Utica Shale | E&P | NGI All News Access

Eclipse Reveals Steep Price-Related Impairments in 2015

Eclipse Resources Corp. revealed Thursday that “substantially lower commodity prices” led to a 58% writedown of its proved reserves as of Dec. 31 compared to 2014 year-end reported values.

The Ohio pure-play exploration and production (E&P) company, based in State College, PA, said the pre-tax present value discounted at 10% of the Dec. 31 proved reserves was $212.9 million, 58% lower than the year-ago value of $509.4 million.

The company said the value calculations are based on Securities Exchange Commission (SEC) prices that “are not indicative of current forward prices.”

Eclipse said it also expects to record a $750-850 million impairment charge on some of its oil and gas properties in Ohio for 4Q2015 as a result of the drop in commodity prices. The company said it “does not anticipate that the expected impairment will result in a violation of any financial covenants associated with the company’s senior secured revolving credit facility or senior unsecured bonds.”

Eclipse has scheduled its 4Q2015 earnings call with investors for March 3 at 10 a.m. EST.

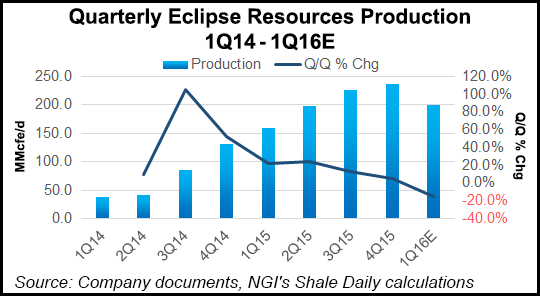

Earlier this month, Eclipse said it would curtail production in response to low prices, deferring completions on 21 Utica Shale wells (see Shale Daily, Jan. 5). In its 3Q2015 earnings call, the E&P said it would be idling its one-rig drilling program through 1Q2016 (see Shale Daily, Nov. 12).

The E&P’s proved reserves as of Dec. 31 were 348.8 Bcfe, down slightly from 355.8 Bcfe as of Dec. 31, 2014. The year-end proved reserves were approximately 79% operated and 79% natural gas.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |