Marcellus | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report

Cabot Slashes 2016 Spending, Plans to Run Just One Rig

Cabot Oil & Gas Corp. will sharply cut its 2016 capital budget in response to the commodities downturn, electing to preserve its cash flow, await more takeaway capacity in the Appalachian Basin and run one rig company-wide, the company said Tuesday.

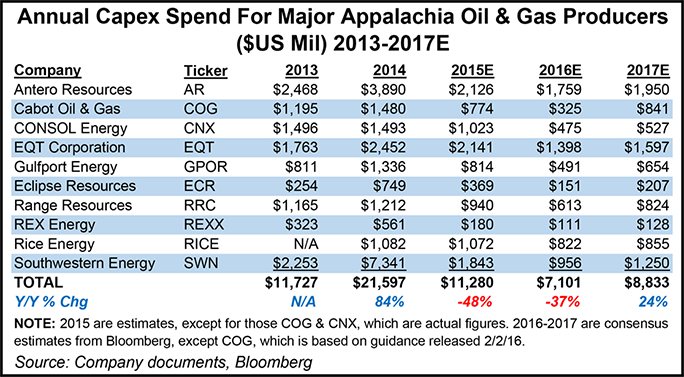

In response to the decline in both crude oil and natural gas prices, Cabot said it would cut its 2016 budget to $325 million, or 47% less than the $615 million it announced in October and 58% less than the $774 million it spent in 2015. Cabot was running three rigs in the Marcellus Shale at the beginning of the fourth quarter, but it had dropped one by the end. After quarters of soaring liquids production and heavy operations in the Eagle Ford Shale of South Texas, the company also dropped its sole rig there late last year.

Cabot said Tuesday it expects to beat the midpoint of its fourth quarter production guidance, with volumes anticipated at 1.642 Bcfe/d. Liquids production was 14,977 b/d in 4Q2015, down from 1.4 million bbl overall in 4Q2014 and 1.5 million bbl overall in 3Q2015. It said natural gas production during the fourth quarter would likely be 1.552 Bcfe/d. The period’s anticipated production would be flattish compared to 159.9 Bcfe overall in 4Q2014 and 142.1 Bcfe overall in 3Q2015.

Based on expected fourth quarter production, Cabot said its annual production growth for 2015 would be 13% when compared to 2014 volumes. That misses the 20-30% target it set at the end of 2014, but the company scaled back throughout last year in response to the commodities downturn (see Shale Daily, Oct. 24, 2014).

Cabot said 70% of its $325 million budget this year would be spent in the Marcellus Shale, while the remainder would go toward the Eagle Ford. It expects to drill 30 net wells this year, including 25 in the Marcellus and five in the Eagle Ford. Additionally, the company said it would complete 40 wells in the Marcellus and 15 in the Eagle Ford.

“Given the productivity of our assets in the Marcellus Shale, we will be prepared to accelerate our production growth in a capital efficient manner when market conditions warrant, as we anticipate over 1.3 Bcf/d of new firm transport capacity and firm sales by the third quarter of 2017 and an incremental 425 MMcf/d by the third quarter of 2018,” said CEO Dan Dinges.

Cabot curtailed more than 500 MMcf/d between the second and third quarters of last year (see Shale Daily, Oct. 23, 2015). At the start of the fourth quarter, Dinges said those volumes would be variable heading into the end of the year and into 2016. The company also reduced its 2016 production growth guidance range to 2-7% given the planned decrease in capital spending.

Cabot also expects to record an after-tax impairment charge of $73 million for 4Q2015, mainly related to sliding oil and gas prices and its legacy, noncore assets.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |