E&P | NGI All News Access | NGI The Weekly Gas Market Report

Baker Hughes Forecasting 30% Further Decline in Worldwide Rig Count

The oil and natural gas commodity price rout is showing no signs of abating, which doesn’t bode well for the rig count this year, Baker Hughes Inc. CEO Martin Craighead said Thursday.

Baker swung to a quarterly loss and reported a near 50% decline in revenue from 4Q2014, with the sting particularly acute in North America, where revenue slid by two-thirds year/year. Customers have continued to adjust their spending to align with poor commodity prices, Craighead said.

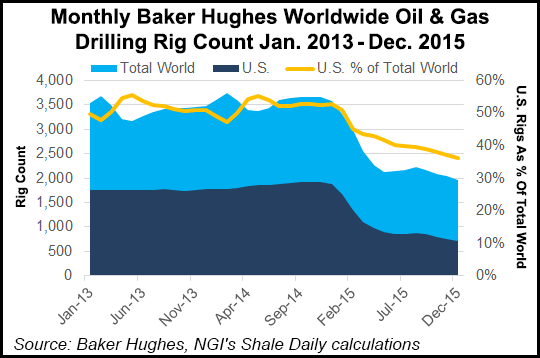

“Our 2015 results are reflective of an extremely difficult and increasingly challenging year for the industry,” he said. “Since the fourth quarter of 2014, the global rig count has declined 46% as our customers adjusted their spending to align with declining commodity prices.”

Revenue fell 10% sequentially as exploration and production (E&P) companies continually rebooted their capital spending plans. One bright spot was the move by E&Ps to maximize drilling efficiencies, which improved Baker’s results for its artificial lift product line. The product line grew 4% year/year, “underlying the importance that our customers are placing on production optimization in this environment,” Craighead said.

“Operating profit margin for the quarter declined with decremental margins of 33%, which were favorably impacted by substantial cost reduction efforts. Additionally, embedded in our operating margins are costs in excess of 300 basis points,” retained in compliance with the agreement to merge with Halliburton Co.

Baker publishes the closely watched North American rig survey weekly and the international rig count once a month. While early forecasts by some operators indicate strengthening conditions in the second half of the year, Craighead was pessimistic.

“Looking ahead, we are forecasting rig activity worldwide to continue to decline throughout 2016,” he said. “At current commodity prices, the global rig count could decline as much as 30% in 2016, as our customers’ challenges of maximizing production, lowering their overall costs and protecting cash flows are now more acute.”

Overall, the Houston-based operator lost $1.3 billion (minus $2.35/share) in 4Q2015, versus year-ago profits of $663 million ($1.52). Excluding a writedown of its pressure pumping business in North America, restructuring charges and merger-related expenses, adjusted losses were 21 cents/share, versus year-ago profits of $1.44.

Revenue slumped by almost half to $3.39 billion from $6.64 billion. Total costs and expenses were $4.77 billion in 4Q2015, compared with $5.62 billion a year ago. Baker spent $214 million for capital expenditures in the final three months of 2015, versus $503 million a year ago.

For the North America segment, revenue declined 17% sequentially to $1.137 billion and was off sharply from year-ago revenue of $3.30 billion. As a result of the revenue decline, year/year operating profit margins decreased from 14.8% in 4Q2014 to (11.2%) in 4Q2015. Cost reduction actions throughout the year contained the decremental operating profit margin in 4Q2015 to 28%.

Full-year revenue fell to $15.7 billion from $24.6 billion in 2014. However, decremental operating margins were contained to 34%, “significantly better than those delivered in the 2009 industry downturn,” Craighead said.

Net loss in 2015 was $2.0 billion (minus $4.49/share), compared with profits in 2014 of $1.7 billion ($3.92). Adjusted for one-time items, last year’s net loss was $209 million (minus 48 cents/share), versus 2014’s income of $1.8 billion ($4.22). Free cash flow for the full year was $1.2 billion, compared with $1.6 billion in 2014. Excluding restructuring payments related to layoffs of $446 million, free cash flow would have been $1.7 billion for 2015. For the year, capital expenditures were $1.0 billion, a decrease of $826 million (46%) from 2014.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |