M&A | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Dominion to Pay $4.4B For Gas Utility Company Questar

Power company Dominion Resources Inc. plans to acquire natural gas distributor and pipeline company Questar Corp. for $4.4 billion cash plus debt in a deal that continues the recent trend of electricity players acquiring natural gas local distribution companies (LDC).

The transaction values Questar at $25/share, representing a 30% premium to its recent closing price. The acquisition would be accretive to Dominion upon closing, which is expected by year-end. Deal financing will be through equity, mandatory convertibles and debt at Dominion, and equity at Dominion Midstream Partners LP, the company said. The combination is expected to support Dominion’s 2017 earnings growth rate and allow the company to reach the top of or exceed its 2018 growth targets, it said.

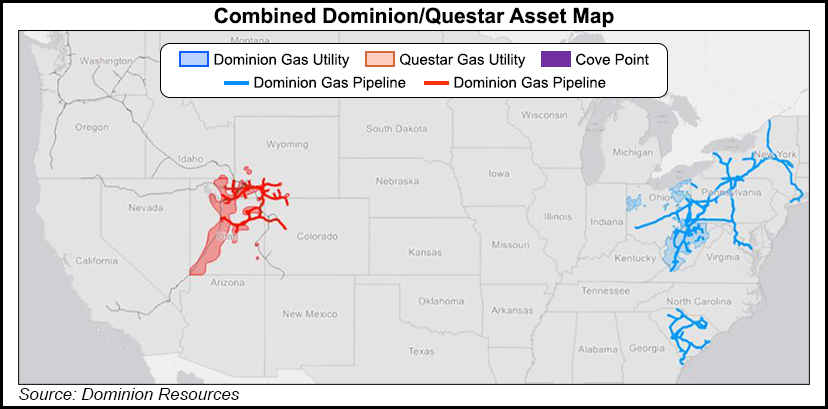

The combined company would serve about 2.5 million electric utility customers and 2.3 million gas utility customers in seven states. It also would operate more than 15,500 miles of natural gas transmission, gathering and storage pipelines, one of the nation’s largest natural gas storage systems, and approximately 24,300 MW of power generation.

Questar, headquartered in Salt Lake City, UT, is a natural gas distribution, pipeline, storage and cost-of-service gas supply company. It serves nearly 1 million homes and businesses in Utah, Wyoming and Idaho, with approximately 97% of those customer accounts in Utah. Questar employs about 1,700 and has about $4.2 billion in assets, including 27,500 miles of gas distribution pipeline, 3,400 miles of gas transmission pipeline and 56 Bcf of working gas storage.

Richmond, VA-based Dominion’s existing operations lie in the heart of the mid-Atlantic, whereas Questar’s system is the “hub of the Rockies” and a principal source of gas supply to Western states. Dominion said it expects the value of the Questar pipeline system to rise over time as Utah and other Western states seek to comply with the requirements of the U.S. Environmental Protection Agency’s Clean Power Plan and meet state-mandated renewable standards, with increasing reliance on gas-fired electric generation.

“This addition is well-aligned with Dominion’s existing strategic focus on core regulated energy infrastructure operations,” said Dominion CEO Thomas Farrell. “Questar boasts best-in-sector customer growth in states with strong pro-business credentials and constructive regulatory environments. These high-performing regulated assets will improve Dominion’s balance between electric and gas operations and provide enhanced scale and diversification into Questar’s regulatory jurisdictions.

“Of note, Dominion Midstream investors will benefit from the addition of Questar, as it is expected to contribute more than $425 million of EBITDA [earnings before interest, taxes, depreciation and amortization] to Dominion’s inventory of top-quality, low-risk MLP [master limited partnership]-eligible assets, supporting Dominion Midstream’s targeted annual cash distribution growth rate of 22%.”

During a conference call to discuss the deal as well as fourth quarter results, Farrell said the acquisition is in line with plans Dominion outlined at the company’s investor conference in February 2015. At that time, management said Dominion would be looking for assets that could be dropped down to its MLP. Questar’s pipeline assets fit the bill, Farrell said Monday.

Questar owns and operates slightly more than 2,500 miles of pipeline with total capacity of 2.5 million Dth/d. Questar’s pipeline system is in the Rocky Mountains near large reserves of natural gas in six major producing areas, including the Greater Green River, Uinta and Piceance basins. Questar transports gas from these areas to other major pipeline systems for delivery to markets in the West and Midwest, including the Questar Gas local distribution system serving natural gas utility customers in Utah, southwest Wyoming and southern Idaho. Through subsidiaries, Questar owns and operates the Overthrust Pipeline in southwestern Wyoming and Southern Trails Pipeline, extending 488 miles from the Blanco Hub to just inside the California state line. Questar also operates and owns 50% of the White River Hub, providing transportation and hub services through interconnections with six interstate pipeline systems and a major processing plant near Meeker, CO.

“We were particularly attracted to Questar’s assets largely because of the pipeline, Farrell said. “We’re perfectly happy with the LDC…But it was the MLP-eligible assets that particularly caught our attention. And after we took a hard look at the region’s Clean Power Plan goals or targets that the EPA [Environmental Protection Agency] has imposed, this is a pipeline that’s going to have a lot of growth opportunities…”

The availability of the Questar assets combined with other assets slated for dropdown to Dominion Midstream Partners, the partnership “…now has available to it a long, long runway of contracted, long-term gas infrastructure assets with zero commodity risk in them,” Farrell said.

Last fall, Duke Energy announced a deal to buy its Charlotte, NC, neighbor and Atlantic Coast Pipeline project partner Piedmont Natural Gas in a $4.9 billion cash deal that it said would give it “a growing natural gas platform” (see Daily GPI,Oct. 26, 2015). Two months earlier, Southern Company announced its $12 billion transaction to acquire AGL Resources, which is also a partner in Atlantic Coast (see Daily GPI, Aug. 24, 2015). Southern also said it wants to wet its beak in the natural gas stream.

Earlier this year, Fitch Ratings cited natural gas utilities as a bright spot for growth within the broader utilities sector (see Daily GPI, Jan. 11).

Questar would operate as a first-tier, wholly owned subsidiary of Dominion and maintain its headquarters in Salt Lake City.

The Dominion-Questar tie-up “…represents just the latest in a long list of U.S. gas utility deals, beginning with the purchase of Nicor by AGL Resources in 2010 [see Daily GPI, Dec. 8, 2010],” Jefferies analysts said in a note Monday. “Just in the last seven months, we have seen announcements from Black Hills Corp. to purchase SourceGas [see Daily GPI, July 13, 2015], Southern Company to buy AGL Resources, and Duke Energy to acquire Piedmont Natural gas. We believe this latest deal will continue to put a bid under small/mid-cap independent LDCs.”

Questar shareholders must approve the deal, which also requires antitrust clearance. Approval, if needed, will be sought from the Utah Public Service Commission and the Wyoming Public Service Commission, Dominion said, adding that information regarding the transaction will also be provided to the Idaho Public Utilities Commission.

Dominion reported fourth quarter operating earnings of $416 million (70 cents/share), compared to $490 million (84 cents/share) for the same period in 2014. Operating earnings are reported earnings adjusted for certain items. Fourth quarter earnings were $357 million (60 cents/share) compared with $243 million (42 cents/share) for the same period in 2014. Special items included charges associated with the State Corporation Commission of Virginia’s final ruling associated with its biennial review of Virginia Power’s base rates and charges associated with future ash pond and landfill closures.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |