NGI Data | NGI All News Access

February NatGas Bidweek Bears On Prowl as Quotes Fall Early, Often

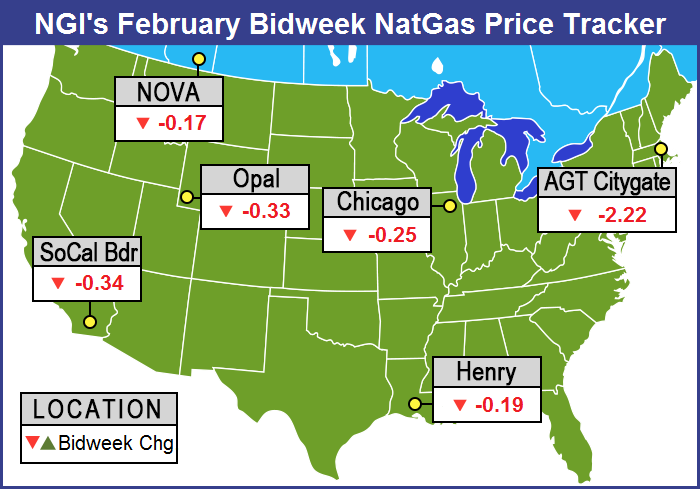

February natural gas bidweek prices slumped as buyers were confronted with medium-term temperature forecasts calling for mild temperatures east of the Mississippi. As a result, NGI‘s National Bidweek Average fell a stout 23 cents to $2.23, and only a handful of points in the Northeast, Rocky Mountains and West Texas made it to the plus column.

Ample supply and lackluster demand remain very much in play as the $2.23 average represents a $1.00 discount from the February 2015 bidweek’s national average.

Of the actively traded points, Tetco M-2 30 Receipt and CIG tied for the biggest gain adding 9 cents to $1.37 and $1.99, respectively. Algonquin Citygate was the biggest loser, dropping $2.22 to $4.64. All regional averages were in the red by double digits, with the Northeast in deepest at a 38-cent setback to $2.40. The Midcontinent and East Texas proved to be the most resilient, with losses of a dime to $2.13 and $2.15, respectively.

California, on average, was 30 cents lower at $2.31, and the Midwest fell 25 cents to $2.30. Both South Louisiana and the Rocky Mountains were off 20 cents to $2.15 and $2.06, respectively, and South Texas shed 19 cents to $2.14.

February futures expired at $2.189, down 18.3 cents from the settlement of the January contract.

Even with a 200-plus Bcf natural gas storage draw reported last Thursday for the week ending Jan. 22, supplies are more than ample, if not burdensome, but indications are that bidweek purchases are not going to be appreciably less simply because of high storage levels.

“Utilities will typically go in with a plan, and if load requires them to go out and buy more on the day, then they will, but otherwise they will use their base load purchases and storage to fulfill demand,” said a Houston-based industry veteran. “I think it’s early for anyone to worry about too much storage. There is still a whole month of winter ahead, and it might be an issue later on. Some pipelines [storage] will require you to rotate the gas and not leave it in over the summer, but some systems are different and don’t require cycling. Every pipeline is different, and there is also third-party storage.

“Some of the gas may also be hedged through the winter so that gas may also be coming out, unless they cover those hedges,” he told NGI. “Everybody is different, so you can’t say it’s going to be across the board one way or another.”

Analysts see less and less attention being paid to weather forecasts going forward given the magnanimity of storage. “As this month proceeds, attention will slowly be shifting away from the short term temperature views and toward a sizable supply surplus that will remain intact through the balance of the withdrawal cycle,” said Jim Ritterbusch of Ritterbusch and Associates in a weekly note to clients.

“And although our previously projected end of season stock at the 2.3 Tcf level may prove out of reach, we still see enough of a supply overhang to force price downsizing through the spring-summer portion of the injection cycle. However, a continued plunge in the gas rig counts should not be ignored as an eventual supportive force that could easily reverse the recent uptick in gas production. Output will slowly be returning to levels below that of a year ago and associated gas output will be realizing more impact from some expected renewed decline in liquids output.

“But in the background, we will continue to emphasize unexpectedly weak demand from the important industrial sector that may not attract much attention within the weekly storage reports. However, further weakening in U.S. manufacturing that will likely be highlighted today per the PMI Manufacturing Index report will be acting to downsize supply draws gradually through the balance of the withdrawal period and well into the upcoming injection cycle a couple of months down the road.”

Ritterbusch recommends entering the short side “on any price rallies this week into the $2.27-$2.31 zone keeping stop protection above $2.36. Ultimately, we are keeping a price decline to sub $2 levels on the table.”

By the end of bidweek Friday most points for Monday delivery traded higher by double digits with the exception of a few points in the volatile Northeast. NGI‘s Daily National Spot Gas Average added 16 cents to $2.17, while the March natural gas futures contract sparked higher as well, adding 11.6 cents on Friday to $2.298, which represents a 15.7-cent increase over the contract’s previous Friday finish.

Friday’s futures gain marked the eighth consecutive regular session increase for front-month futures, which runs back to the last week and a half of the February contract’s reign. This is streak is unlikely to continue according to Citi Futures Perspective Analyst Tim Evans. “The natural gas futures have been undermined by an updated temperature forecast that looks significantly warmer than Friday’s outlook even for the current week,” he said on Monday.

With winter 2015-2016 more than halfway complete, industry consultant Genscape Inc. reports that the Southeast and Mid-Atlantic (SEMA) region are seeing nominations to power plants outpace nominations to citygates by 5.5%. “This trend bucks a long standing pattern whereby citygate nominations overtake power plant nominations at the beginning of each winter,” according to Genscape’s Rick Margolin, senior analyst, natural gas. “In many ways, this is an extension of the overall growth trajectory of the region: In the summer of 2014, power demand grew heavily with a 66% jump in power plant nominations compared to the previous summer. Simultaneously, demand at citygates fell off by 35%. As a result, power nominations overtook citygate nominations.”

In Genscape’s Natural Gas Basis commentary on Friday, Margolin noted that this trend continued in the winter of 2014/2015, with nominations to power plants growing by 15% compared to the previous year, but “not enough to unseat citygates as the proverbial King of the Mountain. Summer of 2015 saw more of the same as power demand grew by another 20% while citygate nominations grew at a mere 3%.

“In total, SEMA is seeing a slight downturn in demand, with overall consumption down 4.9% from an average of 15.8 Bcf/d of consumption last winter to 15.1 Bcf/d this winter,” according to Margolin. “Looking forward to next week, a warming trend over the weekend should put temperatures above average for this time of year. However, as the week progresses, another cold front could potentially drive temperatures into the 25 HDD range, creating bullish demand in the 19-20 Bcf/d range like last week.”

Revisiting Thursday’s natural gas storage report for the week ending Jan. 22, which revealed the season’s first 200-plus Bcf withdrawal, analysts with Tudor, Pickering, Holt & Co. (TPH) on Friday attributed the 211 Bcf draw to colder than average weather.

“Back-to-back strong absolute draws bring storage overhang down into the historic range,” TPH said. “However, like last week, the market on a weather-adjusted basis showed only 3 Bcf/d undersupplied, which is well shy of the impressive 5 Bcf/d undersupply situation in late December. Spot price moved down to $2.20/MMcf/d from $2.40/MMcf/d the previous week, but it didn’t seem to impact gas-generation market share, at least for last week. We continue to look for a 5 Bcf/d undersupply through withdrawal season to clean-up the El Nino-induced storage overhang before the end of season. Of course colder than normal weather also works.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1258 | ISSN © 2577-9877 |