E&P | NGI All News Access | NGI The Weekly Gas Market Report

NOV Equipment Orders Fall Sharply as Customers Delay Orders, Cannibalize Spare Parts

National Oilwell Varco Inc. (NOV), which provides drilling support services worldwide, is bracing for further deterioration this year as customers cannibalize equipment and delay picking up orders, with a recovery not predicted before 2017.

The Houston oilfield services operator suffered a fourth quarter net loss of $1.52 billion (minus $4.06/share), versus year-ago profits of $597 million ($1.39). One-time charges in 4Q2015 included $1.6 billion for goodwill and intangible asset impairments, as well as $139 million in restructuring inventory writedowns.

Revenue tumbled 18% sequentially to $2.7 billion, more than expected, with operating profits of $141 million, or 5.2% of sales. Decremental operating leverage was 35% from the third quarter to the fourth. In 2015, losses totaled $767 million (minus $1.99/share), compared with earnings in 2014 of $2.51 billion ($5.73). From 2014 to 2015, decremental operating leverage was 32%.

“As we have stated for the past few quarters, our focus is to manage what we can, namely cost, while continuing to advance our longer-term strategic goals,” CEO Clay Williams said during a conference call Wednesday morning. “It nevertheless remains a very challenging time for everyone in the oil and gas industry and our visibility remains limited.”

NOV’s most prized business, the completion and production (C&P) segment, reported a 7% decline sequentially, with 4Q2015 posting 56% sequential decremental operating leverage. About 20% of the C&P mix is in production equipment, pump separators and artificial lift, where business declined as distributors slowed their purchases. Orders declined from 99% book-to-bill in the third quarter to 59% in the final period, leading to a sharp fall in the backlog at year’s end.

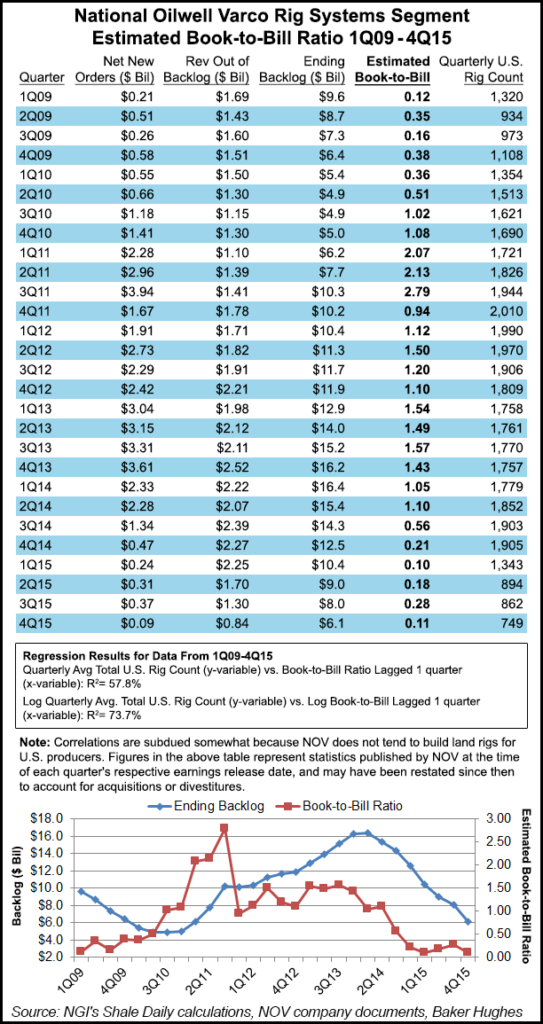

“During the fourth quarter, we received $89 million in new orders resulting in a book-to-bill of 10%,” CFO Jose Bayardo said. “Fourth quarter bookings were composed entirely of discrete pieces of capital equipment, as we received no new rig orders in the quarter.” Bookings in the final three months included top drives and blowout preventers for international land rigs and cranes for offshore construction vessels.

“We ended the quarter with a backlog of $6.1 billion, down 24% sequentially, of which approximately 89% is for the offshore market and 92% is destined for international markets,” the CFO said.

“As you know, the food chain that we work within, drilling contractors sign up for the construction of these new rigs,” Williams told investors. “The shipyards are their customers, and then we work for the shipyards. We’ve been very diligent over the years about demanding very strong contracts, very strong down payments, progress billings and the like. But given our focus on monetizing the profit in that backlog, we have slowed our progress on revenue out of backlog to…better match payments and to minimize our working capital exposure in those programs.

“That’s kind of what you saw on the fourth quarter. We slowed down that revenue recognition out of backlog, but ultimately, it’s really caused by a lot of drillers trying to delay acceptance of rigs, a couple of situations I think have been made public and a couple of situations…remain a little tense,” including the loss of contracts in Brazil.

It’s safe to say, he said, that “no piece of capital equipment across the oilfield globally is being well maintained right now. And what that sets up for the future is when activity does turn, when we find bottom, then it starts to go up. It’s a lot of work for our rig aftermarket folks to repair, to maintain, to replenish spare parts. And so, the deeper this goes and the longer this goes, I think the sharper the rebound and the more positive the rebound.”

No company is maintaining their fleets very well, Williams said. “There’s a lot of equipment auctions underway where you can pick up fleets at pennies on the dollar, and that becomes a source of spare parts. That’s how it affects our business. Rather than buying consumables, fluids and things from us, those are being purchased at auction. So, I think the cannibalization of the existing fleet, sort of the erosion of the equipment overhang, is well underway in that space. And when it does turn again, these can be called upon to step up and boost production to satisfy future demand.”

As NOV moves through the first quarter, however, “we expect rig systems revenue to decline in the high single-digit percentage range, and revenue out of backlog to decrease to around $775 million,” Bayardo said. “But I’ll stress that our visibility remains limited. We plan to deliver on our current backlog while continuing to resize the business aggressively to meet a much lower level of demand. We are actively scaling facilities to single ships, consolidating locations and implementing other cost-control initiatives. Despite these efforts, reduced volumes will work against us and we anticipate some margin erosion on lower activity levels and continued delays in the range of 200 to 300 basis points.”

Declining energy prices “will negatively impact our order book for the foreseeable future, and we expect new orders for large equipment packages, both on and offshore, to remain low.” Bookings in the first quarter are not expected to improve materially from 4Q2015.

NOV laid off about one-fifth of its global workforce last year, and more job losses are expected, Williams said.

“We expect restructuring will continue through the first half of 2016, perhaps longer, in view of the challenging market…We in-sourced tens of thousands of hours from outside suppliers through our own workforce to preserve our teams wherever possible. Nevertheless, our global workforce, including contract labor, declined 21% through the year, and we closed 75 facilities since mid-2014 to retrench to a smaller, more efficient footprint.”

Supply and demand eventually will come into balance. “But we are not planning for recovery in 2016. Instead, we will continue to manage costs to the reality of the marketplace in the short term.” As prices rebound, he said, it will take time for recovery to get underway as E&P customers repair balance sheets, reactivate crews and ramp up the activity that drives the business.

“Each day that passes means we are a day closer to the inevitable rebound,” Williams said. “Our plan is to emerge with new products, new business models and new efficiencies.” Until then, however, it’s going to be a rough go. North American customers have delayed picking up well stimulation equipment already ordered, and some are buying fractionation spreads at distressed pricing to use for spare parts.

“E&Ps…are opting for the lowest investment option to bring on wells and their associated cash flow,” he said. “As rigs come down, particularly onshore, they’re being cannibalized for parts impacting our spares business for the quarter.”

As for the “good news,” the CEO claimed an experienced management team that’s been through volatile times before.

“We’ve been called on in the past to double and triple and quadruple production over a short period of time, and we successfully navigated that very well and maximized the profitability and returns through that. This is the flip side of that. As orders fall away, as spending comes to the screeching halt, we have to cut costs in lockstep. So, I have an abundance of confidence in the capabilities of this team to do both, to respond to this market that’s slowing down dramatically, as well as speed up and flex upwards when we’re eventually called upon to do that.” NOV is in an “enviable position,” as its strong balance sheet provides flexibility to look for opportunities to deploy capital, such as for acquisitions in a buyer’s market.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |