in oil and gas extraction, compared with 198,700 in the year-ago period, a decrease of 7.9%. In mining support activities, a category that includes drilling rig operators and other oil and gas-related fields, BLS reported 333,100 jobs in January, down from 432,600 jobs in January 2015, a decrease of 23%.

A glance at recent state-level data also points to the employment impact of sagging commodity prices, with most major shale states reporting big job losses in their mining and logging sectors, a category that covers oil and gas and other extractive industries. States generally do not provide more detailed industry-level breakdowns in their monthly employment data.

In its latest jobs data release, Texas reported 286,000 jobs in mining and logging for December. That’s a decrease of 33,600 from the year-ago period, down 10.5%. Neighbor Oklahoma’s mining and logging employment fared similarly in 2015, losing 12,200 jobs (minus 19.3%) to finish at 50,900 jobs in December.

In the Appalachian Basin, where coal layoffs have been felt prominently, Pennsylvania reported a year/year decline of 3,300 jobs (minus 8.7%) in its mining and logging sector in 2015, even as the state gained jobs overall. Ohio ended the year at 13,800 jobs in mining and logging, down 11.5% from December 2014’s total of 15,600. West Virginia reported 24,800 jobs as of December 2015, compared with 30,400 jobs in the year-ago period, an 18.4% decrease.

In North Dakota, mining and logging jobs stood at 24,200 in December 2015, down 7,800 from the year-ago total of 32,000, a decrease of 24.4%. In Louisiana, home to the Haynesville Shale, the state reported 42,800 jobs in mining and logging as of December 2015, down almost 10,000 (minus 18.8%) from the year-ago total of 52,700.

Besides employment losses, shale states have also had to contend with declining tax revenues as a result of the ongoing downturn (see Shale Daily, Feb. 2a; Feb. 2b; Dec. 14, 2015; Nov. 2, 2015).

Meanwhile, domestic crude oil and natural gas production remained strong in 2015 despite a sharp drop in the rig count. The Energy Information Administration’s latest EIA-914 survey showed gross natural gas withdrawals reaching 91.5 Bcf/d in November, up 3.8% year/year. Domestic crude production was 9.3 million b/d in November, up 1.3% year/year (see Shale Daily, Feb. 1).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |