Infrastructure | Markets | NGI All News Access

NatGas Cash Gains, While Futures Steady Ahead of Storage Data

Physical natural gas traded on Wednesday for next-day delivery managed to recover somewhat from Tuesday’s drubbing with help from stout gains at eastern points. Most market points added a penny or two but eastern locales on average gained close to 20 cents.

The NGI Daily Spot Gas Average rose 5 cents to $1.95, and only a scattered handful of points failed to make it into positive territory. Natural gas futures managed to hold the psychologically important $2 threshold and marked time ahead of the Energy Information Administration (EIA) storage report.

At the close, the March contract had added 1.3 cents to $2.038 and April added three-tenths of a cent to $2.123. March crude oil shook off Tuesday’s sub-$30 close and rose $2.40 to $32.28/bbl.

With the exception of eastern points, most major natural gas market hubs were held to small gains as near-term weather forecasts favored normal, if not much above normal, levels for the next few days. Forecaster Wunderground.com predicted Wednesday’s high in New York City of 56 would ease to 54 Thursday before dropping to 44 Friday, 5 degrees above normal. Chicago’s 38 high Wednesday was expected to fall to 33 Thursday and to 34 Friday, 1 degree above normal.

Deliveries to the Algonquin Citygate fell 4 cents to $1.90, yet gas headed to New York City on Transco Zone 6 added 19 cents to $1.79. Packages at the Chicago Citygate gained 2 cents to $2.07, and Henry Hub changed hands 3 cents higher at $2.06.

Gas at Marcellus points gained ground relative to higher priced points on the REX Zone 3 Expansion to the West (see NGI’s Rockies Express Zone 3 Tracker).

Deliveries to NGPL at the Moultrie County, IL, interconnect along with gas on Trunkline at Douglas County, IL, both rose 3 cents to average $2.03, while gas on Panhandle Eastern at Putnam Country, IN, came in 4 cents higher than Tuesday at $2.04.

Upstream, however, Marcellus market points rose by double-digits. Gas for delivery Thursday on Dominion South rose 14 cents to $1.35, and parcels on Tennessee Zn 4 Marcellus added 11 cents to average $1.19. Gas on Transco-Leidy Line posted a hefty 15-cent advance to $1.22.

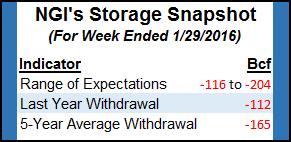

Technical traders Thursday will be watching to see if the release of storage data by EIA will spark a close below $2 and set gears in motion for revisiting sub $2 pricing. Estimates are for another triple-digit pull, but that is unlikely to put much of a dent in a year-on-five year surplus of 432 Bcf. Last year 112 Bcf was withdrawn from storage, and the five-year average is a pull of 165 Bcf.

Citi Futures Perspective estimated a decline of 167 Bcf, and Stephen Smith Energy calculated a 154 Bcf draw. IAF Advisors is looking for a decline of 150 Bcf, while a Bloomberg poll of 17 traders and analysts revealed a median 154 Bcf withdrawal with a range of 145 Bcf to 204 Bcf.

A Reuters survey of 23 analysts and traders produced a 116 Bcf to 202 Bcf range with a median of a 157 Bcf draw.

The market continues to labor under expectations of tempered weather conditions by mid-month, but not all weather models show market-crushing moderation. Forecaster Natgasweather.com in a noon update on Tuesday said the Global Forecast System shows “a strong winter storm the next few days across the central U.S., then a glancing blow of frigid polar air across New England this weekend, but not pushing far enough south to impact major Northeast cities. It then follows with the polar outbreak next week, although less cold than the overnight run.

“It shows a brief break at the end of next week before another polar blast arrives across the northern U.S. on Feb. 14-15. Essentially ,milder days eight-11, then much much colder days 12-15. This solution is quite a bit different than recent runs and is considered an outlier for now, but does highlight that warming after next week isn’t a given.”

Despite the continued erosion of futures prices, analysts remain optimistic for the second half of 2016.

“Front month averaged $2.23/MMBtu in January, which was a little under our $2.30/MMBtu target but within range considering the bearish weather patterns the market had contend with,” said Societe Generale analyst Breanne Dougherty. “The March contract is now in the front month position and it saw some brief support at the end of last week, but that support seems to have disappeared with the softer weather outlook.

“Unfortunately, the market continues to move aggressively off weather, which at the moment does gravitate toward more normal temps in the 11-15 day period, but this is hardly something to provide a material catalyst for a shift in sentiment. The immediate term does not present a good platform for a return of the bulls. We continue to see the spring as the most vulnerable to downside price pressure given the expected boisterous March storage exit level, but the curve continues to have those contracts trading at a premium to front-month.

“We continue to hold a constructive price expectation starting in 2H2016 [$3.05-3.45], with 2017 exposed to significant upside price risk the longer oil and gas prices stay at current levels,” Dougherty said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |